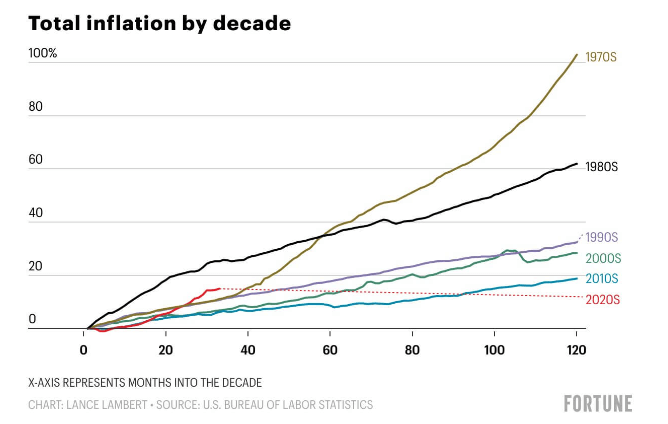

Research: US inflation breaking barriers in the 2020s; started faster than 70s, 80s trend

Research: US inflation breaking barriers in the 2020s; started faster than 70s, 80s trend Research: US inflation breaking barriers in the 2020s; started faster than 70s, 80s trend

Gasoline, fuel oil, and energy prices are the primary causes of the current alarming inflation rate.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Currently, inflation is a global intruder that threatens to disrupt the growth and calm waters of established economies like those in Europe and the United States.

Increasing energy, fuel oil, and gasoline prices are primarily responsible for the current alarming rate of inflation.

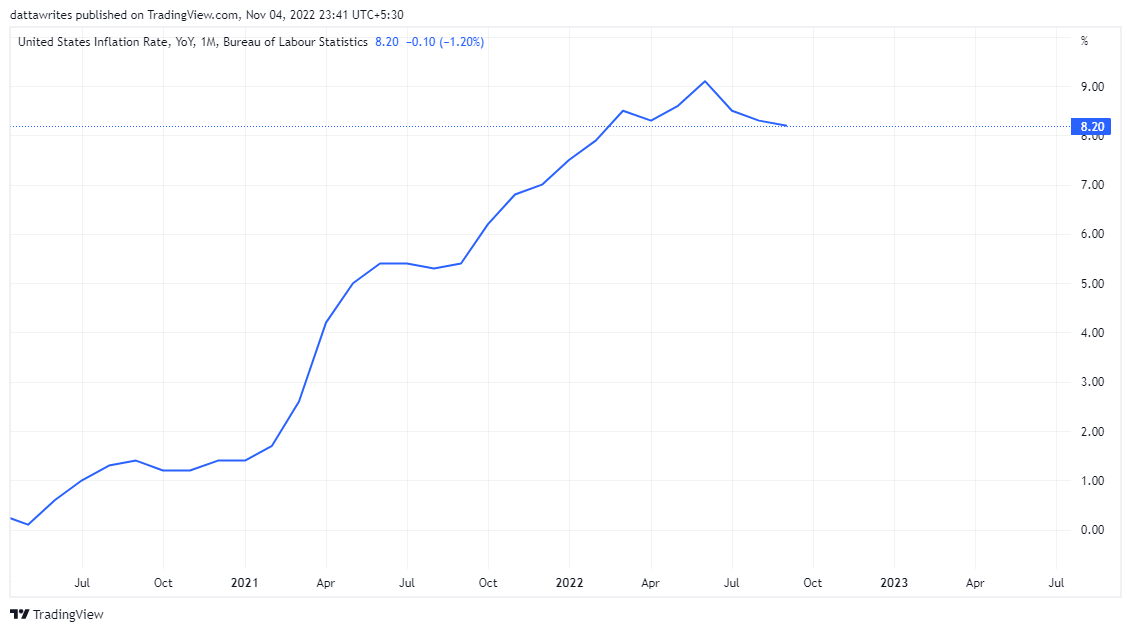

Currently, the U.S economy is experiencing its highest inflation rate in 40 years. Data provided by the U.S Labor Department indicates that inflation in the country now sits at 8.2% as of the last publication in September.

An alarming growth of Inflation between 2020 – 2022

In the United States, the inflation rate reached 7.5% at the beginning of this year, and by June, it reached 9.0%, much higher than the 5.4% and 0.6% recorded in June 2021 and 2020.

May 2020 represents the month with the lowest inflation rate of 0.1% from 2020 to 2022. However, the low figure took a sharp corner in May 2021 by 5.0%. Twelve months later, inflation had already grown to 8.5%, as it prepared for a massive increase in the following month.

