Research: Options market analysis suggests Ethereum’s Merge may be a ‘buy rumor, sell news’ event

Research: Options market analysis suggests Ethereum’s Merge may be a ‘buy rumor, sell news’ event Research: Options market analysis suggests Ethereum’s Merge may be a ‘buy rumor, sell news’ event

The Volatility Smile charts for September and October show dramatic differences that suggest options traders are expecting Ethereum to drop post Merge.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

The long-awaited Merge will connect Ethereum’s existing execution layer to its Proof-of-Stake consensus layer and general market sentiment has investors buying in preparation for a sustained pump as this is a milestone event in the project’s evolution.

However, analysis of the options market suggests the Merge may be a “buy the rumor, sell the news” event.

The Volatility Smile

The Volatility Smile chart results from plotting the strike price and implied volatility of options with the same underlying asset and expiration date.

Implied volatility rises when the underlying asset of an option is further out-of-the-money (OTM), or in-the-money (ITM), compared to at-the-money (ATM).

Options further OTM usually have higher implied volatilities; hence Volatility Smile charts typically show a “smile” shape. The steepness and shape of this smile can be used to assess the relative expensiveness of options and gauge what kind of tail risks the market is pricing in.

The accompanying legend refers to historical overlays and shows the shape of the smile 1 day, 2 days, 1 week, and 2 weeks ago, respectively. For instance, when ATM implied volatility values for extreme strikes are lower today compared to historical overlays, it could indicate a reduced tail-risk being priced in by the market. In such cases, the probability for extreme moves compared to medium moves has come down in the market’s view.

