5 million ETH is now locked up in the Ethereum 2.0 deposit contract

5 million ETH is now locked up in the Ethereum 2.0 deposit contract 5 million ETH is now locked up in the Ethereum 2.0 deposit contract

Months after the ‘beacon chain’ for Ethereum 2.0 was launched, over 5 million ETH are now locked on the protocol.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

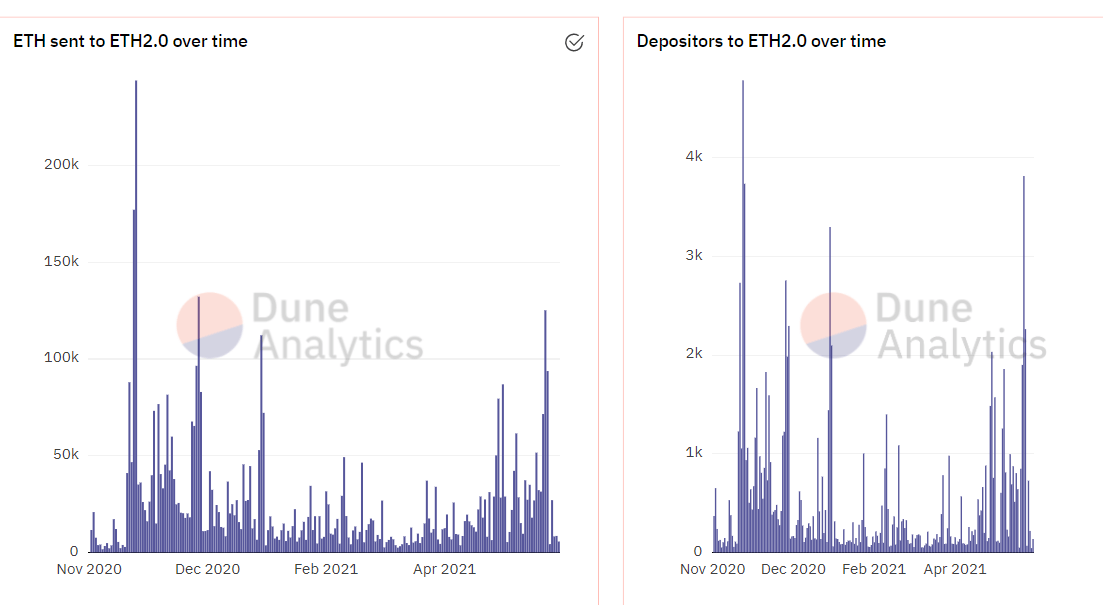

5.2 million ETH are now locked up in the Ethereum 2.0 contract, data from on-chain analysis tool Dune Analytics shows. The lock-up is part of the network’s shift from a ‘proof of work’ (PoW) consensus design to a ‘proof of stake’ (PoS) one.

What does data show

As per Dune Analytics, over 27,000 ‘unique’ depositors have locked up the 5.2 million ETH in the ETH 2.0 deposit contract—using up a total of 108,605 transactions to make this possible.

The amount is nearly 1,000% bigger than ETH 2.0’s 524,000 ETH threshold (the minimum amount to signal and greenlight a move to staking). Data shows big transfers to the ETH 2.0 deposit contract in the past week, with 125,000 ETH getting transferred on May 26 alone.

Meanwhile, while the lockups show great anticipation for 2.0, the network is yet to decide on further details. All ‘stakers’ currently do not earn any interest on their locked up ETH, and any estimates of annual yields remain unknown. The staked amounts cannot be taken out either.

Understanding the Ethereum shift

PoS networks rely on node owners, called ‘validators,’ who ‘stake’ a certain amount of tokens on a crypto network to validate transactions and process on-chain interactions. These are unlike PoW networks, which rely on intensive computing rigs that conduct millions of calculations each second to keep the network running.

PoW, for its allegedly high energy usage, has received a rap in recent times. Environmental concerns have led to huge public criticism for networks like Bitcoin, the world’s largest cryptocurrency, with some like Tesla even dropping BTC payments due to these reasons earlier this year.

PoS networks change that. The absence of heavy machinery means the overall process is much cheaper and more ‘environmentally-friendly,’ while this type of consensus design also leads to an overall cheaper and faster network.

Ethereum’s headed towards that direction. The shift to 2.0 is, for some, one of the most historic changes to the network, one that can be proved with the amount of ETH locked up in the 2.0 contract.