Top analyst: here’s the simple path forward for Bitcoin to become a major safe haven

Top analyst: here’s the simple path forward for Bitcoin to become a major safe haven Top analyst: here’s the simple path forward for Bitcoin to become a major safe haven

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Cryptocurrency investors have been greatly disappointed by Bitcoin over the past few weeks, with its lackluster price action seeming to invalidate the safe haven narrative that many investors had previously bought into.

BTC’s close correlation to the traditional equities market is, however, showing some signs of breaking, with this potential decoupling coming about after the crypto erased multiple months of gains in a matter of weeks.

If this does occur, it could lead to a massive influx of new capital from investors, potentially bolstering its price action as the global economy continues to crater.

Bitcoin continues tracking equities market; incurs slight momentum today

Although Bitcoin traded independently of the traditional markets during the latter part of last week, the benchmark cryptocurrency has once again continued tracking the U.S. stock market last night, with BTC declining to $5,800 alongside last night’s massive futures selloff.

The crypto’s price was able to rebound this morning, however, with this upwards momentum coming alongside that seen by the traditional markets in the time following the stock market’s open.

This rebound has come about due to news regarding the Fed’s plan to take unprecedented actions to try to insulate the U.S. economy from the impacts of the rapidly spreading Coronavirus.

The rebound in stock futures prior to today’s market open led Bitcoin to rally to highs of nearly $6,700, which is around where it found significant resistance that led it to retrace back into the lower-$6,000 region.

Cantering Clark, a cryptocurrency-focused analyst, explained that Bitcoin’s retrace from its highs was solely based on equities futures inability to extend their momentum, with BTC and the stock market being “dance partners.”

“BTC and ES right now are dance partners. The success of calling that run the highs idea before dumping is mirage, even for myself. If ES continued up, BTC would have as well.

Is BTC showing some early signs of decoupling from the traditional markets?

Although Bitcoin and equities may currently be “dance partners,” it is important to note that Willy Woo – a prominent analyst – explained in a recent tweet that BTC is beginning to show signs of decoupling from the markets. He explained:

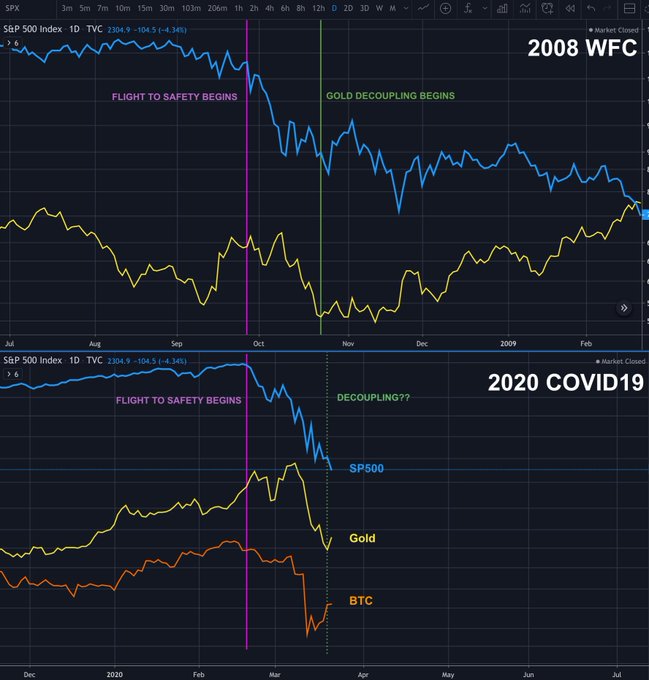

“Seeking the decoupling… Here’s where we are in the timeline compared to the 2008 banking crisis. Decoupling of safe havens from equities showing hints it may have begun (i.e. when BTC and Gold go bullish). We’ll have more confirmation in a week.”

How Bitcoin and the aggregated crypto market trends in the week ahead should elucidate the validity of the possibility, with a confirmation of this being highly bullish for Bitcoin.

Bitcoin Market Data

At the time of press 12:35 am UTC on Mar. 24, 2020, Bitcoin is ranked #1 by market cap and the price is up 11.56% over the past 24 hours. Bitcoin has a market capitalization of $119.9 billion with a 24-hour trading volume of $47.23 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 12:35 am UTC on Mar. 24, 2020, the total crypto market is valued at at $186.91 billion with a 24-hour volume of $148.76 billion. Bitcoin dominance is currently at 64.19%. Learn more about the crypto market ›

Farside Investors

Farside Investors

CoinGlass

CoinGlass