Metaverse tokens show big gains in January with sector expected to reach $5 trillion value by 2030

Metaverse tokens show big gains in January with sector expected to reach $5 trillion value by 2030 Metaverse tokens show big gains in January with sector expected to reach $5 trillion value by 2030

Out of the top 20 metaverse tokens, 18 were in the green in January, including several that went north of +300%

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

After spending a considerable portion of 2022 in the doldrums, a number of tokens in the metaverse sector have seen considerable gains over the last several weeks, with 18 of the top 20 tokens in the sector seeing gains of up +319%, over the last 30 days.

Magic and High Street, two metaverse tokens, are both up north of 300% in the last month.

The metaverse token market sector is characterized by tokens related to virtual worlds and decentralized platforms built on blockchain technology, such as Decentraland and Sandbox.

The total of 92 tokens on Cryptoslate’s metaverse sector index have an overall market cap of $9.51 billion. These tokens are used as currency within virtual environments, used as a way to onboard and use specific services, or to purchase content on these platforms, known in the industry as play-to-earn (think Axie Infinity).

The rise in their popularity recently may be due to several factors. A big one is the multi-billion dollar push from many in Big Tech to see the industry through a number of expensive VR and AR applications.

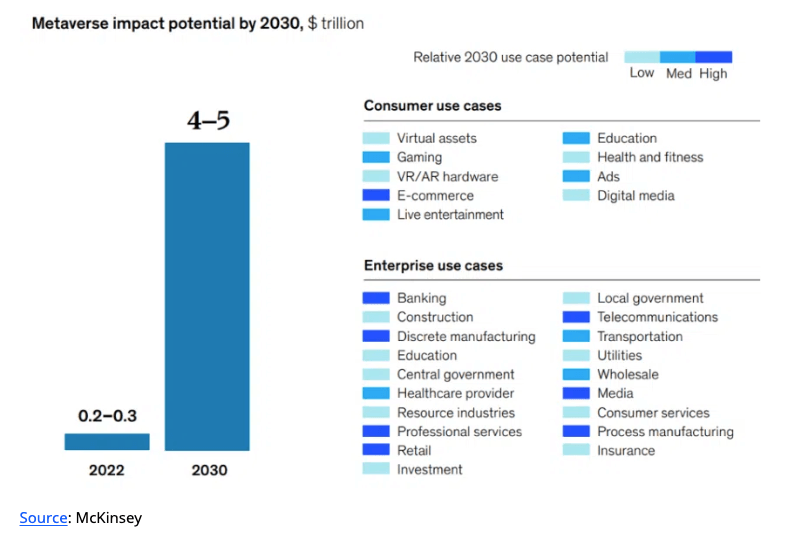

In January 2023, McKinsey reported that the Metaverse sector could reach a $5 trillion value by 2030, led by a significant push from companies like Alphabet (Google), Apple, and Meta (Facebook), which have all expressed interest in developing this market.

