Wombat Exchange Releases First Single-Sided Volatile Pool AMM in DeFi

Disclaimer: This is a sponsored press release. Readers should conduct their own research prior to taking any actions related to the content mentioned in this article. Learn more ›

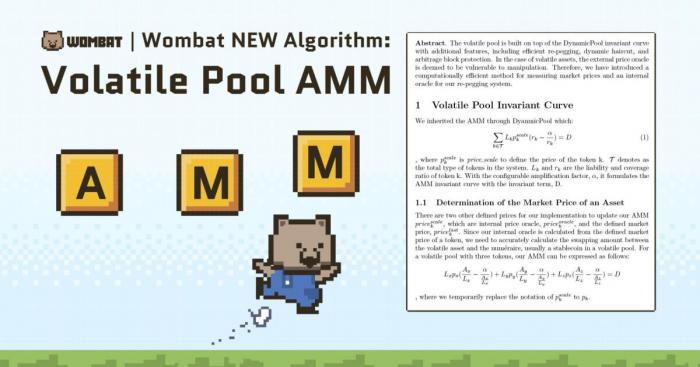

Hong Kong, Hong Kong, February 2nd, 2024, Chainwire – Wombat Exchange, a leading multi-chain and cross-chain single-sided stablecoin swap, published the first-ever single-sided Volatile Pool Automated Market Maker (AMM) algorithm in the decentralized finance (DeFi) space. This groundbreaking development marks a new era in DeFi, providing the very first oracle-less, user-friendly single-asset-deposit, and capital-efficient trading environment for all asset classes, including GameFi assets. Earlier last month Wombat unveiled its GameFi expansion plan through announcement of its new Gamified Bribe Market 2.0 as well as upcoming collaborations with Animoca portfolio games.

The whitepaper release comes on the heels of Wombat Exchange’s remarkable track record, having done over $3 billion in trading volumes to date with only pegged assets, such as stablecoins, LSTs, and LRTs. The brand new single-sided volatile asset pool is expected to turn Wombat Exchange into a full-service multi-chain and cross-chain Decentralized Exchange (DEX), greatly increasing the platform’s TVL and trading volume through extending the platform’s trading coverage to include non-pegged volatile assets, including any crypto assets and GameFi assets.

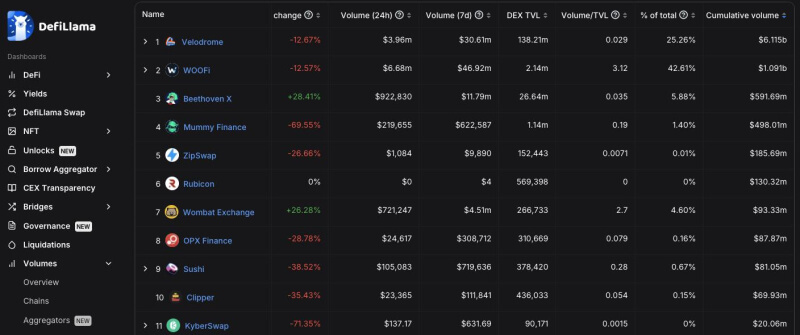

The team has long been committed to capital efficiency, focusing on refining its proprietary algorithm to support high trading volumes with minimal Total Value Locked (TVL), to deliver sustainable and long-term yields for its users. This dedication has propelled the platform to some notable achievements. Wombat Exchange has swiftly secured a position among the top 7 on DefiLlama in terms of accumulated trading volume, surpassing even industry giants like SushiSwap, on Optimism, without any trading incentives, within just two months after its launch.

Earlier last month, the cross-chain swap feature of Wombat Exchange, built on Wormhole technology, supporting 6 blockchains, Ethereum, BNB Chain, Arbitrum, Optimism, Base and Avalanche, moved out of Alpha to Beta. Through this new volatile asset extension of the battle-tested hyper-capital-efficient Wombat algorithm, the platform is turning into a full service single-sided deposit DEX and Bridge with different hyper-capital-efficient algorithms for different asset classes.

About Wombat Exchange

Wombat Exchange is the only single-sided deposit, multi-chain, and cross-chain DEX. Our proprietary hyper-capital-efficient algorithms offer (i) full-range concentrated liquidity for pegged assets and (ii) oracle-less single-sided LP for volatile assets. Supported by industry giants such as Binance Labs, Animoca, Shima, and Jump Crypto, Wombat is here to deliver sustainable DeFi to the masses.

Contact

Marketing

KWOM

Wombat

[email protected]