U.S. megafund Fidelity targets Asian family offices wanting Bitcoin

U.S. megafund Fidelity targets Asian family offices wanting Bitcoin U.S. megafund Fidelity targets Asian family offices wanting Bitcoin

Photo by CHUTTERSNAP on Unsplash

US-based Fidelity Investments, a trillion-dollar fund manager with a deep interest in the cryptocurrency market, is targeting rich Asian investors by way of a new partnership with a fund in Singapore, financial publication Bloomberg reported Thursday.

Asian family offices are FOMOing into crypto

Stack, the Singapore fund that provides access to crypto products and similar services, will cater to the high demand for cryptocurrencies from Asian family offices and high-net-worth individuals. It will promote Fidelity’s own custody services to attract clients.

Cryptocurrencies have seen a textbook institutional FOMO in 2020 after nearly three years of a bear market. Firms like MicroStrategy and Square have picked up over $425 million and $50 million respectively in 2020, while hedge fund managers like Paul Tudor Jones have similarly turned to Bitcoin to protect against inflation as well.

Singapore bank says Bitcoin is no longer a “dismissive” asset. Image: Flickr

Family offices are coming for a pie of that as well. In addition, reports suggest that while US investors are more like to choose investments with a lower risk profile, Asian investors show a greater affinity to take higher risks (and thus higher profit potential), making cryptocurrencies a natural fit.

Stack is doing its bit to facilitate that. It said that all assets secured by the service will be subject to monthly audits, and promises protections like insurance coverage as well as weekly contributions and redemptions.

The firm also aims to appeal to investors in the region with risk mitigation and the attraction of Fidelity’s involvement, said Michael Collett, the co-founder of Stack.

“This year has been tough as far as getting people into Bitcoin because it didn’t cover itself with glory in the market downturn,” Collett said, adding, “since the dark-dark days of March we’ve had inquiries pick up again.”

In a statement to Bloomberg, Christopher Tyrer, head of Fidelity Digital Assets Europe, said:

“There is a critical need for platforms which have a deep understanding of what local and regional investors are looking for” that “has historically been lacking in the digital asset space.”

Crypto’s institutional bull case in 2020

The partnership with Stack comes months after Fidelity launched its passively-managed Bitcoin fund in August. The latter started its Fidelity Digital Assets division in late 2018, with CEO Abigail Johnson declaring the goal was to boost accessibility for investors.

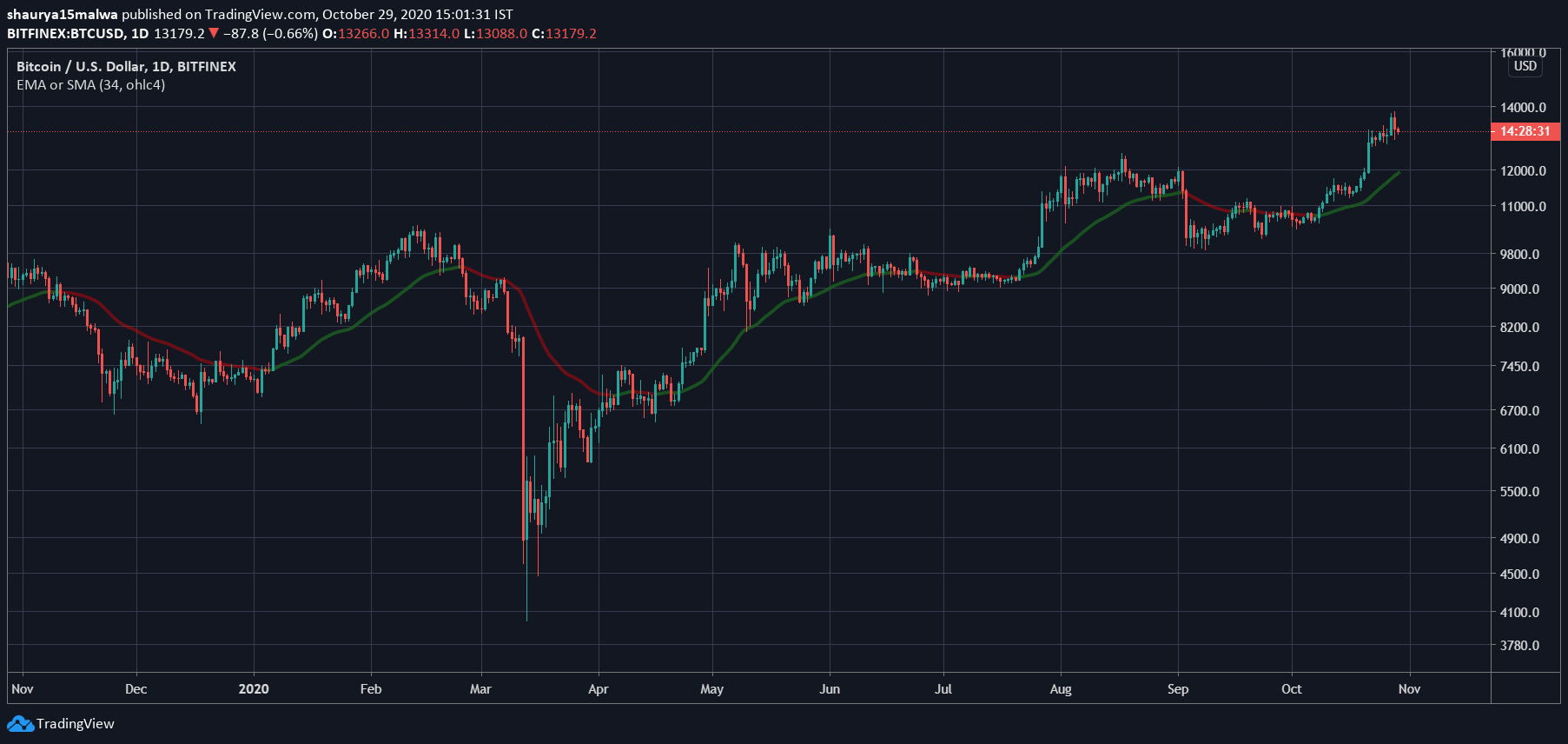

Meanwhile, the cryptocurrency market continues to wow and doom. Bitcoin has returned over 300% to investors since March 2020, while DeFi projects like Yearn Finance have made gains of over 10,000%.

Bitcoin’s has gained over 300% for investors since March. Image: BTCUSD Chart via TradingView

The broader digital currency space is seeing big moves as well. Just last week, US payment processor PayPal announced it would allow investors to purchase cryptocurrencies like Bitcoin and Ethereum via its platform — rolling out the service to an estimated 350 million users this week.

On the institutional side, JPMorgan said its JPM Coin was successfully used to make interbank settlements in the past few weeks, with results showing great promise for a much-bigger roll out of the digital currency in the near future.

Bitcoin Market Data

At the time of press 12:11 pm UTC on Oct. 29, 2020, Bitcoin is ranked #1 by market cap and the price is down 3.64% over the past 24 hours. Bitcoin has a market capitalization of $242.19 billion with a 24-hour trading volume of $32.63 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 12:11 pm UTC on Oct. 29, 2020, the total crypto market is valued at at $388.61 billion with a 24-hour volume of $92.42 billion. Bitcoin dominance is currently at 62.29%. Learn more about the crypto market ›