Over $6 billion has been lost to just two crypto scams

Over $6 billion has been lost to just two crypto scams Over $6 billion has been lost to just two crypto scams

The two biggest crypto scams alone defrauded investors of over $6 billion.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

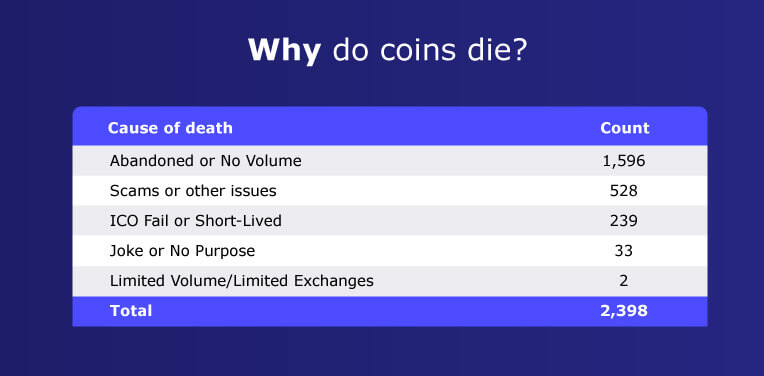

Scams were among the leading causes of cryptocurrency deaths, accounting for over 500 doomed coins so far.

This is the finding in the latest report from Traders of Crypto, which analyzed over 2,300 “dead” cryptocurrencies to find out what brought so many projects to their demise.

A tour of the crypto graveyard

As of January 2022, the crypto industry has officially buried almost 2,400 cryptocurrencies. Around 1,000 of them died in the past two years alone, research from Traders of Crypto has shown.

This 71% increase in the number of dead coins can, at least in part, be attributed to the cutthroat environment of 2020’s DeFi summer, which saw the demise of hundreds of projects.

According to the report, 1,596 coins have been pronounced dead due to abandonment or lack of volume. This means that their trading volume stayed below $1,000 for three consecutive months or that their websites were either shut down or abandoned by developers.

The fast development pace of the crypto industry has no sympathy for projects that fail to keep up, so the large number of tokens that died because of this comes as no surprise.

What does come as a surprise is the number of tokens that died as a result of scams.

The report identified 528 scam cryptocurrencies, ranging from billion-dollar elaborate Ponzi schemes to low-volume pumps and dumps. This category also includes coins that died as a result of hacks and thefts, although that number is significantly smaller than founder-led scams.

Scams—the most lucrative crypto business

By January 2022, over $7.1 billion has been lost to cryptocurrency scams. Out of that $7.1 billion, $6 billion was lost to just two scams—OneCoin and BitConnect.

OneCoin is by far the largest scam the crypto industry has ever seen. Official FBI filings put the amount OneCoin defrauded from investors at around $4 billion—none of which have made their way back to investors.

OneCoin could also be considered the biggest scam in the world given how many people invested in the classic Ponzi scheme. According to data from OneCoin, the so-called “Bitcoin killer” had over a million investors at one point.

The scam took place between 2014 and 2016 and had the advantage of being the first on the market. With cryptocurrencies still being a niche asset class, OneCoin’s extravagant marketing and promises of outlandish returns caught the eye of an incredible number of retail investors.

OneCoin promised fast and easy payments and a much more approachable infrastructure than Bitcoin. Investors that wanted in on the opportunity were offered several different “packages” of tokens, which could be purchased only for cash. These tokens would then generate more OneCoins for its owners—the more expensive the package, the bigger the returns. The company also did little to hide its very clear MLM organization, as people who brought on new users to OneCoin earned revenue on every purchase they made.

When it came time to launch the OneCoin Exchange, the only way of cashing out OneCoins, the company shut down and its founder Ruja Ignatova mysteriously disappeared. And while several other high-ranking OneCoin executives were arrested and sentenced for fraud, Ignatova and her brother still remain missing, alongside the $4 billion.

From the ruins of OneCoin emerged BitConnect, the second-largest cryptocurrency scam. Founded in 2016 as a lending protocol, BitConnect offered users daily interest payments calculated by a controversial “trading bot.” These payments would increase if the owner of the BCC token brought on more buyers—at one point, BitConnect offered a 1% daily compounded interest.

The BCC token quickly became the best performing coin on the market, rising from a post ICO price of $0.17 to over $500. However, as more regulators began cracking down on BitConnect and issuing warnings for unlawful operations, the official website shut down and dragged the price of the token to the ground and locking all of the BCC tokens. And while many investors eventually received their BCC back, their value plunged to near zero and rendered their investments worthless.

BitConnect’s founders, however, pulled out over $2 billion worth of Bitcoin before shutting down the project. Last year, BitConnect’s founder Satish Kumbhani and its top promoter Glenn Arcaro were arrested and charged with fraud—Arcaro pled guilty, while Kumbhani’s whereabouts are still unknown.