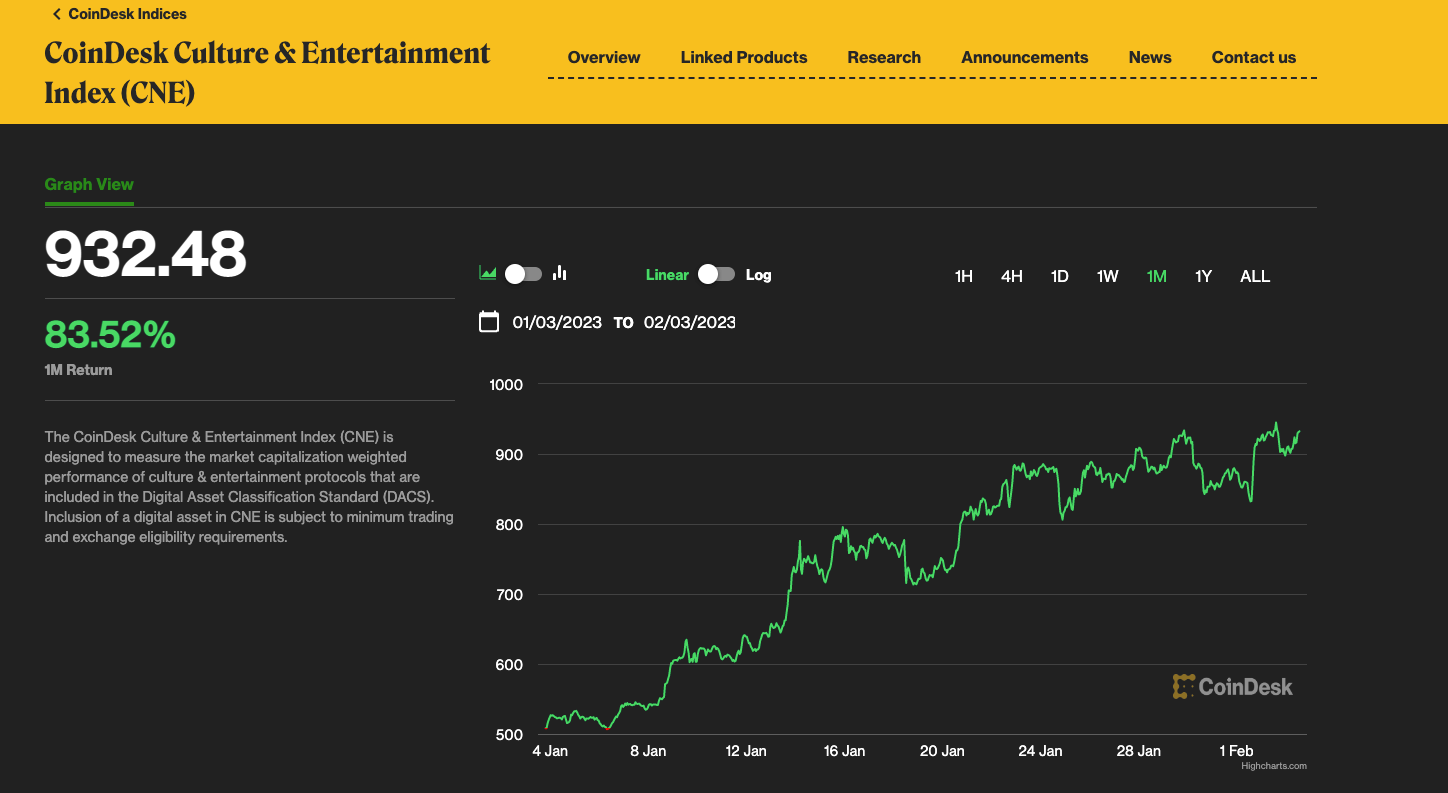

Add to this the surging popularity of token projects that unlock keys to culture in arts and entertainment, such as ApeCoin, which has been utilizing celebrity endorsements like Snoop Dogg to advance projects related to the Bored Ape Yacht Club community. The CoinDesk Culture & Entertainment Index (CNE), for example, which includes a number of metaverse tokens like Decentraland and Sandbox, but also play-to-earn game tokens like Axie Infinity, has skyrocketed 83.2% in the last month.

Metaverse token top performers month of January

Internet Computer (ICP) market cap: $1,675,682,598

- Though a bit of an outlier when it comes to traditional metaverse tokens, Internet Computer (ICP) is a digital token that enables users to build apps, websites, and other web services developed by the Dfinity Foundation and supported by prominent venture capital firms, Andreesen Horowitz and Polychain Capital. Its IC Gallery allows users to build an interoperable 3D metaverse integrating GameFi and DeFi, which allow holders of ICP to play, mint, and trade all their existing NFTs through various immersive 3D experiences.

- 30 day change: +46.83%

- Internet Computer’s website currently features 75 projects, including one, DVSR, that bills itself as a decentralized version of Reddit. Another, Kinic, functions as a decentralized search engine.

Decentraland (MANA) market cap: $1,373,495,659

- Decentraland (MANA) remains one of the most popular metaverse tokens that allows users to purchase, develop, and trade virtual land in a decentralized manner in one of the industry’s most popular ecosystems. Its users include major art galleries, museums, fashion houses and brands.

- 30 day change: +138.73%

- Decentraland has one of the most active communities in the entire metaverse token sector. Between Jan. 16-19, the company partnered with the ATP and the Australian Open to present several matches viewable in the metaverse. Users were also able to interact via “New AO Tennis Club” and “Beach Bar.”

Sandbox (SAND) market cap: $1,093,357,853

- The Ethereum-based metaverse and gaming platform that allows users to develop plots and monetize unique in-world assets such as digital collectibles has also seem a considerable upshot over the month of January.

- 30 day change: +78.32%

- Sandbox’s gains come on the heels of an imminent token unlock scheduled for mid-February that will release 12% of the token’s supply.

Axie Infinity (AXS) market cap:$1,090,398,947

- The immensely popular token-based online video game developed by the Vietnamese studio Sky Mavis has had as many as 2.78 million average unique monthly users, a number that has since dwindled to around 411,653, but still an active enough community of daily users that give this token strength in numbers.

- 30-day change: +69.54%

- Axie keeps developing DeFi onboarding. On Feb. 2, Axie Infinity’s [AXS] engine, the Ronin network, said it would begin allowing users of the Play-to-Earn game to get loans directly from their wallets. According to the announcement, “anyone anywhere is now able to access liquidity and earn yield from their Axies and land on Ronin. In the future, players will even be able to play with their NFTs when collateralized.”

For metaverse tokens to reach their next wave of potential upwards, most analysts agree that a convergence of technological factors must first take place. Devices like augmented reality/virtual reality, sensors, haptics, and peripherals; the interoperability and open standards between; the platforms; and the development tools that allow for innovations to be built on top, the metaverse token sector still has a number of hurdles to clear before reaching more widespread adoption.