Understanding Robo Strategies with Delta Exchange

Understanding Robo Strategies with Delta Exchange Understanding Robo Strategies with Delta Exchange

Crypto trading can sometimes prove to be a daunting task for an amateur trader trying to find his luck in the volatile crypto markets.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Disclosure: This is a sponsored post. Readers should conduct further research prior to taking any actions. Learn more ›

Given their decentralized nature, cryptocurrencies are unbound by any central agency and can be traded round the clock globally. The prices in the cryptocurrency market fluctuate rapidly, continuously making it a challenge for the trader to profit from the price rise or drop. It is almost impossible for any trader to sit 24/7 and watch over the market. The experience would surely be dizzying!

As an investor, you seek to earn profits by speculating on the value of the asset you have invested in. Whether the price is in an uptrend or downtrend, you want to take advantage of the price fluctuations over time. Talking of the crypto markets, the volatility attached to them is both fascinating and restricting. As cryptocurrency trading becomes more popular with the current influx of traders looking to rake in some ‘digital moolah,’ it becomes more difficult for an individual investor to decide when to sell or purchase while ignoring the FOMO factor, too.

To address this challenge, Robo strategies come to our rescue!

What are Robo Strategies?

Robo Trading is one of the technologies developed to ease your crypto trading worries by helping you keep track of the market trends and build sound decision-making capabilities. It requires little effort on your part and lets you profit from your crypto investments by employing algorithms to purchase and sell your cryptocurrencies at predetermined intervals.

Robo Strategies allow you to put your crypto investments on autopilot to work for themselves and earn a potential return over time. There are several popular robo strategies that let traders conduct trades based on the asset price or technical parameters or the proportion of particular crypto in your portfolio. Robo strategies involve trading bots to collect market data and evaluate it to assess the possible market risk and perform the buying and selling functions based on the same.

How can You Benefit from using Robo Trading Strategies?

Robo trading strategies use the API of the exchange platform to operate functions based on predefined parameters to conduct trades. It helps make crypto trading safer, easier, faster, and more effective while giving the user the delight of earning daily profits.

You needn’t deal with the market’s volatility to enjoy gains, nor do you require any trading abilities to trade successfully using such strategies.

Why Choose Delta Exchange?

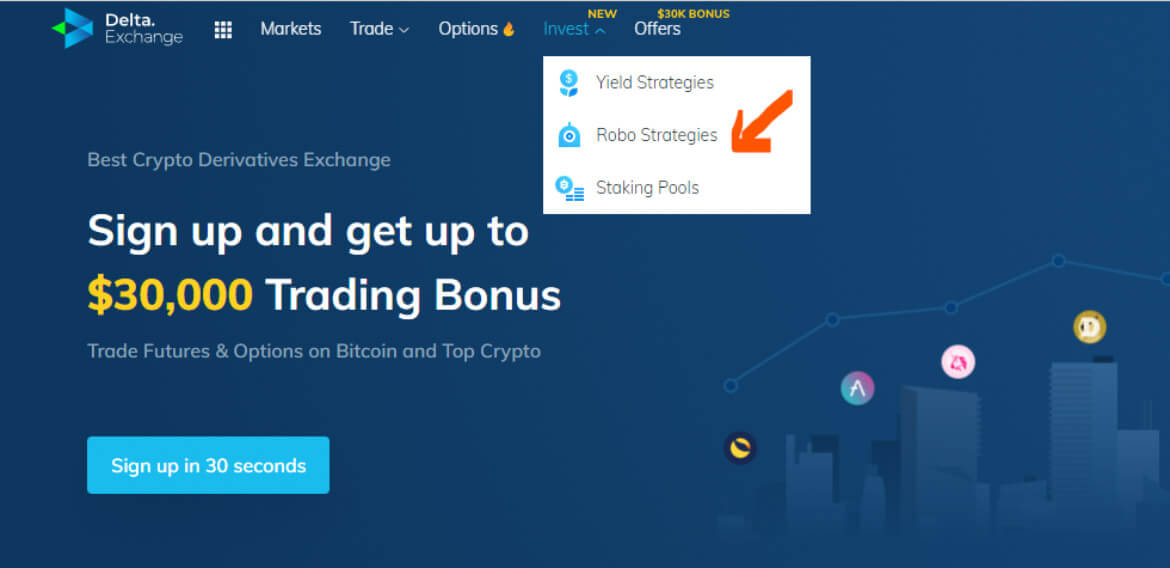

Delta Exchange is a crypto derivatives haven for traders from all walks of life. It offers several robo trading strategies that allow you to hold, acquire, or sell your crypto investments quickly and efficiently on autopilot. Delta exchange has opened new avenues in robo strategies in three unique categories:

- the momentum strategy,

- the arbitrage strategy, and

- the AMM or Automated Market Makers Strategy.

