Why traders are making a strong case for Bitcoin at $7,700 as volume and momentum weaken

Why traders are making a strong case for Bitcoin at $7,700 as volume and momentum weaken Why traders are making a strong case for Bitcoin at $7,700 as volume and momentum weaken

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

The Bitcoin price is pulling back after testing the $10,000 level three times in the past week. As the price trend of BTC eerily reflects its movement in October 2019, traders are anticipating a steep pullback.

How bitcoin failed to rise above important resistance

Throughout the past three weeks, the bitcoin price attempted to break out of a crucial resistance level at $10,500, which it rejected in October of last year.

Four months ago, after the bitcoin price abruptly surged from the $8,000s to $10,600 within less than 24 hours, it immediately rejected the $10,500 to $10,600 range, ultimately leading to a multi-month correction to the $6,000s.

At higher time frames, bitcoin is hovering under two key resistance levels at $10,500 and $9,800.

Traders are anticipating $10,500 to have been the local top and expect the dominant cryptocurrency to consolidate after a near 50 percent rally.

In previous bull cycles, bitcoin saw large pullbacks following rallies of around 40 to 50 percent.

Reputable traders like DonAlt have pointed towards $7,700 as the potential target of the consolidation, especially if the weekly candle of bitcoin closes below $9,700.

So far, the short-term price trend of bitcoin in the past month replicates the reaction to the previous rally of BTC to $10,600 in 2019, making it vulnerable to an extended correction.

A pullback at this time would provide would provide balance to the market for long-term prosperity, as some whales have described the recent upsurge as irresponsible manipulation.

Joe007, one of the largest whales on Bitfinex, said:

“Funny how it’s manipulation only when the price crashes. When someone pushes the price up to unsustainable levels with 100x leverage on triply borrowed money using extremely fake 50M buywalls, nobody complains. It’s just ‘the thing BTC always does: organic growth and bull run.”

Some have speculated that the whale who placed large $50 million spoof orders on BitMEX to push the price up throughout January and February could have dumped at $10,300, causing the market to correct.

Altcoin market in danger

If the bitcoin price continues to pullback, cryptocurrency trader Josh Rager emphasized that it could negatively affect the well-performing altcoin market.

In merely a month and a half, the price of Ethereum, EOS, and XRP have rallied by 100 percent, 65 percent, and 50 percent respectively.

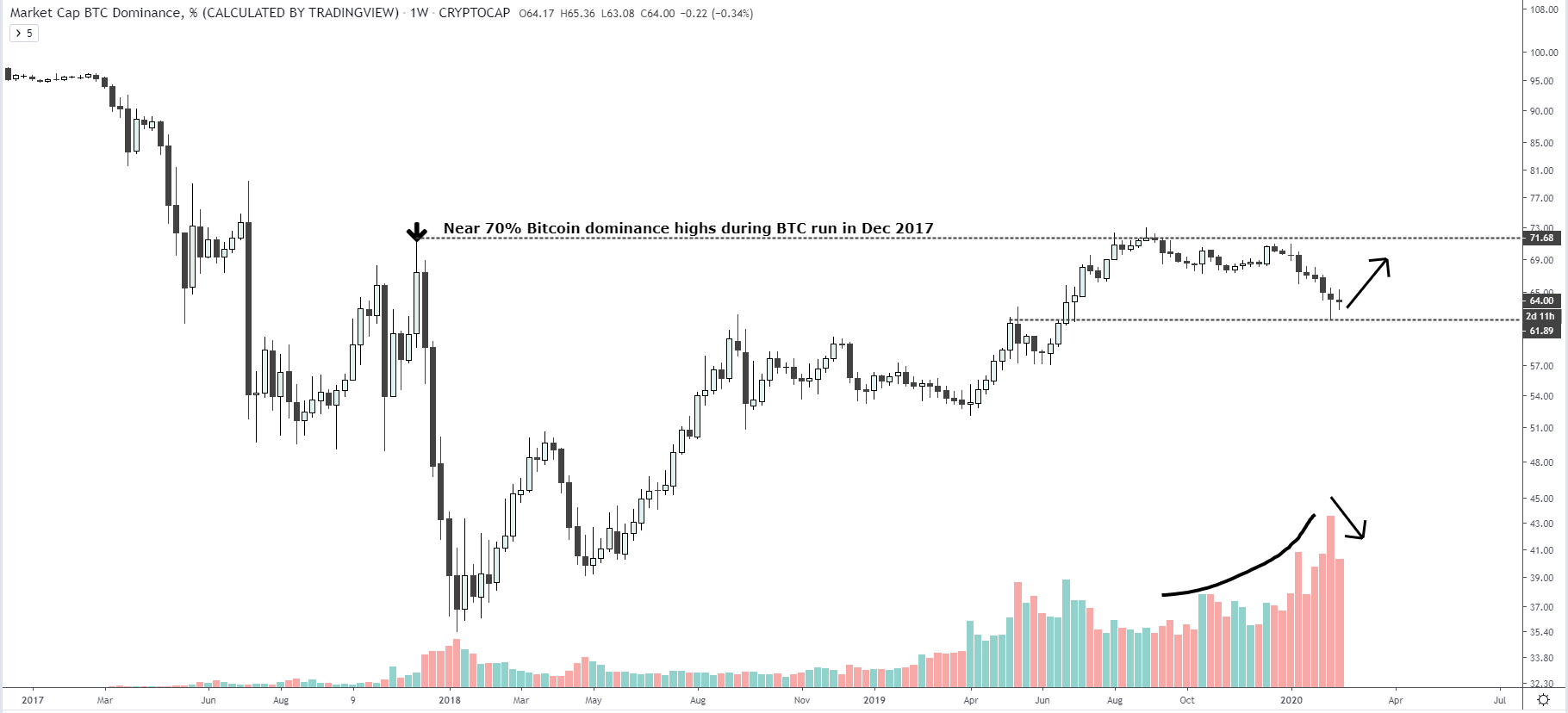

But, Rager noted that the dominance of bitcoin tends to rise during a market downtrend as investors look to minimize risk, and it could cause the altcoin market to consolidate.

He said:

“BTC dominance was near two-year highs in 2019 but we saw it tail off as altcoins rallied over the past couple months. We can see volume possibly decrease with an increase in BTC dominance in the coming weeks if price continues pullback.”

Ethereum remains as the only major cryptocurrency that is yet to see a rejection at a weekly level, while others have strongly rejected their respective resistance levels.

Farside Investors

Farside Investors

CoinGlass

CoinGlass