This crucial Bitcoin metric reached a high. But traders don’t seem to care

This crucial Bitcoin metric reached a high. But traders don’t seem to care This crucial Bitcoin metric reached a high. But traders don’t seem to care

Mining revenue jumped up by 50% as active miners profit from the difficulty drop.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Bitcoin spot exchanges outflow transaction count hit a year high, data from CryptoQuant, a popular on-chain data analysis tool for Bitcoin and other cryptocurrencies, showed.

$BTC spot exchanges outflow transaction count hits a year high

View chart?https://t.co/GMN0Qjtjqy pic.twitter.com/pBXnnngBaQ

— CryptoQuant.com (@cryptoquant_com) July 6, 2021

As the network re-adjusted its difficulty, Bitcoin mining saw a sharp rise in its revenue. Analytics service Blockchain.com reported that active miners reaped rewards after the sharp rise as the majority of the hash rate went down in the past few weeks as China imposed strict bans on Bitcoin mining in their country.

Such Bitcoin outflows from exchanges are often seen as a very bullish sign for the price. However, the market didn’t seem to care, as the asset continues to range in the $30,000 to $35,000 price band.

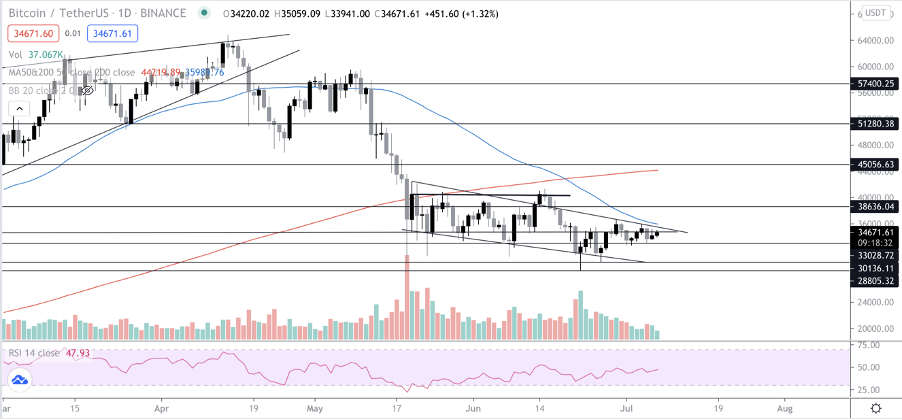

So what’s next for Bitcoin?

The price action is showing good strength and bounced off the $33,000 support. However, the $35,000-$36,600 area has been a region of concern on many occasions in the past and there is a good chance that the price might face rejection in that area once again and come back down to a lower support level.

The Relative Strength Index (RSI) is also showing strength and indicates further upside to the price however it is crucial to break the $36,600 range.

The volume is still a bit on the lower side and a volume influx will guarantee the continuation of the price uptrend.

The 50MA is currently in the $36,000 region and a flip of the 50MA and the daily resistance will be very bullish for the price.

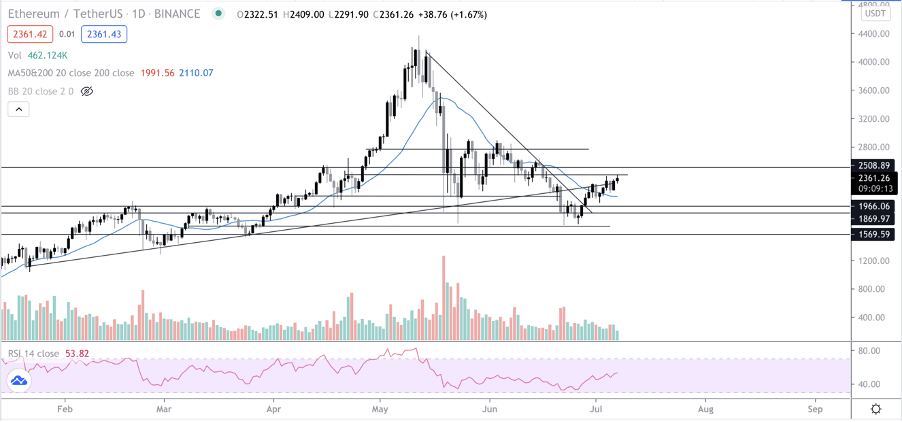

What’s next for ETH?

Ethereum also looks good against the USDT and BTC pair. There is a small resistance in the $2,400-$2,450 region and it is likely that the price might face rejection there.

The Bollinger Bands, a popular indicator to determine the price action using volatility and historical prices, also showed resistance in the same area and a pull-back towards the 20MA is possible.

The RSI (Relative strength index), similarly to Bitcoin’s, is showing strength, indicating a positive price action in the coming days. On the shorter time frame, $2,300 region is a good area to LONG as that happens to be local support on the 4hr time frame.

All in all, if BTC manages to stay stable, ETH should push towards the $2,500 mark.