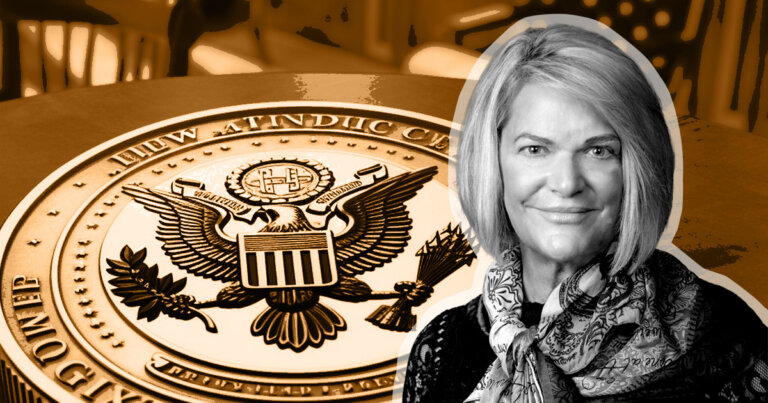

Senator Cynthia Lummis criticizes SEC’s action against Coinbase, says lawmakers are working on crypto regulation bill

Senator Cynthia Lummis criticizes SEC’s action against Coinbase, says lawmakers are working on crypto regulation bill Senator Cynthia Lummis criticizes SEC’s action against Coinbase, says lawmakers are working on crypto regulation bill

The Wyoming Senator said she is "scratching her head" over the SEC's enforcement action against Coinbase.

U.S. Senate

U.S. Senator Cynthia Lummis said the SEC’s recent action against cryptocurrency exchange Coinbase despite its attempts to comply with regulators, “is not the right way to do business in America.”

The Wyoming senator made the statement during an interview with Yahoo Finance on June 22. She said:

“I’m scratching my head about why they would do that with Coinbase.”

Lummis said Coinbase had publicly shown that it was willing to cooperate with regulators and repeatedly asked the SEC for guidance on how to comply with rules properly. However, the SEC failed to give the company an “adequate” response and instead chose to take enforcement action.

She said:

“That’s not a good way to regulate; that’s not a good way to do business.”

On the other hand, the senator said she could somewhat “understand” why the regulator was going after Binance as it is a “large” company that is not “domestic.”

Commodity or security?

Lummis also spoke about bringing clarity to the regulatory landscape in the U.S. and confirmed that an updated version of her 2022 crypto regulation bill would be revealed to the public soon.

She said that lawmakers are working on establishing a proper framework to determine whether a cryptocurrency is a commodity or a security, which should help establish a foundation for future regulation.

This framework will preserve the Howey test, according to the senator.

Lummis said the updated bill addresses various concerns that have been raised after its initial submission, including issues related to the illicit use of digital assets by ensuring there are enough “personnel and authorities” to combat it.

She said the bill beefs up consumer protection-related components and also establishes a “self-regulatory organization” that will handle the advent of new technologies in the future and “shepherd them through the regulatory process.”