Stablecoin shake-up as Tether expands and USDC retreats

Stablecoin shake-up as Tether expands and USDC retreats Stablecoin shake-up as Tether expands and USDC retreats

Tether's market dominance surges as USDT supply crosses 87 billion while USD Coin's supply trends downward.

Quick Take

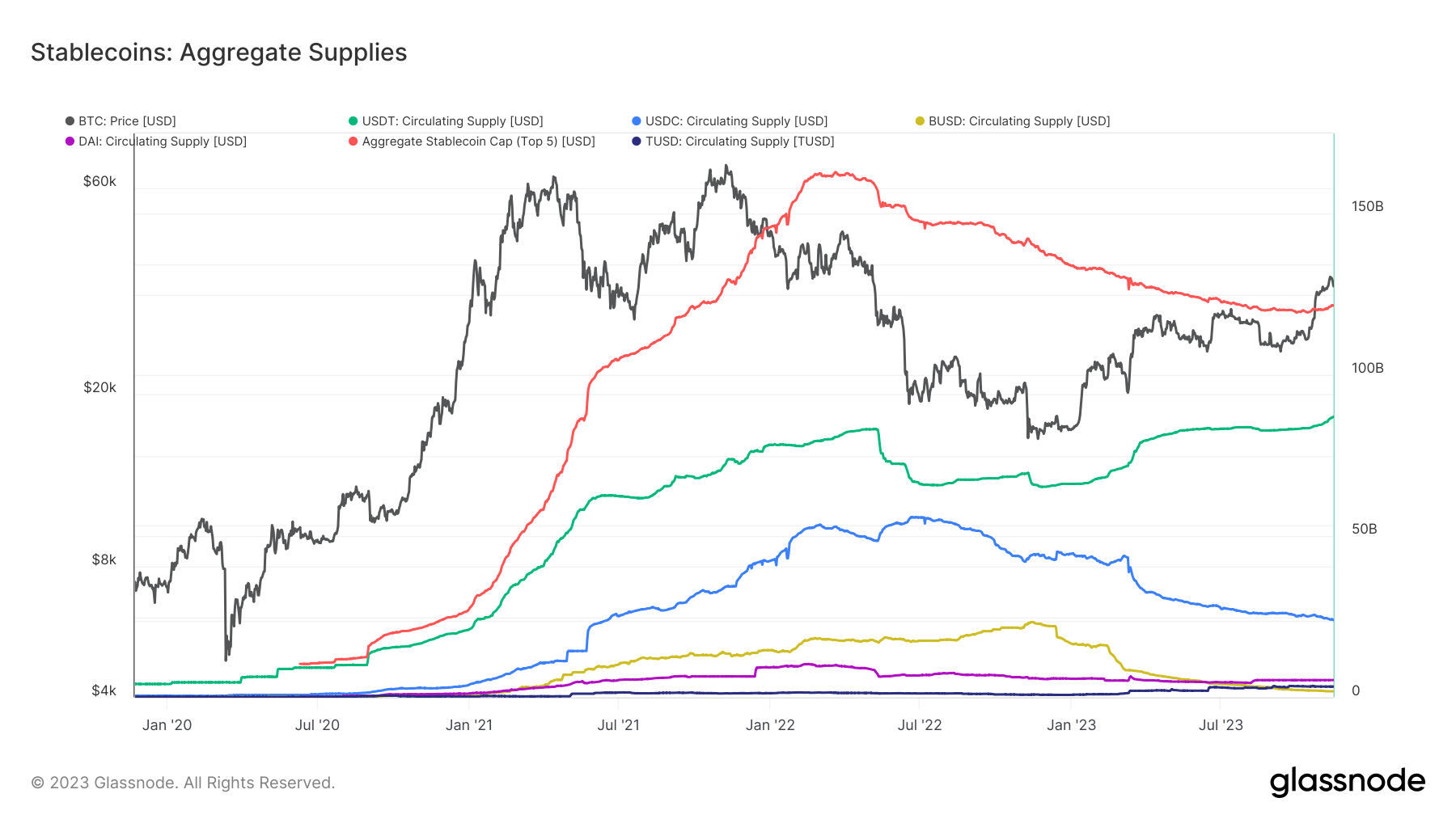

The stablecoin landscape is witnessing a significant divergence as Tether (USDT) and USD Coin (USDC) continue on distinct trajectories. The circulating supply of USDT has recently crossed the 87 billion mark, highlighting its dominant market presence among the top five stablecoins. Notably, its burgeoning dominance is about to reach a whopping 72%, a pinnacle last seen in the early months of 2021.

