Data shows investors bought huge amounts of Ethereum this week, sparking joy for rally

Data shows investors bought huge amounts of Ethereum this week, sparking joy for rally Data shows investors bought huge amounts of Ethereum this week, sparking joy for rally

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

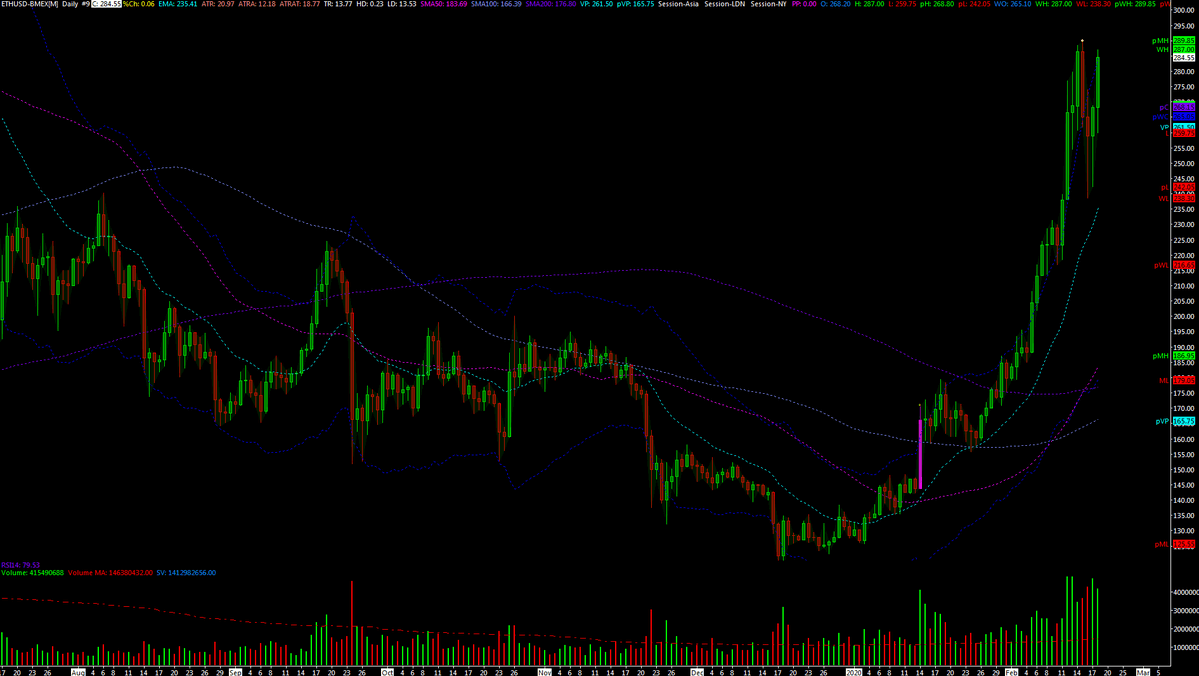

Throughout the past month, Ethereum has outperformed most major cryptocurrencies to become one of the best-performing assets amidst a strong bitcoin upsurge.

Since Feb 1, within just 19 days, the Ethereum price has increased by 60 percent against the USD, from $185 to $280.

What’s pushing the Ethereum price up?

According to global markets analyst Alex Krüger, the average trading volume of Ethereum in the last seven days was four times higher than in the second half of 2019.

He said:

“The average ETH trading volume during the past week has been 4 times larger than the average volume for the second half of 2019. Somebody has been buying a lot of ETH.”

When the volume of an asset rises in tandem with its price, it means that the demand for it is on the rise and demonstrates a bullish market structure.

It critically shows that the upsurge of Ethereum is not necessarily completely manipulated as some whales like Joe007 pointed out.

There is a possibility that as the Ethereum price began to pick up in late January supported with spoof orders, which some consider being an attempt at manipulation, investors started to buy into the cryptocurrency.

The continuous increase in volume supplemented with various fundamental factors such as a clear rise in decentralized finance (DeFi) activity and accumulation in spot markets suggest that Ethereum is about to enter an extended uptrend.

Traders optimistic on ETH

Since the first week of January, Ethereum has front-run bitcoin and the rest of the cryptocurrency market.

In 2020, if the Bitcoin price sustains its momentum and tests higher resistance levels in the short to medium-term, traders expect ETH to be one of the best-performing assets in the market.

In comparison to cryptocurrencies like bitcoin that are down by less than 50 percent from record highs, the Ethereum price fell by as much as 94 percent from its all-time high in 2019. Even after a 60 percent rally, ETH remains down by more than 80 percent from its highest point in 2017.

With Ethereum theoretically oversold at a macro level and the usage of applications on top of the blockchain network such as DeFi seeing an explosive surge, traders remain confident in the upward momentum of ETH.

While the altcoin market depends on bitcoin to maintain its momentum, as long as BTC holds critical supports such as $10,000, technical analysts expect strength in the altcoin market.

One cryptocurrency trader known as Satoshi Flipper wrote:

“Chainlink and Tezos will be the darlings of this bull market/alt season. They will constantly outperform everyone else. And as long as BTC behaves, I’m stocking up on each at every dip and not going to think about selling until the year is well under way. “

Highly respected traders like Angelo who are speculated to trade with large amounts of bitcoin have also expressed their unwillingness to sell bitcoin and other crypto-assets until they hit new highs in the coming year.

With the block reward halving on the horizon and whales reluctant to sell, the general sentiment around the cryptocurrency market is positive.

Ethereum Market Data

At the time of press 5:05 am UTC on Feb. 19, 2020, Ethereum is ranked #2 by market cap and the price is up 3.76% over the past 24 hours. Ethereum has a market capitalization of $30.64 billion with a 24-hour trading volume of $26.26 billion. Learn more about Ethereum ›

Crypto Market Summary

At the time of press 5:05 am UTC on Feb. 19, 2020, the total crypto market is valued at at $295.11 billion with a 24-hour volume of $173.33 billion. Bitcoin dominance is currently at 62.44%. Learn more about the crypto market ›