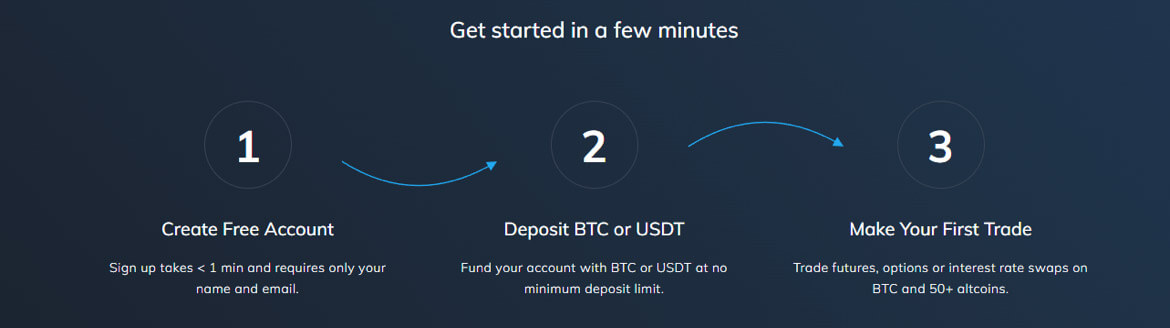

Get started at Delta exchange in just 30 seconds with these simple steps.

Unlike other automated bots, Delta’s Robo trading doesn’t require you to pay any fees to subscribe to any of its robo trading techniques. You can opt from a range of the finest robo strategies on offer in the market right now at the exchange. Before you head over to the exchange website, let’s get down to basics and try and understand the robo trading strategies currently on offer at Delta Exchange:

#1 Top 2 Momentum

If you are someone interested in testing the waters in crypto trading via the top 2 premium currencies, then this strategy is for you. Under it, positions are opened only in BTC and ETH, and a trader gets maximum gross leverage of up to 3x. The strategy doesn’t concern many coins and is uncomplicated.

Given its simplicity, it is expected to perform better in volatile market conditions. Those investing in the Top 2 Momentum strategy are recommended to hold the investment for extended periods to maximize their gains.

#2 Top 20 Momentum

As the name suggests, this strategy covers positions in the top 20 cryptocurrencies by market cap. This strategy is for those traders that are looking to widen the horizon of their crypto portfolio. Since the strategy covers many cryptos, it is expected to minimize the losses, if any, simultaneously. It offers maximum gross leverage of up to 2x.

Those investing via this robo strategy should keep the investment for the short term, which would help them in boosting their portfolio’s performance.

#3 Defi Momentum

This strategy lets you invest in top Defi assets by market capitalization. Under this strategy, positions are opened based on the price momentum. The strategy is suitable in a market undergoing its Defi wave. It offers maximum gross leverage of up to 2x to its users and is Suitable for volatile market conditions. The traders are advised to hold for longer periods to maximize gains.

#4 BTC Momentum

This strategy can be employed only in positions based on the price momentum of BTC. Traders can trade only in BTC inverse perpetual using this strategy. It offers maximum gross leverage of up to 3x and is aimed to improve performance while simultaneously reducing any drawdown.

#5 ALTBTC Momentum

True to its name, the strategy trades only in BTC pairs which trade in other altcoin pairs. The strategy is expected to provide maximum gross leverage of up to 3x in volatile and trending markets.

#6 Cash Future Arbitrage

The strategy concerns only Bitcoin and Ethereum futures. Its main aim is to capture premium in these futures over the spot markets. When trading in Futures, the strategy waits for the time when the spot prices and futures prices converge at the expiry of the futures.

The strategy can also be employed to trade perpetual and spot pairs to earn funding in a market-neutral setup. It offers maximum gross leverage of up to 3x to the traders.

#7 Large Cap AMM

This strategy uses order book and price information on BTC and ETH contracts to generate bids and offers. The traders seek liquidity over the fair price and aim to capture the dynamic premium. There is one condition which the traders need to adhere to – they must be ready to pay over the fair price. You can utilize this strategy to your benefit only by using USDT.

To invest in these strategies, you need to make an account on the Delta Exchange and deposit USDT. From the menu, click on Delta’s Robo Trading Strategies.

Take your time to research and compare all the available options and go in for the strategy best suited to you. Get ready for an amazing drive-through in the world of derivatives trading via Delta’s crypto robo strategies.

Invest with Delta now! And sit back and watch your crypto investments swell and multiply on autopilot.