What made Lido a top ETH staking platform?

What made Lido a top ETH staking platform? What made Lido a top ETH staking platform?

Lido has become a top ETH staking platform by allowing you to obtain in-between 12% to 14% APR. How do you do that?

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Lido is a platform built on Ethereum 2.0’s Beacon Chain. Users are rewarded with staking without locking up ETH and receive 1:1 in the token stETH, which they can further employ or leverage.

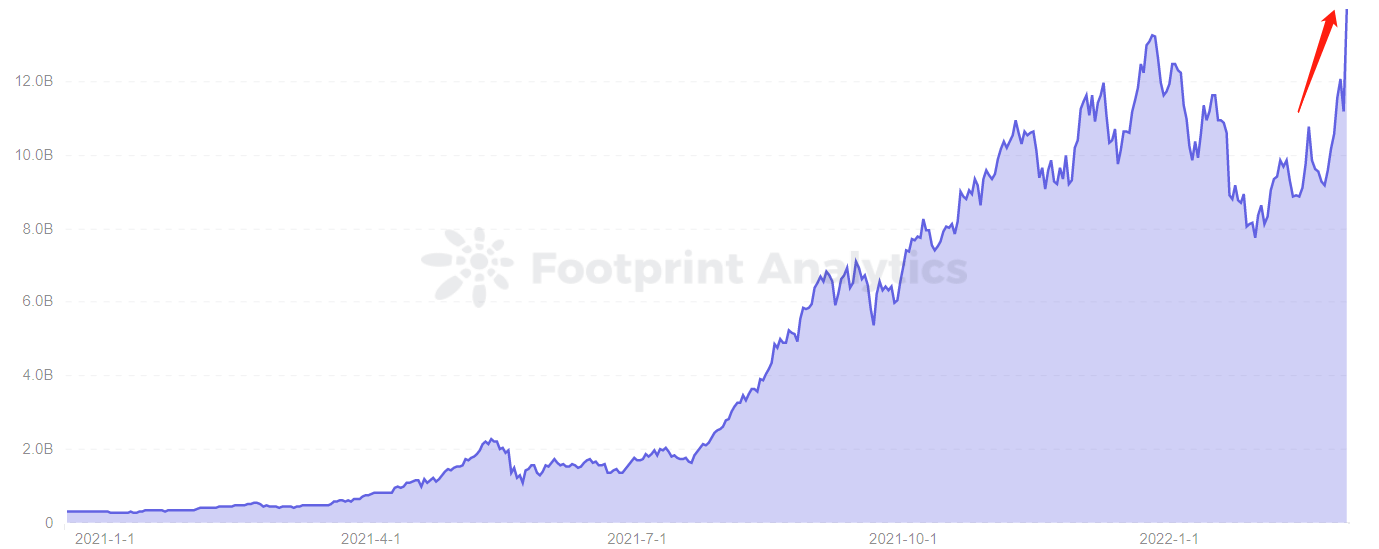

In just 3 months, Lido has reached a record high TVL of $13.98 billion and jumped ahead of AAVE and Convex Finance to rank #3 among DeFi protocols.

Let’s break down whether Lido, with its rapid TVL growth, is a platform worth using.

