The entire DeFi market is worth less than XRP or Bitcoin Cash, despite the frenzy

The entire DeFi market is worth less than XRP or Bitcoin Cash, despite the frenzy The entire DeFi market is worth less than XRP or Bitcoin Cash, despite the frenzy

Photo by Daniel Cheung on Unsplash

The DeFi market has exploded in recent times, bringing back ICO-like returns on some projects. But a recent report said that despite the frenzy, the sector remains a fraction of the crypto space and is worth less than XRP or Bitcoin Cash.

Even Dogecoin worth more

Ryan Watkins, an analyst at Messari, tweeted yesterday that “despite its rerating over the past couple months, DeFi is still extremely small in perspective.”

The entirety of what we call DeFi is worth less than both XRP and Bitcoin Cash alone.

Despite its rerating over the past couple months, DeFi is still extremely small in perspective.

— Ryan Watkins (@RyanWatkins_) July 28, 2020

Using a variety of metrics, Watkins said DeFi’s relative stature becomes even starker when “comparing it to all publicly traded layer 1s outside Bitcoin and Ethereum.” Such projects are cumulatively worth over $45.7 billion, with the DeFi market “an order of magnitude.”

Watkins noted even Dogecoin — the meme coin joked about being used by Shiba-Inu dogs — is “worth more than nearly every asset in DeFi.”

Even Dogecoin, a literal meme coin, is worth more than nearly every asset in DeFi. pic.twitter.com/cpVIaoAPL2

— Ryan Watkins (@RyanWatkins_) July 28, 2020

DeFi doesn’t need new money flowing into crypto to continue its rise, said Watkins. He noted the DeFi sector has been rising since the infamous “Black Thursday” in March, but Compound’s liquidity mining program served as a spark.

COMP tokens were issued at a price of $60 in June; quickly reaching $350 days later. Projects like Yearn Finance had even gargantuan returns — literally giving investors 100,000x returns days after launch.

Watkins said most investors are “scrambling over each other” to get in on DeFi tokens, which “unlike most ICOs in 2017, have live products rather than pipe dreams.” He adds:

“Further adding to the excitement, many DeFi tokens also generate cash flows, allowing investors to frame these tokens’ value using more common valuation methods.”

DeFi continues to heat up

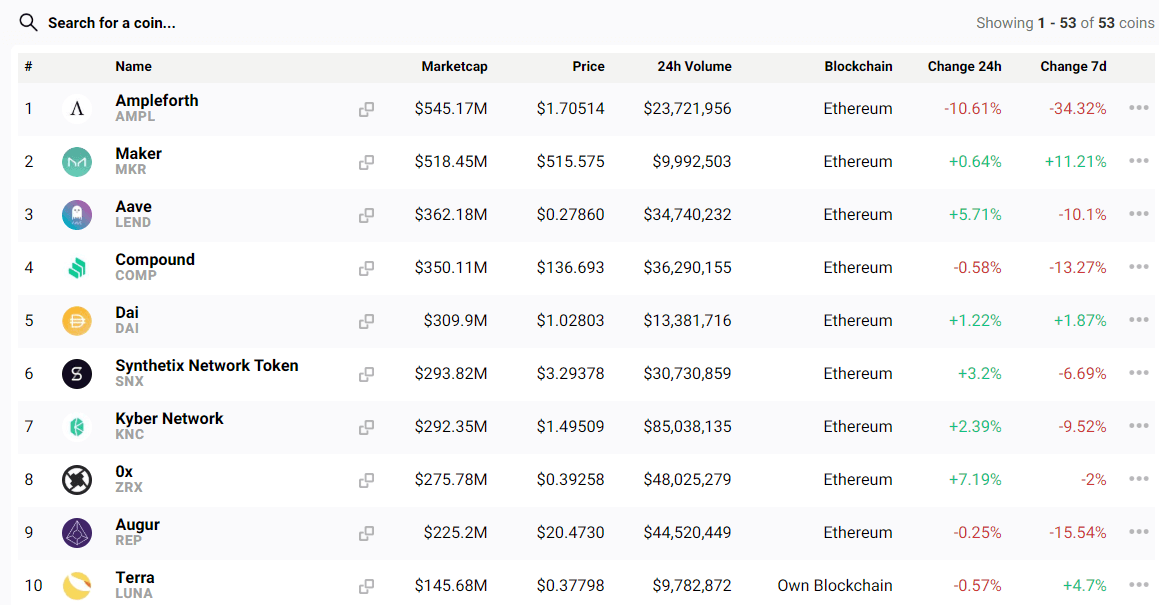

CryptoSlate’s proprietary tracker shows the DeFi space makes up only 1.39 percent. of the entire crypto market. Sector volume in the past days (calculated from press time) stands at $541.99 million with a market cap of $4.5 billion.

Among the DeFi players, Ampleforth has flipped Maker as the top-ranked DeFi project by market cap. It’s AMPL tokens saw a surge earlier this month, but have since fallen by 34 percent in the past week.

Earlier this week, MakerDAO became the DeFi platform to reach the milestone early on Monday. The development followed an increased mainstream interest in the sub-sector and Ethereum breaking above $300 over the weekend.

So many people got this one wrong…..

Maker becomes the first DeFi protocol to cross the magical $1B TVL mark. https://t.co/VN5mFB54Uv pic.twitter.com/HtI4jFOCia

— SpartanBlack (@SpartanBlack_1) July 27, 2020

But as Messari’s report shows; the DeFi sector still has a long way to go.

Farside Investors

Farside Investors

CoinGlass

CoinGlass