Texas sees a 31% rise in Bitcoin mining energy use paired with an 80% drop in electricity prices

Texas sees a 31% rise in Bitcoin mining energy use paired with an 80% drop in electricity prices Quick Take

One of the most persistent misconceptions about Bitcoin is the belief that mining harms the environment. While it’s true that Bitcoin mining requires substantial energy, this energy consumption is crucial for maintaining the network’s security. Recent data from Pierre Rochard, VP of Research at Riot Platforms, provides valuable insights into the evolving landscape of Bitcoin mining, particularly in Texas.

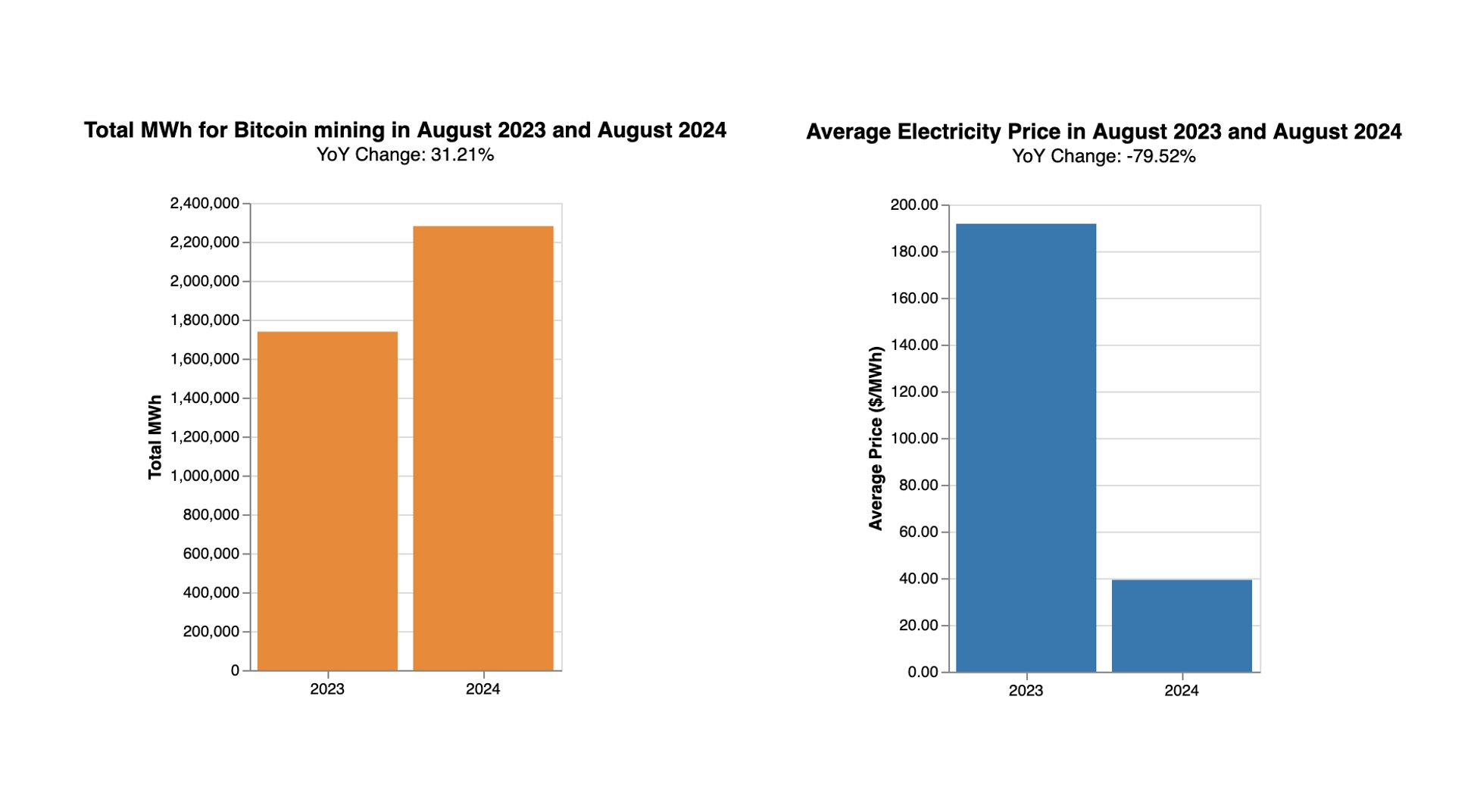

According to Rochard’s analysis, there has been a significant 31% year-over-year increase in Bitcoin mining energy consumption in Texas, rising from 1.7 million MWh in August 2023 to 2.3 million MWh in August 2024. Interestingly, this increase in energy usage has coincided with a remarkable 80% decrease in electricity prices, from $190 per MWh to just $40 per MWh. This decline in energy costs is partly attributed to the unique role that Bitcoin miners play in stabilizing energy grids.

Rochard believes that electricity prices soar primarily due to increased air conditioning use, for example, during extreme heat, as seen last summer. Bitcoin miners, therefore, often curtail usage to focus on consuming increased electricity during off-peak times when demand and prices are lower.

Riot Platforms highlights in an article that Bitcoin miners’ flexibility in power usage helps balance energy grids, ensuring stability while securing reliable, predictable power at lower costs.

“Unlike traditional data centers, Bitcoin miners can easily adjust their power usage, making them ideal for balancing energy grids. They provide steady demand during low-use periods and scale back when power is in high demand, ensuring a smooth, efficient grid”.

During periods of low energy demand, miners provide a steady demand, and when energy demand spikes, they can scale back their usage. This flexibility ensures a more efficient and stable grid and provides miners with reliable power at predictable prices.

For the energy grid, having Bitcoin miners as consistent, long-term customers reduces demand and price volatility, encouraging more competition and lowering overall energy rates. This symbiotic relationship between Bitcoin mining and the energy grid presents a compelling case for the positive impact of Bitcoin on energy markets.