It’s do-or-die for Litecoin as halving approaches

It’s do-or-die for Litecoin as halving approaches It’s do-or-die for Litecoin as halving approaches

Concerns surrounding Litecoin's demise grow as price remains stagnant with upcoming halving fast approaching.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

As Litecoin approaches its third halving, analysis shows this to be it’s most pivotal to date.

Litecoin halving

A recent tweet thread from Alex of crypto proprietary trading firm Scimitar Capital posed the question of “whether Litecoin even needs to exist anymore.”

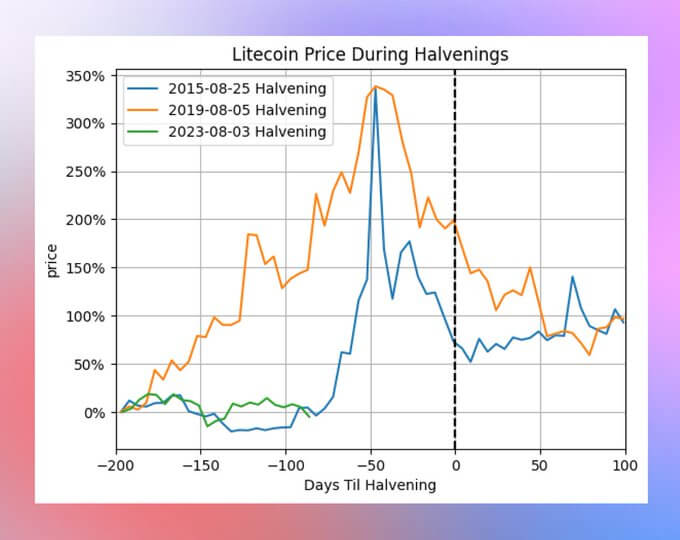

At the crux of the thread was a price chart that superimposed previous halvings based on days before and after the event against the percentage price increase on the y-axis.

Alex noted that, of the earlier halvings, the period -100 days before saw the start of the expected price uptrend — with -50 days seeing a price peak.

At the current block production rate, the upcoming halving will occur in 79 days — or August 3. After this date, the block reward will be cut from 12.5 LTC to 6.25 LTC.

Alex pointed out that the price of Litecoin has yet to react as it did in previous halvings. However, he acknowledged that drawing conclusions from just two data points may not be a reliable methodology.

Why this matters

Considering the lack of price reaction to date, Alex said this is concerning as halvings are “a vote of confidence in the network.”

“When people bid Halvenings, it is actually a vote of confidence in the network that its security is worth preserving

The Bitcoin Halvening in 2024 will likely be a strong coordination for bidders of all shapes to coordinates

Because the survival of Bitcoin is worth it.”

He wondered whether the indifference displayed so far is a signal from the market that Litecoin “isn’t worth saving.”

With that, he said that he doesn’t think Litecoin is ready to die just yet — playing down the apathy as a lack of supporting narrative to push bullish sentiment.

Supporting this view, Alex drew attention to the spike in on-chain activity since May 3 — driven by the LTC-20 token standard rollout. This was accompanied by active addresses hitting an all-time high last week.

Summing up, “There is a disconnect between the attention on-chain versus an apathy in the price action,” said Alex. However, altcoin weakness in recent weeks may be a (temporary) factor.

Signing off, he said should a pump fail to materialize within the next 100 days, it could be over for Litecoin — along with other “dinos[aurs],” which will fade into irrelevance.