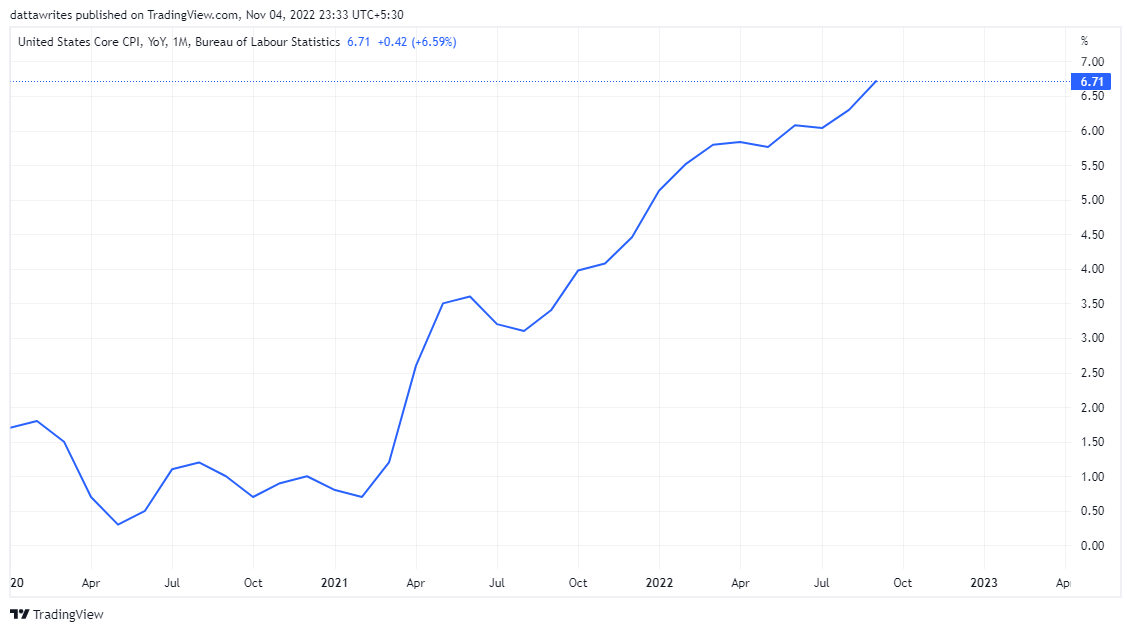

This alarming predatory increment hurts both the immediate and future state of the U.S economy and the citizens of the country. Inflation comes with a general increase in the price of commodities, reducing consumers’ purchasing power. The Consumer Price Index (CPI) has risen by 15.05% since January 2020.

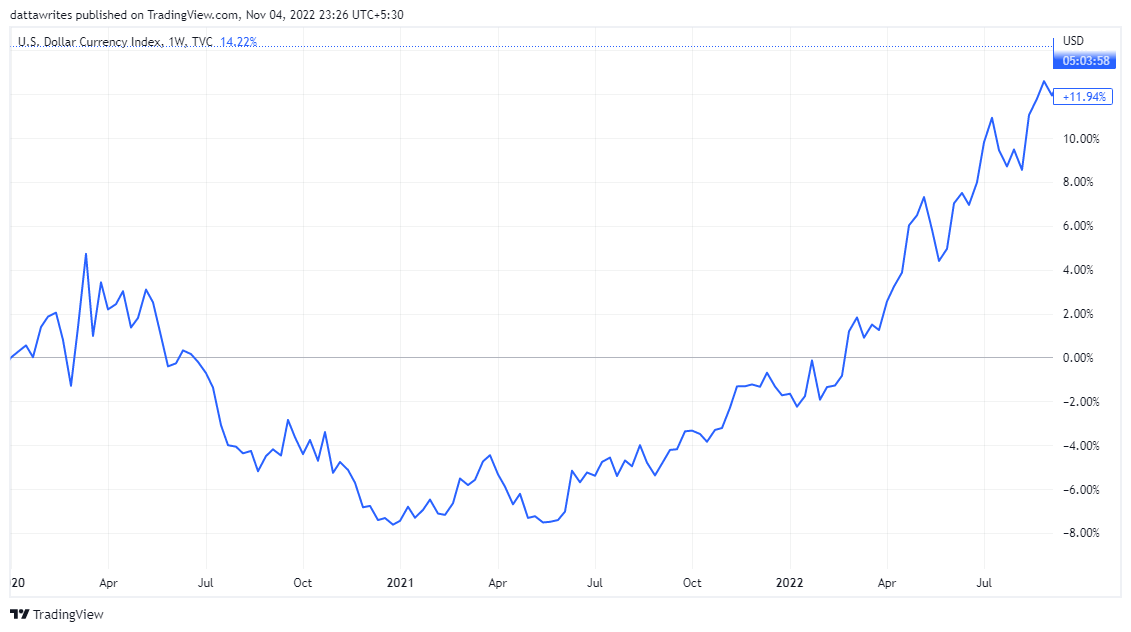

Thus, in the long run, if not checked, inflation may weaken the U.S dollar.