Lido Supports Multiple Blockchains, Has Innovative Tokenomics

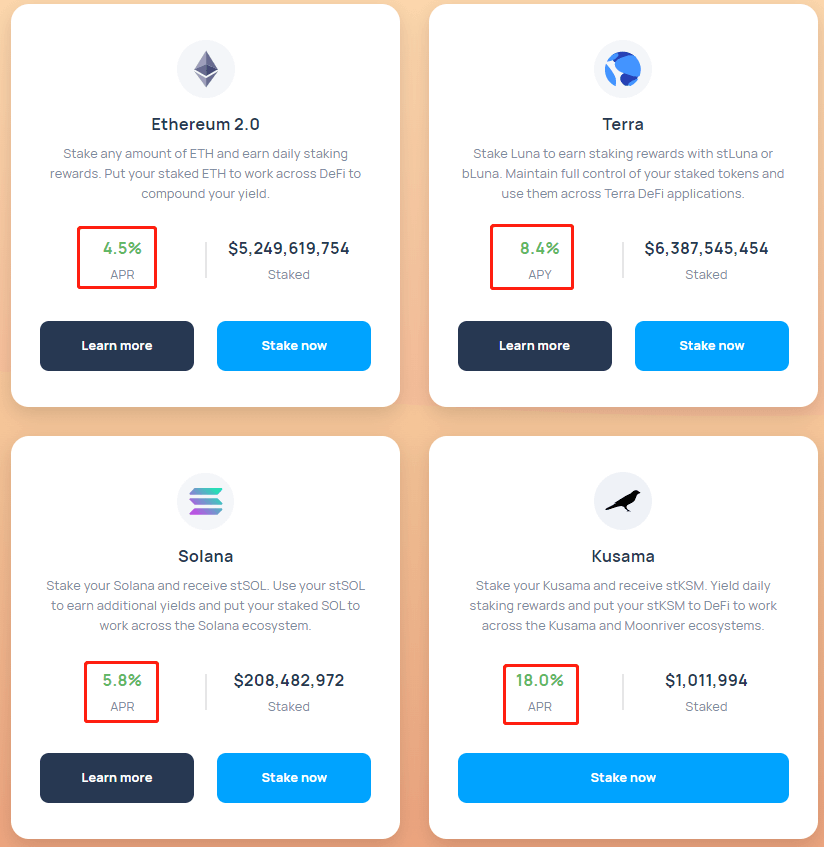

Lido’s business is a staking pool service for PoS blockchains, currently supporting Ethereum 2.0, Terra, Solana, and Kusama. According to Footprint Analytics, as of March 1, Lido’s TVL was at a record high of $13.98 billion, with Terra accounting for the largest share (56%), followed by Ethereum (41%).

By supporting these 4 blockchains, Lido can integrate many header protocols and issue token derivatives of the corresponding blockchains to provide liquidity to the equity holders’ assets. Users can stake ETH, SOL, LUNA, and KSM to get the same percentage of Token stETH, stSOL, stLUNA, and stKSM, while also receiving an APR of 4.5% to 18%.

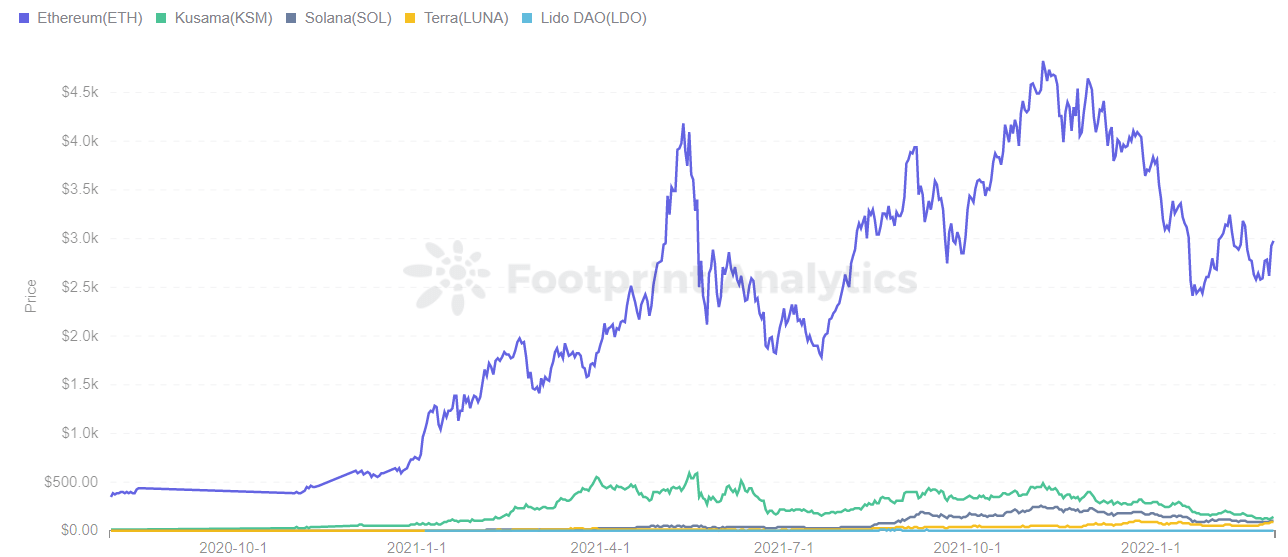

Lido also issues the native Token LDO, which is priced at $2.08 as of March 1, a lower price compared to the four tokens mentioned above. LDO is mainly used for voting and governance, and is not on a larger decentralized exchange, so the overall price trend is not proportional to Lido’s TVL.

