This trend amongst Chainlink investors might give the crypto a serious boost

This trend amongst Chainlink investors might give the crypto a serious boost This trend amongst Chainlink investors might give the crypto a serious boost

Photo by Kenrick Mills on Unsplash

Parabolic uptrends in the crypto market tend to be short-lived and followed by immense selloffs, but Chainlink has been able to buck this trend – being one of the few altcoins that has been able to post steady gains over the past year.

It doesn’t appear that this strength will disappear anytime soon either, as data shows that the cryptocurrency is fundamentally robust due to the token’s investors taking a long-term investment approach.

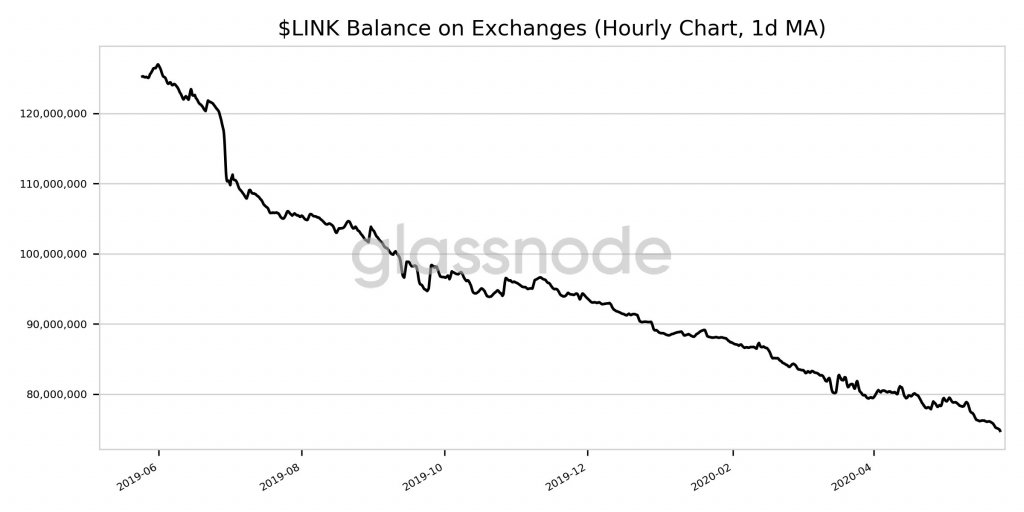

This trend is clearly illustrated by the balance of Chainlink on exchanges, which has been diving significantly – reaching a one-year low yesterday.

Because these tokens are likely being moved to cold storage solutions, it is highly probable that this will lessen the crypto’s volatility and help bolster the stability of its macro uptrend.

Chainlink continues flashing signs of technical strength despite declining transaction volume

Chainlink’s price action has remained relatively strong in spite of the volatility seen by Bitcoin and most other digital assets in recent times.

At the time of writing, LINK is trading down marginally against USD at its current price of $3.86. It has been able to dodge most of the losses seen by Bitcoin over the past couple of days, however, and it is currently up 3 percent against its BTC trading pair.

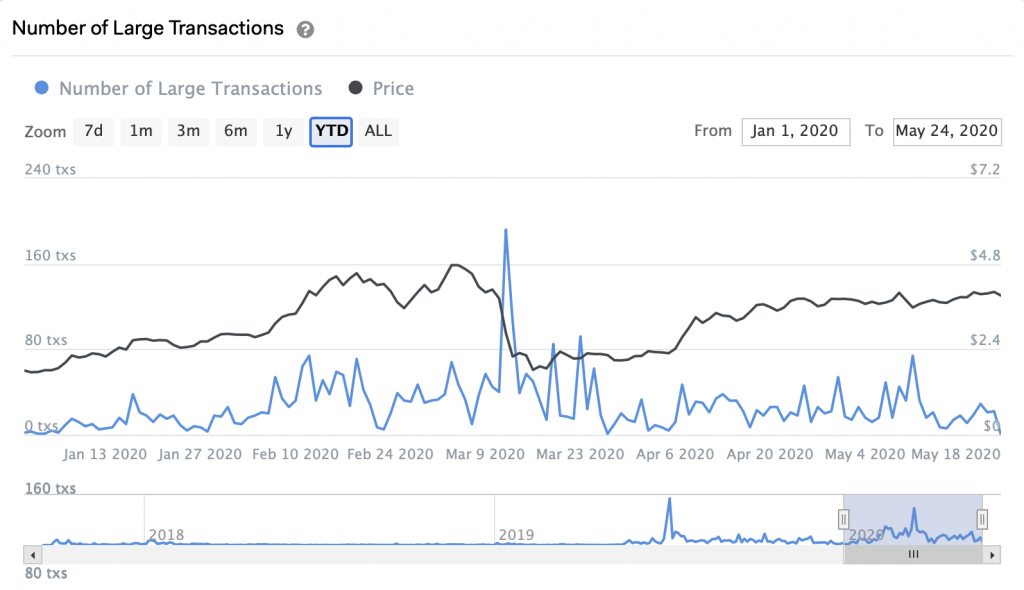

Although the crypto is flashing signs of immense technical strength, it should be noted that large on-chain transactions have been declining significantly in recent times.

Data from the research platform IntoTheBlock elucidates this trend, showing that the number of transactions worth over $100,000 has plummeted as of late.

This may point to a lack of buying activity from large investors, potentially signaling that large investors are neutral on the crypto’s near-term trend due to Bitcoin’s present weakness.

This LINK investor trend may bolster its price action

One trend that could bolster Chainlink’s price action is the mass exodus of LINK away from exchanges and towards cold storage wallets.

This trend is elucidated by recently released data from blockchain analytics firm Glassnode, which shows that the balance of LINK on exchanges just hit a fresh one-year low yesterday.

“LINK Balance on Exchanges (1d MA) just reached a 1-year low of 74,768,711.938 LINK. Previous 1-year low of 75,097,276.000 LINK was observed on 23 May 2020.”

Because cold storage makes it more difficult for investors to readily sell their tokens, the exodus of Chainlink away from exchanges likely suggests that investors are planning to hold their tokens over a longer time frame.

This could provide it with some significant stability due to lessened trading activity amongst its core investors.

Chainlink Market Data

At the time of press 12:58 am UTC on May. 27, 2020, Chainlink is ranked #12 by market cap and the price is down 0.8% over the past 24 hours. Chainlink has a market capitalization of $1.34 billion with a 24-hour trading volume of $294.8 million. Learn more about Chainlink ›

Crypto Market Summary

At the time of press 12:58 am UTC on May. 27, 2020, the total crypto market is valued at at $247.79 billion with a 24-hour volume of $95.01 billion. Bitcoin dominance is currently at 65.52%. Learn more about the crypto market ›

CoinGlass

CoinGlass