Researcher: Mirror Protocol was allegedly set up to scam retail investors

Researcher: Mirror Protocol was allegedly set up to scam retail investors Researcher: Mirror Protocol was allegedly set up to scam retail investors

FatManTerra has revealed a series of Ethereum and Terra transactions that allegedly link Do Kwon to a scam to secretly sell MIR tokens.

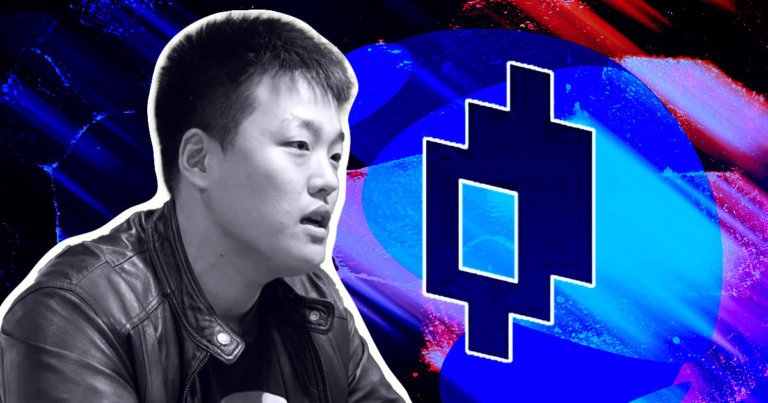

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Terra analyst and source of several whistleblower leaks, FatManTerra, has alleged that Mirror Protocol is a “farce designed to enrich Do Kwon/VCs while manipulating governance and screwing over retail.”

FatManTerra identified a wallet via Etherscan that deployed the Mirror Protocol yield farming smart contracts. The wallet created the smart contract 0xdb27, which FatManTerra alleges to be a part of the Terra wormhole infrastructure and a liquidity pool for Mirror Protocol.

The contract certainly appears to be acting as an LP pool for some protocol, but at this time, CryptoSlate can neither confirm nor deny that it belongs to Mirror Protocol.

FatManTerra highlights that this wallet:

“Owned most of the Mirror LPs on Ethereum. They thus farmed most of the MIR rewards, which would allow them to have a disproportionate say in governance decisions.”

The wallet in question is listed as one of the top 20 MIR wallets, according to CoinMarketCap. The data matches with FatManTerra’s next accusation.

“I have found evidence that this wallet and related wallets try very hard to make it look like MIR governance is not majority-controlled by a single entity – they do so by splitting up MIR between several fresh anonymous wallets.”

The MIR held in the wallets identified in the Twitter thread is apparently all staked, giving them excessive voting power in the MIR governance when combined.

FatManTerra then identifies several wallets that interacted by bridging tokens across the wormhole, transferring mAssets from Ethereum to Terra, purchasing $750 million tranches of UST, and spreading MIR across multiple wallets similarly to the previously described wallets.

Again, FatManTerra alleges that someone with high levels of capital and access to LP contracts was spreading MIR tokens across multiple wallets to make the protocol appear more decentralized. The accusation is damaging to the reputation of Mirror Protocol; however, the next part of the thread changes the direction of his accusations.

Here's a fun little bonus bit. One of the addresses above (https://t.co/Dgz46MjBXU) bridged over money to this Ethereum address (https://t.co/ETy7vBUqw3) that owns the "dao5.eth" ENS name. Uh oh… What's this? (12/19) pic.twitter.com/UYF5DdBV5t

— FatMan (@FatManTerra) May 25, 2022

FatManTerra suggests that one of the wallets he has been tracking sent tokens to a DAO address for which Do Kwon is an official advisor. He then describes how MIR funds incorporated in this web of wallets have been transferred to Binance and KuCoin to be sold on the open market.

The accusations can be traced by reviewing the on-chain data which he claims:

“corroborates much of what the employee currently working at Jump told me.”

FatManTerra concludes the thread by saying, ” I suggest that people examine the data and draw their own conclusions wherever possible.” Links to each of the wallets are available in the thread, and the beauty of blockchain is that the information is free for the world to see.

The question now is whether these wallets can be officially tied to Do Kwon and Jump Capital as he alleges and whether FatManTerra’s unnamed sources will come forward publically to reveal more information.

Update May 29th, 2022: Fatman Terra provided some additional thoughts about this, noting that he does not believe it was an inside job as there is no definitive evidence.

Two days on, I'd like to correct some claims going around:

– I don't believe this was an inside job. No compelling evidence of that yet.

– I'm not a 'genius' and I didn't find this all by myself. Story embellished for narrative; the credit goes to my amazing anon research team.— FatMan (@FatManTerra) May 29, 2022

CoinGlass

CoinGlass

Farside Investors

Farside Investors