This differentiates Lido from protocols such as MakerDAO and Liquity. For example, MakerDAO rewards DAI for depositing ETH, while Lido requires staking tokens such as ETH, SOL, and Luna to receive a derivative token at the same price, which enjoys a decent annualized return and is not affected by the LDO price of the native token.

Lido’s Multiple Investment Options

If you want to participate in Ethereum 2.0 independently, you need to stake 32 integer multiples of ETH, which is very unfriendly for retail investors. Lido is more user-friendly in terms of the number of staking, as users can stake any amount of ETH to participate in Ethereum 2.0.

As of March 1, the total number of ETH staked is 1.98 million. Let’s take pledging ETH as an example and analyze how to earn more on Lido.

- Users staking any amount of ETH get 1:1 in stETH, and can earn 4.5% APY. By comparison on AAVE, depositing ETH generates 0.2% APR.

- Users can turn otherwise interest-bearing stETH asset certificates into liquidity and earn more by participating in other DeFi protocols such as Curve, AAVE, and Convex Finance.

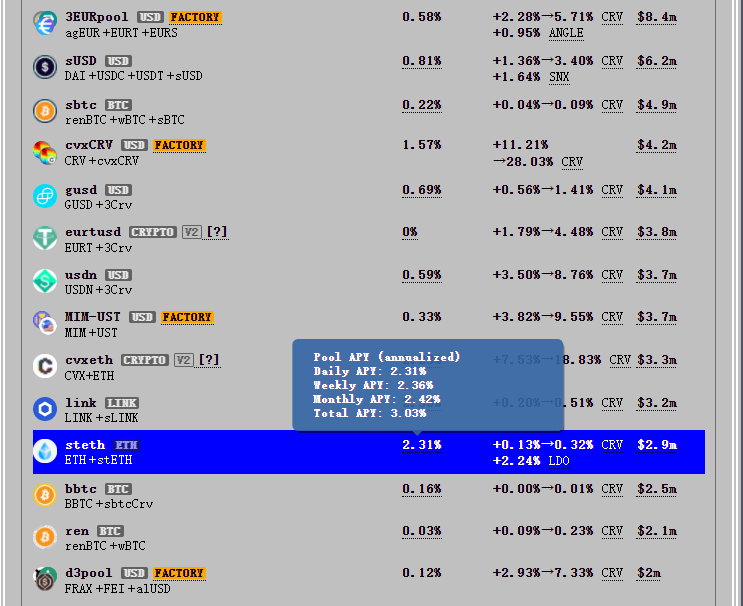

- Users can earn approximately 3% APY by investing stETH in Curve.

