Grayscale GBTC investors still in profit with average cost basis 20% below current prices

Grayscale GBTC investors still in profit with average cost basis 20% below current prices Grayscale GBTC investors still in profit with average cost basis 20% below current prices

Data suggests 70% of Grayscale holders remain profitable at current levels with an average cost of $27.82.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

According to data from trading firm Webull, around 70% of Grayscale GBTC holders likely remain in profit. The average shares were purchased at $27.82, some 20% below the current price as of press time.

The Webull data shows the state of the trust the day before its conversion to a spot Bitcoin ETF and indicates that 70% of investors had a cost range between the $18.84 and $27.24 range.

In terms of distributions, the first concentration of shareholders appears to be positioned between $33 and $40. With the price at $34.9 as of press time, it will be interesting to see whether the bottom of this range acts as a support for the price amid continued outflows.

The second concentration is much lower, between $18 and $21. This group will remain profitable until the GBTC price falls another 39%.

Should the price fall to this level and its assets under management see an equivalent decline, we’d witness a further 230,000 BTC hit the OTC desks, worth around $8.9 billion as of press time.

Such a drop would leave Grayscale with roughly 350,000 BTC, which at a 1.5% management fee would still generate approximately $200 million in revenue if Bitcoin retained a value of around $39,000. This underlines the lack of pressure on Grayscale to lower fees along with the seemingly limitless potential for Grayscale investors to take profits. With few inflows into the ETF, the percentage of investors in profit is very high.

Thus, there is certainly an argument to be made that Grayscale’s pressure on Bitcoin’s price through profit-taking could be as severe as a near-40 % drawdown. For bears in the audience, a 40% drop for Bitcoin right now would take it to May 2023 lows of roughly $23,000.

Potentially 100% of Grayscale investors in profit at conversion.

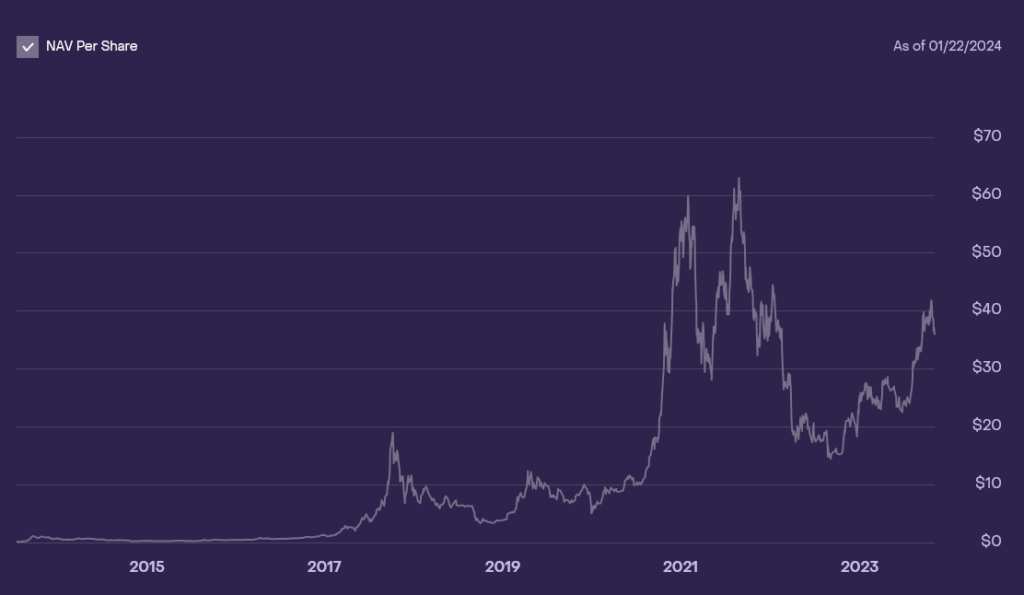

Since its conversion, the ETF has seen considerable outflows totaling roughly $3.5 billion. Its assets under management have also fallen to $22.1 billion (552,681 BTC) from a year-to-date high of $29 billion (623,390 BTC) on Jan. 10. In dollar terms, its AUM all-time high was actually further back, aligning with the top of the 2021 bull market at a staggering $44 billion (651k BTC.)

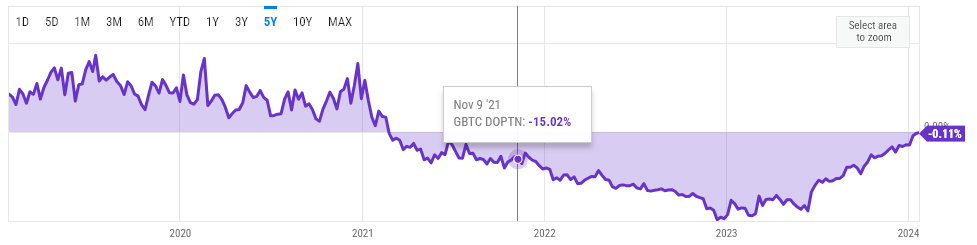

Interestingly, even at the top of the market, concerns about the trust’s makeup resulted in it trading at a 15% discount to its net asset value (NAV), representing a price top of around $58,000 instead of the spot price of $69,000. This discount continued to increase until the start of 2023, reaching -47% at its lowest.

Through the application and eventual success of its conversion to a spot Bitcoin ETF, the discount has all but disappeared to a mere -0.11% as of Jan. 23.

Interestingly, the position cost distribution chart from Webull above indicates that all investors who bought about $40.53 exited the trust before its conversion. Compared with the chart below of the historical NAV price, GBTC mostly traded above $40.53 for around 12 months between May 2021 and Jan. 2022. However, Webull data suggest that when the trust closed on Jan. 10, its last day before its conversion to an ETF, 100% of shares were profitable.

The TradingView chart below supports this claim, as it closed out at its highest price in 17 months. What is more surprising is the number of investors who had already exited the fund after having entered at higher prices throughout 2021.

Following the revelation that much of the outflows from GBTC were a result of FTX liquidations, many in the Bitcoin community were buoyed by the prospect of the ETF outflows slowing down. However, a further 17,000 BTC was sent to Coinbase Prime today, Jan. 23, with net outflows of around 15,000 BTC, valued at roughly $600 million.

The high number of investors in profitable positions puts the ETF in a precarious position for further outflows. Yet, the impact this will have on the spot Bitcoin price will only be seen with time. Trades between the ETF issuers and its trading counterparty, Coinbase, happen over the counter (OTC), thus having a limited effect on the underlying Bitcoin price directly.

Still, this is only true as long as there are buyers ready to acquire Bitcoin. Should the OTC liquidity dry out, the price impact could be monumental. However, given the institutional demand for Bitcoin, I cannot imagine investors like Michael Saylor turning down the chance to acquire some cheap Bitcoin.

Bloomberg analysts such as James Seyffart estimated only around 33% of GBTC outflows had been flowing into other ETFs. However, if the FTX liquidations are now over, it will be interesting to see if flows eventually shallow and the majority simply switch to lower-fee funds such as Fidelity and BlackRock, which are currently leading the Newborn Nine.