Will Ethereum’s “parabolic” DeFi growth be the main factor of ETH recovery?

Will Ethereum’s “parabolic” DeFi growth be the main factor of ETH recovery? Will Ethereum’s “parabolic” DeFi growth be the main factor of ETH recovery?

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Year-to-date, the price of Ethereum is down slightly from $155 to $148 and has been noticeably struggling to recover to 2018 levels.

As said by Adaptive Fund partner Willy Woo, on-chain fundamentals determine the long term trend of a cryptocurrency like Bitcoin and short term price movements are primarily dictated by margin trading platforms such as BitMEX.

BTC market in a nutshell:

Long term price is determined by investor activity and adoption curve. The domain of on-chain fundamentals.

Short term price is determined by a random walk of pivots in the direction of liquidating the most traders on BitMEX.

— Willy Woo (@woonomic) November 23, 2019

The strong growth of the Decentralized Finance (DeFi) market, most of which are built on the Ethereum protocol, could be a fundamental factor that supports the recovery of ETH in the medium to long term.

DeFi on the rise, analysts call it “parabolic” growth

DeFi utilizes smart contracts on a decentralized blockchain network to facilitate financial services that were previously only available through traditional third-party service providers and banks.

It removes middlemen to enable users of cryptocurrencies to issue and receive loans, and to carry out other services.

According to cryptocurrency investor Anton Pagi, the adoption of DeFi has increased significantly throughout the past 11 months, with the usage of Ethereum as collateral crossing 2.5 million.

Prior to the abrupt rise in the popularity of DeFi, analysts anticipated decentralized applications (DApps) that run on Ethereum to bolster the usage of ETH.

However, in recent months, DApps have seen lagging growth, possibly due to the substantial decline in the valuation of the cryptocurrency market.

As such, investors expect DeFi to be the driving factor behind the medium to long term increase in the on-chain activity of Ethereum, which could also be a key factor in the price trend of ETH.

Will Ethereum price recovery anytime soon?

During a downtrend, prices of major alternative cryptocurrencies become increasingly correlated with bitcoin.

As the bitcoin price fell from mid-$8,000 to the low-$7,000 region, the price of Ethereum plummeted from around $180 to $148, by 17.7 percent against the U.S. dollar in a span of a week.

Given the steep sell-off in the cryptocurrency market, the ETH price is unlikely to recover in the short term.

As its fundamentals improve through upcoming updates like Ethereum’s Istanbul hard fork that are set to improve the scalability of the network, it would strengthen the foundation for the next potential rally of the asset.

The ConsenSys team said of the hard fork:

“Istanbul brings upgrades that will alter the cost of various opcodes to prevent spamming blocks and improve overall denial-of-service attack resilience. This upgrade will enable greater Ethereum and Zcash interoperability as well as with other Equihash-based proof of work cryptocurrencies.”

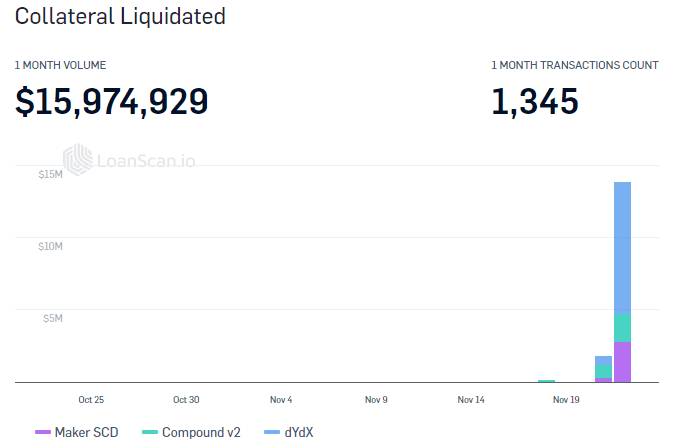

Still, as long as cryptocurrencies remain as volatile as they currently are, DeFi carries risks in terms of stability.

As the price of Ethereum dropped steeply against the U.S. dollar, tens of millions of dollars in collateral for DeFI platforms are said to have been liquidated.