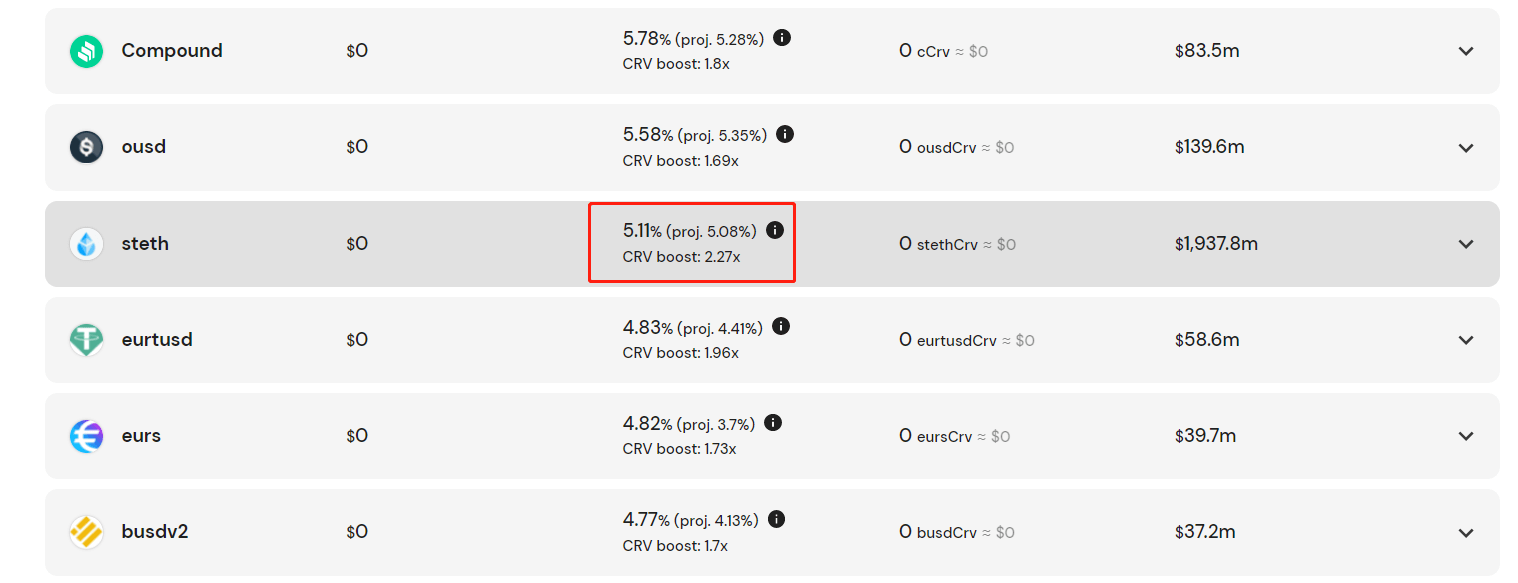

- The proceeds earned on Curve can also be placed on the Convex Finance to earn again. After depositing stETH into Curve to get LP, users can deposit it into the steth pool of Convex Finance to earn about 5.1% APR.

In summary, users can stake any amount of ETH on the Lido platform for use in other DeFi platforms to earn 12% to 14% APR, which is a significant amount of revenue for users. Curve and Convex Finance are the top 5 protocols on the network, which are not only risk-controlled, but also have no liquidation risk and are completely single-coin staking models.

Lido’s Strengths and Weaknesses

Strengths:

- User-friendly

- Flexible for staking to an external contract for a higher APY

- Single currency staking model

Weaknesses:

- Rebasing mechanism

Lido is a platform built on Ethereum 2.0 Beacon Chain, where tokens staking by users are raised and then stored on the Beacon Chain. It has a reward and penalty mechanism. When a rebase occurs, the supply of the token is increased or decreased algorithmically, based on the staking rewards (or slashing penalties) in the Ethereum chain. Rebase happens when oracles report beacon stats.

- Earnings are not stable

The balance of stETH is updated every day at 24:00 UTC, and if the balance of stETH increases, a certain amount of reward will be given, and if the balance of stETH decreases, a certain amount of Token stETH will be lost. The two are calculated separately.

- Gas fees on Ethereum are also a cost consideration for small-amount users

Date and Author: February 12. 2022, Vincy

Data Source: Footprint Analytics – Lido Dashboard

This piece is contributed by the Footprint Analytics community.

The Footprint Community is a place where data and crypto enthusiasts worldwide help each other understand and gain insights about Web3, the metaverse, DeFi, GameFi, or any other area of the fledgling world of blockchain. Here you’ll find active, diverse voices supporting each other and driving the community forward.

What is Footprint Analytics?

Footprint Analytics is an all-in-one analysis platform to visualize blockchain data and discover insights. It cleans and integrates on-chain data so users of any experience level can quickly start researching tokens, projects, and protocols. With over a thousand dashboard templates plus a drag-and-drop interface, anyone can build their own customized charts in minutes. Uncover blockchain data and invest smarter with Footprint.