Why analysts are bullish after Bitcoin’s just saw an explosive 10% surge to $7,400

Why analysts are bullish after Bitcoin’s just saw an explosive 10% surge to $7,400 Why analysts are bullish after Bitcoin’s just saw an explosive 10% surge to $7,400

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Over the past few days, bullish pressure has been building for Bitcoin; all throughout the last two weeks, the cryptocurrency has been forming an uptrend, registering a consistent series of higher lows and higher highs.

On Apr. 6, this streak of strength culminated in an ongoing explosion higher for BTC, which just minutes ago forced Bitcoin to $7,450 — the highest price since the Mar. 12 crash. With this price action, the cryptocurrency is up 10 percent on the day — a stellar performance that comes as stocks, gold, and commodities saw similarly bullish moves higher.

Data from Skew.com indicates that approximately $20 million worth of BitMEX short positions were liquidated amid this move higher.

What’s next for Bitcoin?

Although still moving, analysts are growing increasingly bullish on the cryptocurrency, citing technical trends playing out for the asset.

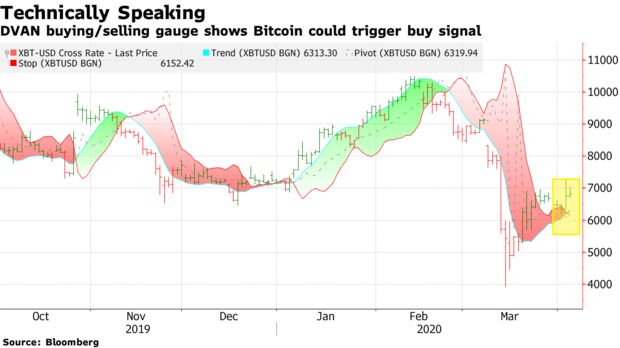

Bloomberg wrote last week that Bitcoin’s recent move higher has allowed it to trigger a “positive divergence and a buy signal,” according to the indicator the DVAN Buying and Selling Pressure Gauge.

BTC last saw this trend in January, prior to the 50 percent surge from $7,000 to $10,500. The same indicator also flipped bearish when BTC fell under $10,000 in the middle of February, adding credence to the recent signal.

Furthermore, the recent rally has allowed Bitcoin to push the price at which it opened 2020, which means the cryptocurrency is finally positive on the year. Although seemingly irrelevant, many crypto traders have branded this occurrence “bullish.” Indeed, 2017’s yearly close of $13,800 marked the exact top of 2019’s bull run.

Not to mention, analysis from Willy Woo, a noted on-chain analyst and an ex-partner at the now-shutdown Adaptive Capital, found that there’s a high likelihood Bitcoin established a macro price bottom in March when it fell to $3,800.

Not out of the woods just yet

Although there is bubbling bullish sentiment, it’s important to accentuate that Bitcoin is not yet out of the woods.

Trader “Filb FIlb” — known for accurately predicting Bitcoin’s price action in Q4 2019 and January almost down to the exact dollar moves — noted in a TradingView update nearly two weeks ago that at $8,000 lies a nasty cluster of technical resistance. In fact, the pseudonymous trader explained that $8,000 likely has the “worst cluster of resistance seen since the bear market of 2018.”

Indeed, his chart indicates that around this level lies the following:

- The 20-month simple moving average

- The 50-day, 100-day, and 200-day simple moving averages

- The 61.8 percent Fibonacci Retracement of the February top to March bottom.

- A yearly pivot level.

To convince bulls that it is heading back into a bull market, the crypto will need to surmount this cluster.

Bitcoin Market Data

At the time of press 4:42 pm UTC on Apr. 9, 2020, Bitcoin is ranked #1 by market cap and the price is up 0.26% over the past 24 hours. Bitcoin has a market capitalization of $133.53 billion with a 24-hour trading volume of $36.18 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 4:42 pm UTC on Apr. 9, 2020, the total crypto market is valued at at $208.72 billion with a 24-hour volume of $127.78 billion. Bitcoin dominance is currently at 63.99%. Learn more about the crypto market ›

![Skew [acquired by Coinbase]](https://cryptoslate.com/wp-content/themes/cryptoslate-2020/imgresize/timthumb.php?src=https://cryptoslate.com/wp-content/uploads/2019/11/skew-logo.jpg&w=16&h=16&q=75)

![Skew [acquired by Coinbase]](https://cryptoslate.com/wp-content/themes/cryptoslate-2020/imgresize/timthumb.php?src=https://cryptoslate.com/wp-content/uploads/2019/11/skew-logo.jpg&w=100&h=100&q=75)