US Federal Reserve Vice Chair sees need for a digital dollar

US Federal Reserve Vice Chair sees need for a digital dollar US Federal Reserve Vice Chair sees need for a digital dollar

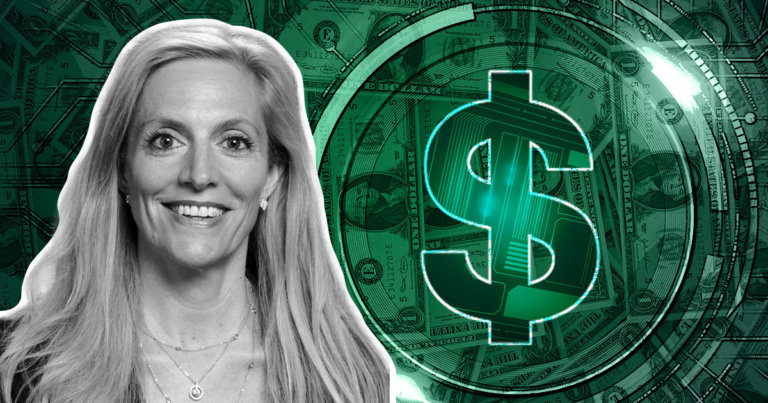

Fed Vice Chair Lael Brainard said that the U.S. needs a CBDC to ensure the country's competitiveness in the global digital financial landscape of the future.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Lael Brainard, Vice-Chair of the Federal Reserve, believes a U.S. central bank digital currency (CBDC) could help maintain the financial system stability and prepare the country for the future.

Her comments are part of a testimony released ahead of her appearance before the Committee on Financial Services, U.S. House of Representatives, on May 26.

Brainard said:

“The rapid ongoing evolution of the digital financial system at the national and international levels should lead us to frame the question not as whether there is a need for a central-bank-issued digital dollar today, but rather whether there may be conditions in the future that may give rise to such a need. We recognize there are risks of not acting, just as there are risks of acting.”

In the U.S., the use of cash for payments has declined from 31% to 20% over the past five years. Moreover, for those below 45 years, the percentage of cash usage is even lower, she said. Therefore, it is imperative that the U.S. “consider how to preserve ready public access to safe central bank money” for the future digital financial system. The answer could be a digital dollar.

Adoption of digital assets is undoubtedly growing, and Brainard believes that CBDCs could co-exist and complement cryptocurrencies.

“In some future circumstances, CBDC could coexist with and be complementary to stablecoins and commercial bank money by providing a safe central bank liability in the digital financial ecosystem, much like cash currently coexists with commercial bank money.”

But the introduction of CBDC will bring its risks. The digital dollar could substitute commercial bank money and reduce the total deposits in the banking system. People might also prefer CBDCs during times of stress.

Brainard suggests offering a non-interest-bearing CBDC or placing limits on the amount of CBDC one can hold or transfer to mitigate these risks.

But a CBDC is not just required for U.S. citizens. The government also needs to consider the evolution of the international payments system, Brainard said. She said:

“In future states where other major foreign currencies are issued in CBDC form, it is prudent to consider how the potential absence or presence of a U.S. central bank digital dollar could affect the use of the dollar in global payments.”

Having a digital dollar may allow the U.S. to ensure dollar users across the globe can rely on the currency and are able to conduct transactions with it. Besides, Brainard said it is essential that the U.S. takes a leading role in setting the governing standards for CBDC transactions to ensure privacy, accessibility, interoperability, and security.

Moreover, the risks associated with cryptocurrencies and stablecoin have come into the spotlight since the Terra LUNA fiasco. The loss of TerraUSD’s (UST) peg to the dollar and the subsequent nosedive of LUNA’s value to virtually zero earlier this month impacted the entire crypto market. Bitcoin’s (BTC) price has slipped 28% over the past 30 days.

Brainard said:

“These events underscore the need for clear regulatory guardrails to provide consumer and investor protection, protect financial stability, and ensure a level playing field for competition and innovation across the financial system.”

Although President Biden’s executive order in March placed the “highest urgency” on researching the designs, risks, and need for a CBDC, Fed policymakers remain largely divided in their opinion on the need for a digital dollar. For instance, Fed governor Christopher Waller remains skeptical of CBDCs and has raised concerns around privacy.

The U.S. central bank has also indicated that it would not launch a CBDC without clear support from the White House and lawmakers.

Last week, the Federal Reserve finished a three-month public consultation period soliciting comments and feedback on the CBDC issue. Brainard said that a summary of the comments will be published soon.

The U.S. is lagging behind many countries that have either already deployed or are considering issuing their own CBDCs. According to the Atlantic Council while China is piloting the digital Yuan, 87 other countries are currently exploring CBDCs.