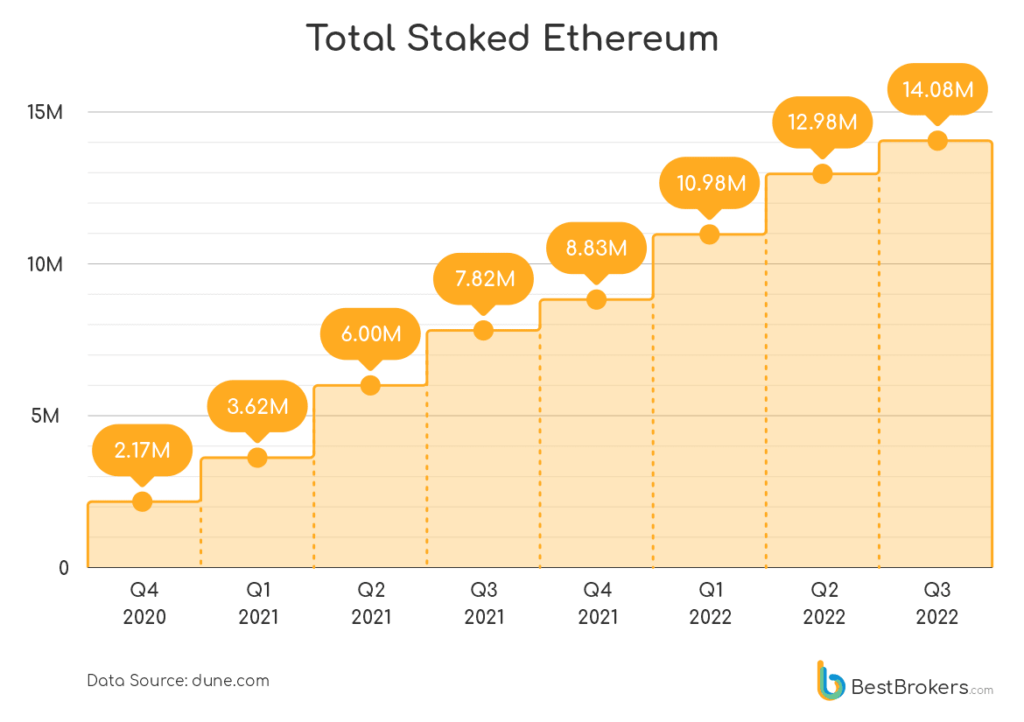

Total staked Ethereum surpasses 14 million in Q3 amid 64% decline in price

Total staked Ethereum surpasses 14 million in Q3 amid 64% decline in price Total staked Ethereum surpasses 14 million in Q3 amid 64% decline in price

Ethereum staking appears to be entirely detached from the price of ETH as the TVL surpasses $19B once more

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

The amount of staked Ethereum has increased to just over $19 billion at about 14 million ETH since the start of the year, according to a report by the trading platform Bestbrokers.

While the price of Ethereum has declined around 64% during the same time, other assets such as Gold and equities are also down about 10-20%.

Alan Goldberg, a market analyst at BestBrokers, commented that

“Total Ethereum stake currently sits at approximately 14.44 million ($19.5 billion). Total staked ETH in Q3 2022 alone exceeds 1.096 million, which is a sign that traders find it a reliable alternative to the traditional markets.”

The Merge finally completed the proof-of-stake upgrade for the Ethereum network, and thus, it is unsurprising that this has had a net positive effect on the amount of ETH staked. Miners can no longer mine Ethereum using the proof-of-work consensus method; therefore, staking Ethereum is the primary way to contribute to the network’s security.

The current APR for staking Ethereum is around 4-5% but cannot be unstaked until the Shanghai update is completed. Platforms such as Lido allow investors to exchange sETH tokens for ETH, known as liquid staking. However, the original Ethereum remains staked in the protocol, and it simply changes hands to be redeemable by the owner of the sETH tokens.