Even so, the U.S. Dollar has done well against EUR and GBP. Additionally, this is due to the general inflation that has affected leading economies in Europe and the United Kingdom.

Does the current inflation trend resemble the causes of inflation in the 70s and 80s?

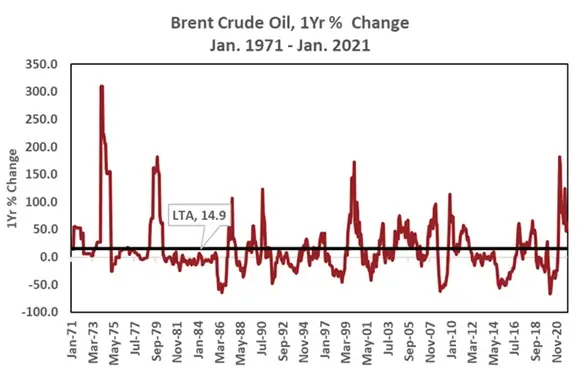

Several recent comparisons have been drawn between inflation causes in the current decade and those in the 1970s and 1980s, when the U.S. economy also faced high inflation rates.

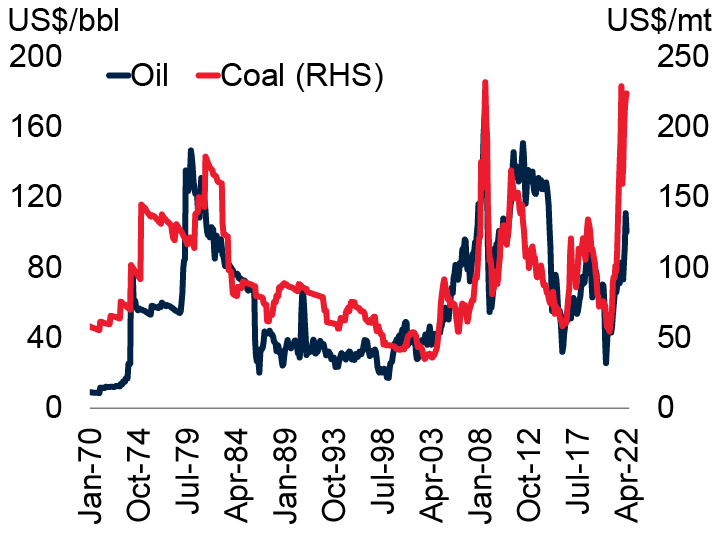

Reports suggest that oil prices soared by 300% and 180% in 1974 and 1979, respectively. In that period as well, geopolitical tensions contributed to energy shocks and oil price fluctuations.

At that time, inflation was triggered by OPEC‘s increase in oil prices, known as the Oil boom by its members. In the past, most of the world’s economies relied heavily on oil before seeking alternatives in the present era.

Other factors contributing to inflation during the 70s and 80s included low-interest rates, weak economic growth, and lower inflationary pressures.

However, there are pointers that the recent inflation in the current decade started faster than what was recorded in the previous decades.

The U.S. has experienced 15% inflation this decade over 33 months. If this trend continues, we’re on track for a 50% increase this decade.

Fed’s Response to Inflation; Hike in Interest rates and impact on Jobs in the U.S

In response to the prevailing inflation, the Federal Reserve has raised interest rates on different occasions within the year. Recently, the FED raised interest rates by 75 basis points at its Nov 1-2 meeting for the fourth time in a row.

Meanwhile, the increment has been a major strength of the USD’s strong performance against the EUR and GBP, highlighting an impressive growth of the US Dollar Index (DXY) by 14.57%.

However, there are standing arguments by economists that the Fed might reduce the pace of the hike in interest rates at the beginning of 2023.

On a simple note, the approach of the Fed can be described as an attempt to destroy demand while encouraging firms and individuals to save.

At every opportunity, business owners will reduce their expenditures which could result in a stagnant employment rate, leaving workers’ wages at the status quo and discouraging them from spending more.