Conversely, USDC’s supply has shown a downward trend, dropping below the 24 billion mark. This divergence between the two major stablecoins underscores the shifting dynamics in the digital currency ecosystem.

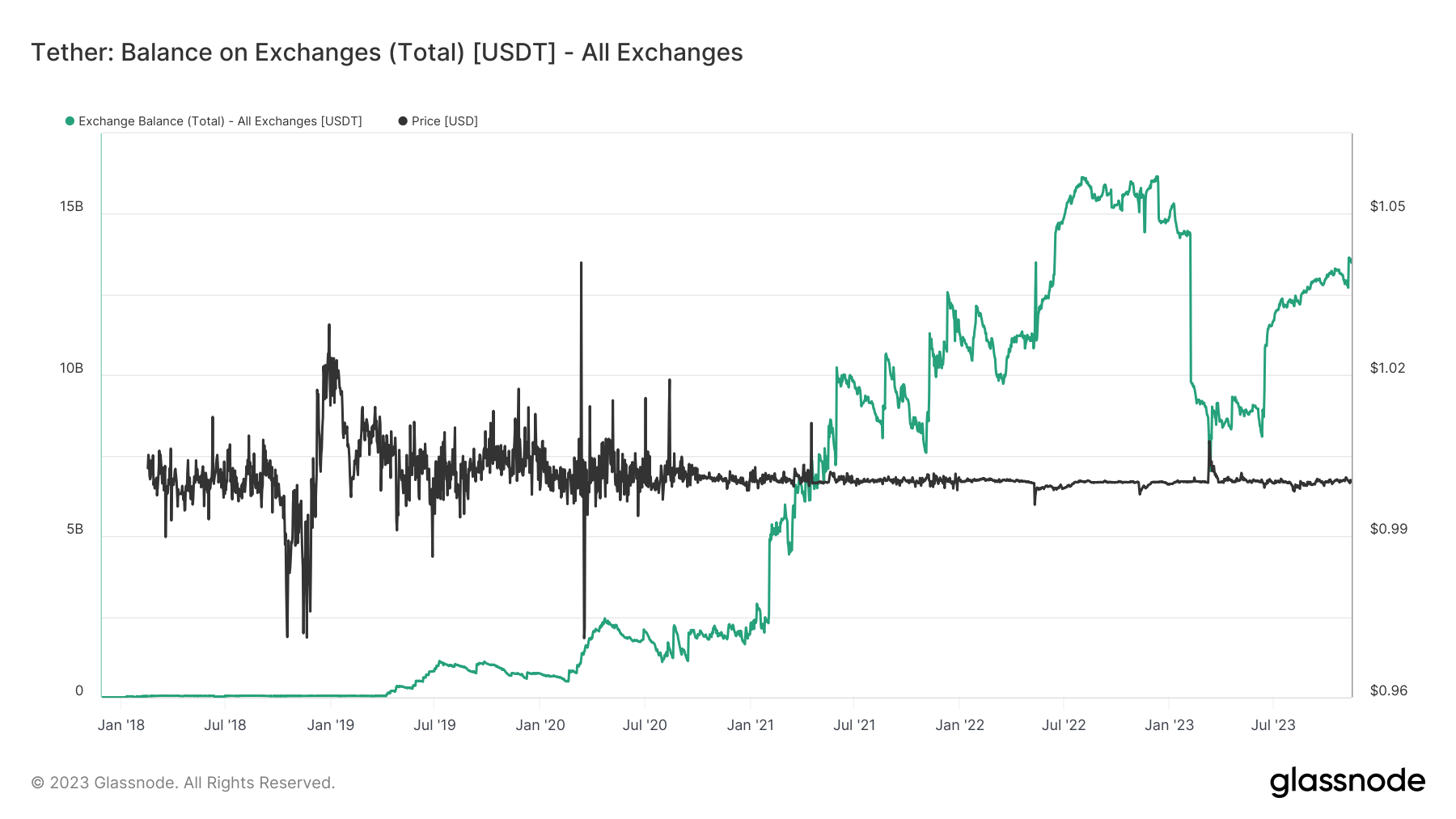

Additionally, approximately 13.5 billion USDT are now held on exchanges, marking a near doubling from the lows experienced in March 2023. This rise in exchange-held USDT points towards a potential increase in liquidity and trading activities within the crypto ecosystem.