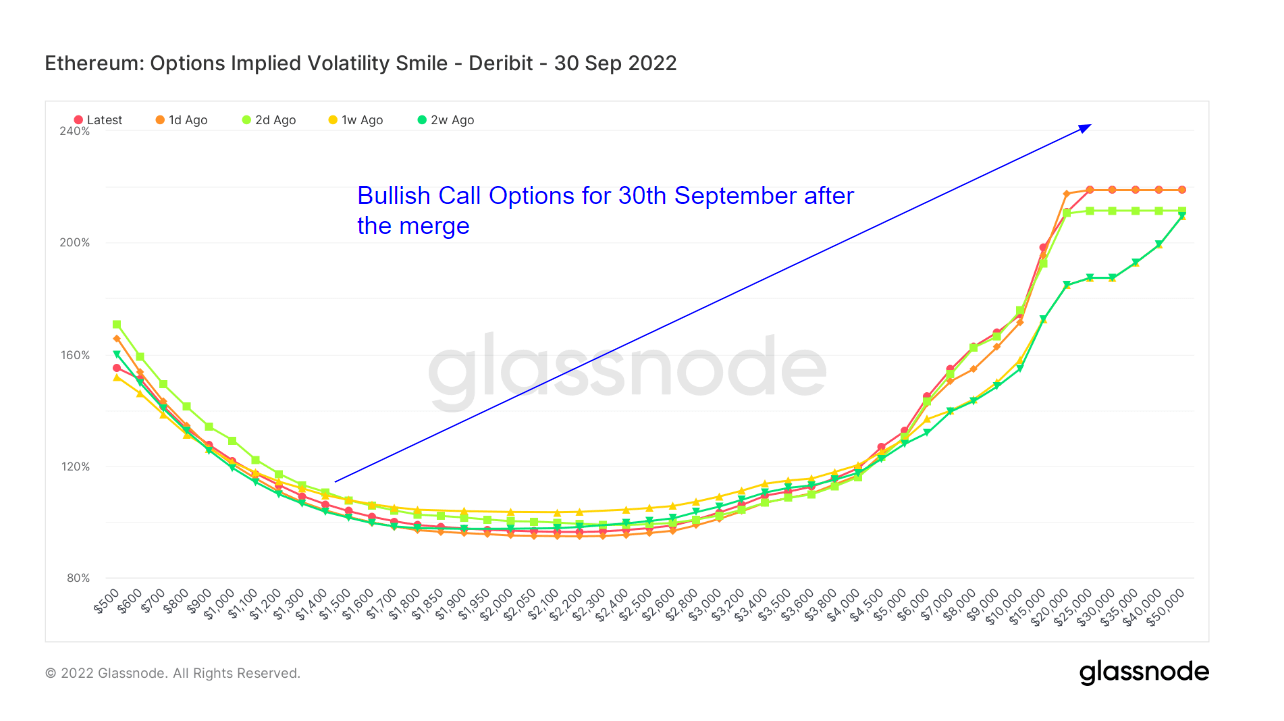

The Merge is scheduled for Sept. 15 and the huge demand for call options expiring at the end of September is acting as a bullish driver on price. Implied volatility is up over 200% for prices over $10k-$50k, meaning investors are willing to pay a premium.

Ethereum options demand tailing off post-Merge

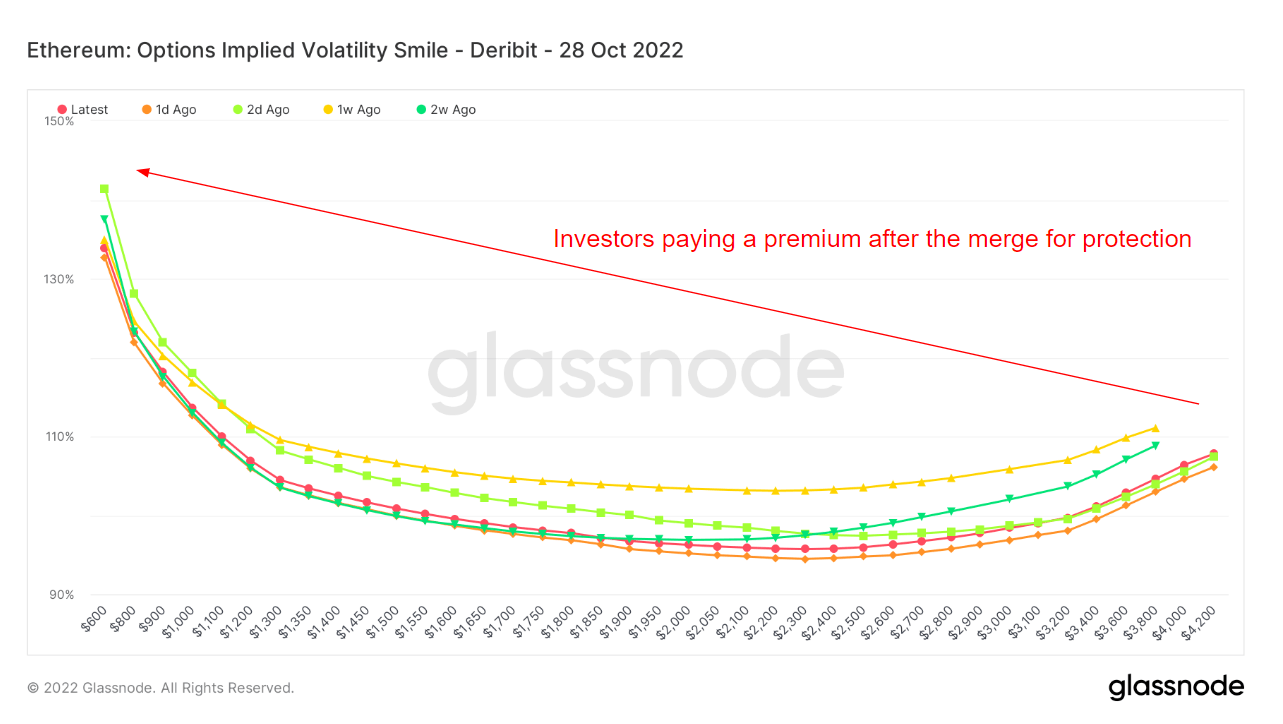

Volatility for options expiring in October shows a drastic change in the Volatility Smile.

The chart below depicts a sharp decline presenting a flatter structure. This change suggests lower demand for Ethereum options after the Merge goes live.

Nonetheless, the left tail is still high for implied volatility, implying traders are willing to pay a premium for put options after the Merge.

In conjunction, the two charts indicate options traders are buying the rumor and selling the news.