Cryptocurrency response to inflation

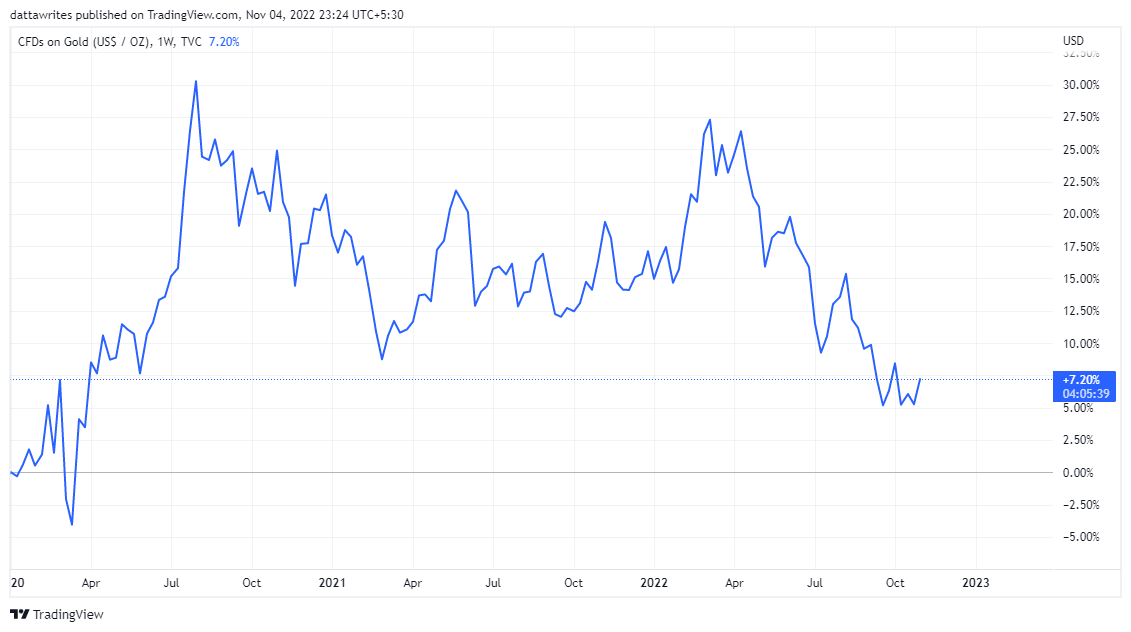

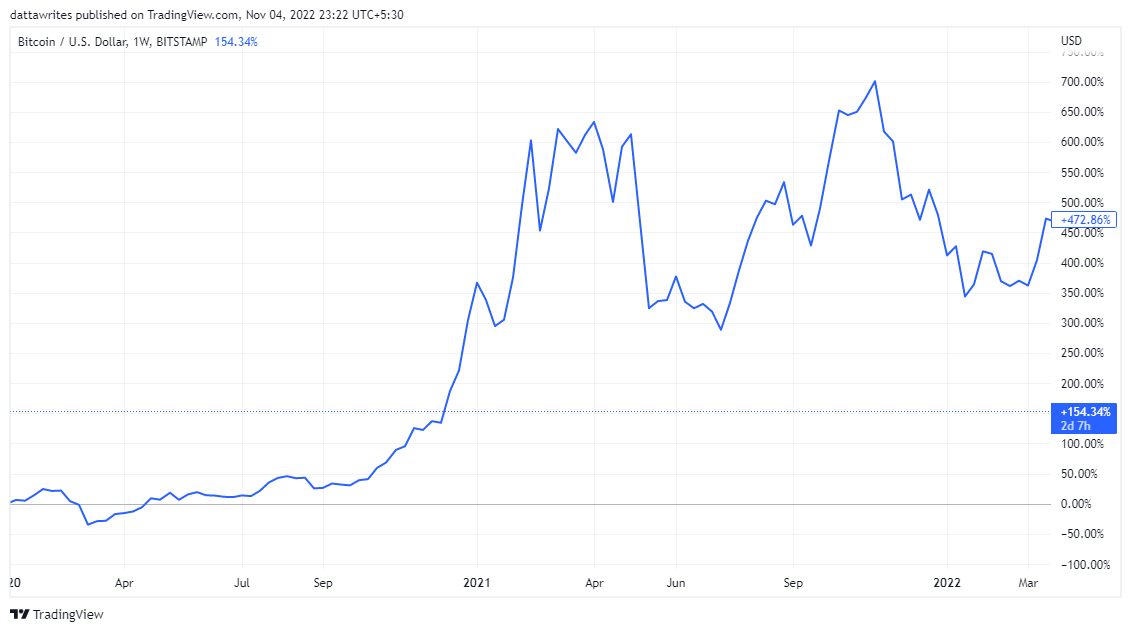

Since the start of 2020, BTC has been up 184.28%, while gold has gone up Gold by only 5.38%. These figures reflect how cryptocurrency assets surged, strongly opposed to traditional assets like Gold.

Before now, assets like Gold gained much relevance as an inflation hedge. However, Cryptocurrency has proven to be an ideal option compared to Gold as an investment against severe inflation.

Bitcoin Market Data

At the time of press 7:56 pm UTC on Nov. 4, 2022, Bitcoin is ranked #1 by market cap and the price is up 3.79% over the past 24 hours. Bitcoin has a market capitalization of $403.41 billion with a 24-hour trading volume of $62.86 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 7:56 pm UTC on Nov. 4, 2022, the total crypto market is valued at at $1.05 trillion with a 24-hour volume of $111.56 billion. Bitcoin dominance is currently at 38.40%. Learn more about the crypto market ›