However, in relation to the Ethereum directly staked into the network, Goldberg also noted;

“Making a deposit for a year without access to your funds is a risky move, especially if the funds are in crypto. However, traders continue to stake. Currently over 11% of the total circulating supply are staked and the amount rises daily. It just proves that many traders feel secure with Ethereum.”

The above chart showcases the steady increase in staked Ethereum since Q4 2020. When compared to the price chart for Ethereum, the data suggests that price action is not leading the staking revolution happening on Ethereum Mainnet.

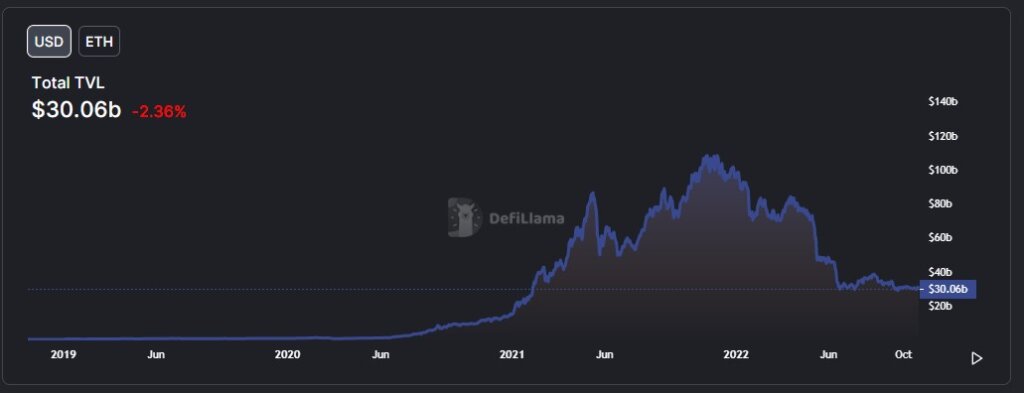

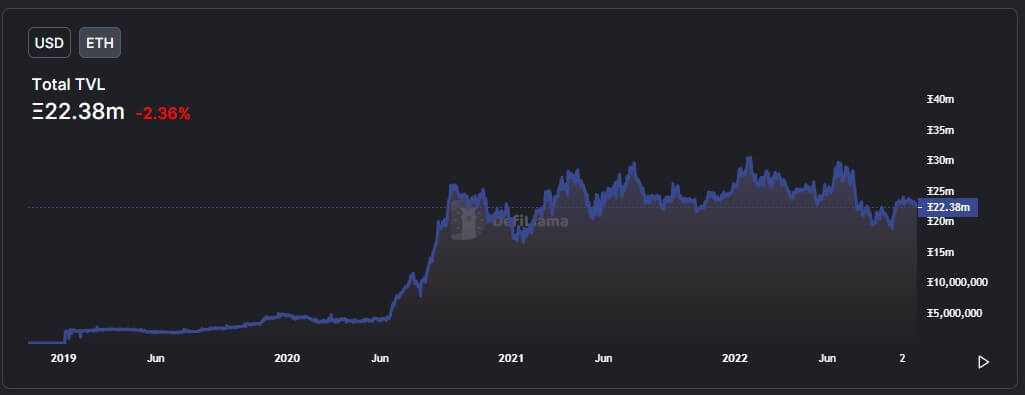

The charts below showcase the total amount of Ethereum staked across all DeFi protocols denominated in both ETH and USD. While the TVL topped at around $105 billion in November 2021, the TVL denominated in ETH neared its all-time high as recently as June 2022.

When all of DeFi is considered, including liquid staking, the total value staked Ethereum tallies up to 22.38 ETH, down 26% from its all-time high in November 2021. When reviewing the TVL denominated in USD of any crypto asset, it is essential to understand the underlying asset’s price throughout time.

In June 2022, the USD value of the Ethereum TVL was in decline, but the amount of ETH being staked was increasing. This discrepancy relates to the drop in the price of ETH during that time. Ethereum opened in June at $1,942 and closed the month down 43% at $1,099.