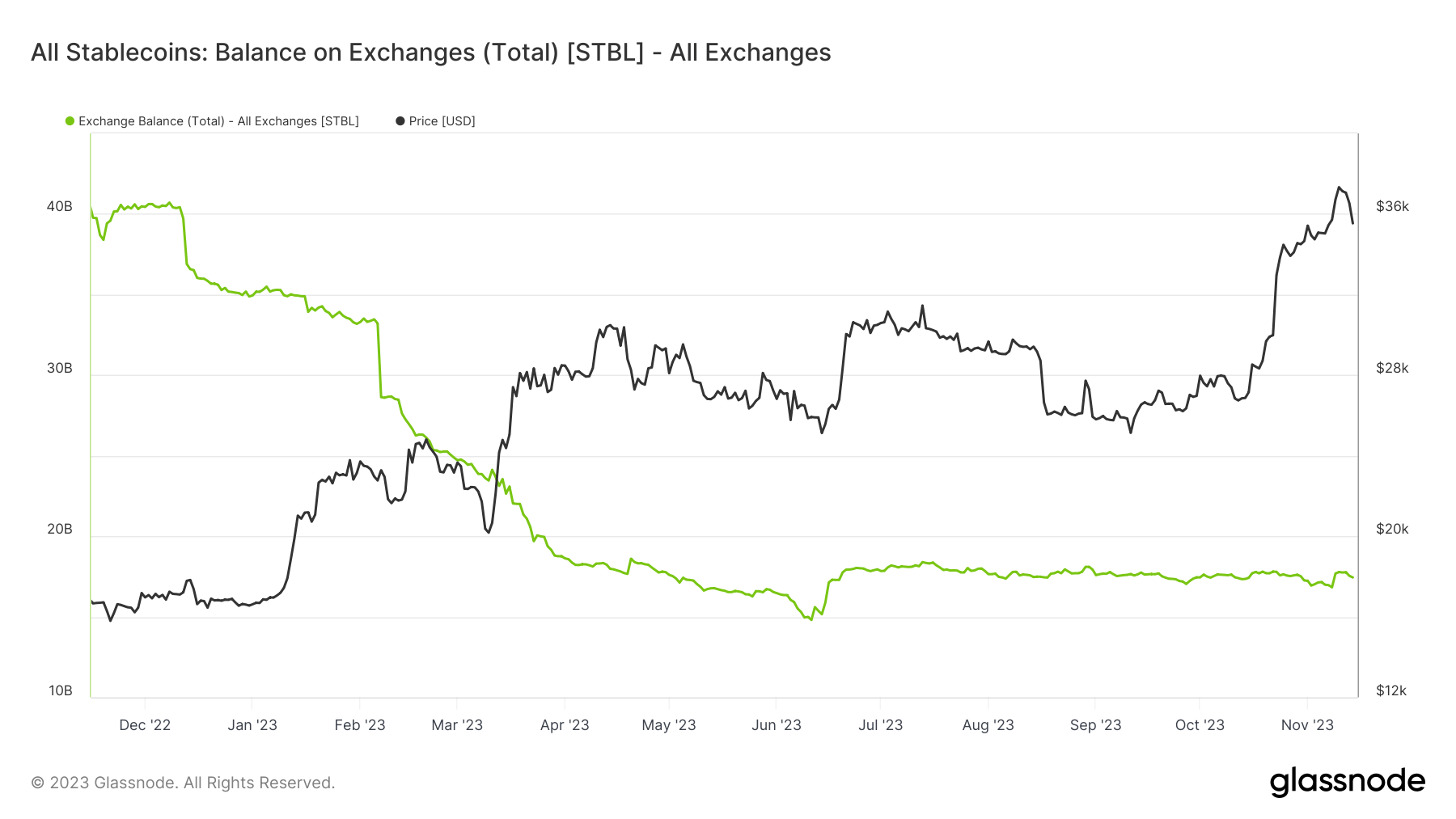

While the total value of coins held on exchange addresses currently hovers around $17.5 billion, it has remained relatively stagnant since April. Interestingly, it experienced a substantial plunge in the fourth quarter of 2022, falling from $40 billion to $18 billion by June 2023.