Examining the “sell-side liquidity crisis” brewing in the Bitcoin market

Examining the “sell-side liquidity crisis” brewing in the Bitcoin market Examining the “sell-side liquidity crisis” brewing in the Bitcoin market

Photo by Thor Alvis on Unsplash

Even after the five percent drop that took place on Wednesday morning, Bitcoin remains far above the lows of September and early October. The coin currently trades for $13,200; at the lows of September, BTC was changing hands for $9,800.

Analysts believe that this price action is a clear byproduct of a brewing “sell-side liquidity crisis.” The theory goes that the intrinsic value in holding Bitcoin is increasing massively, leading to a simultaneous increase in holding activity and an increase in demand to buy BTC.

After $14,000 there are literally no coins on the books.

…Only 900 new BTC mined per day.

That's ~$13MM of fresh daily sell side.

These are the makings of a sell side liquidity crisis aka reflexive buying to the upside. pic.twitter.com/bDLcM1k32h

— Matt ? (@Matt__Kaye) October 27, 2020

This is believed to create a recursive loop where prices shoot dramatically higher, enticing in even more investors, resulting in an even greater rally.

The sell-side liquidity crisis in the Bitcoin market

It became clear that Bitcoin holders were more bullish than ever earlier this year, when blockchain analytics firms such as Glassnode indicated that the percentage of BTC that had not moved in over a year had hit new all-time highs.

But it’s becoming even more apparent looking at on-chain data and market data that investors are increasingly holding on to their Bitcoin. Should this be met with further buying pressure, the price of BTC will appreciate even faster than it already has.

On an on-chain basis, whales are hesitant to deposit their coins into exchanges. CryptoQuant, a blockchain data firm, shared this chart below, showing that “whale” Bitcoin addresses are depositing few coins into exchanges despite the price surge.

Glassnode data also indicates that the dollar value of deposits into exchanges has reached multi-week lows as investors are increasingly hesitant to sell their Bitcoin in anticipation of upside.

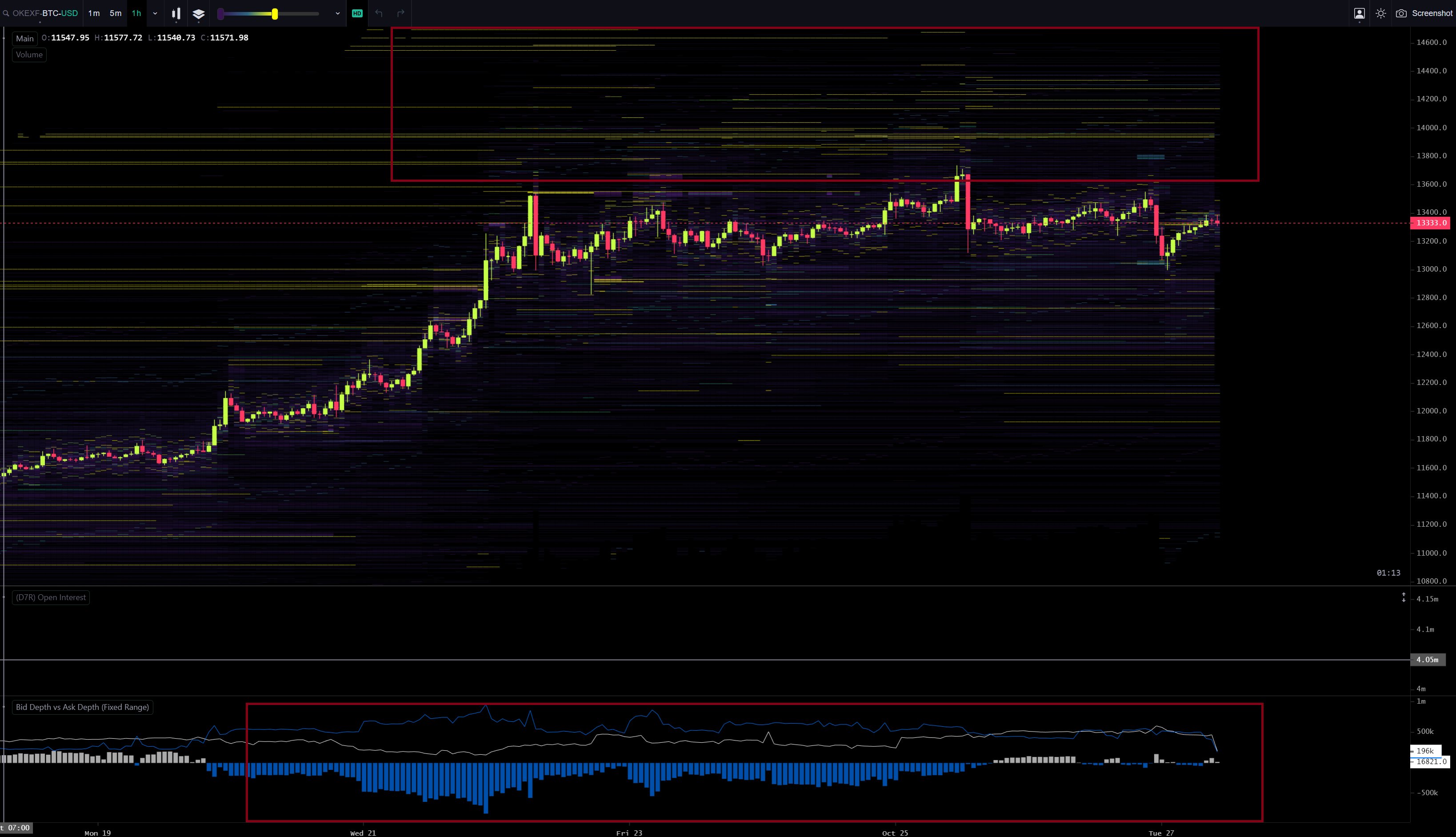

Order book data also shows an increasing amount of hesitance to short or sell Bitcoin.

As reported by CryptoSlate previously, pseudonymous trader “Light” found that OKEx order book data shows that investors are pulling their “asks” as investors price in a rapid rally:

“OKEx futures orderbook asks being pulled/executed at market in last few days as BTC consolidates. A move above $14k in near term is increasing in probability.”

The institutional influence

A sell-side liquidity crisis is a two-sided equation, though. To result in this “crisis,” there also needs to be an increase in demand that eats at the decreasing market supply.

Market commentators expect institutions to play a key role on the side of demand.

“Light” commented earlier this week:

“A lot of the buy pressure that is competing for tightening BTC sell-side liquidity these last weeks is coming from institutionals. They are buying from people who are in the disbelief stage.”

Raoul Pal, CEO of Real Vision, agrees. The Wall Street veteran said that he expects Apple and Google to own Bitcoin to hedge inflation, adding that he expects fund managers on Wall Street to take on a similar risk in the years ahead.

That’s not to say that retail capital won’t play a role in acting as a driver of demand for Bitcoin. With PayPal and other prominent technology and finance companies dipping their toes in the crypto space, retail capital is likely to follow if Bitcoin continues its ascent.

Farside Investors

Farside Investors

CoinGlass

CoinGlass