SEC Twitter hoax sparks $2B Bitcoin transferred to exchanges in mayhem

SEC Twitter hoax sparks $2B Bitcoin transferred to exchanges in mayhem Quick Take

The recent compromise of the SEC’s Twitter/X account, which falsely posted Bitcoin ETF approval news, catalyzed considerable market activity. Bitcoin’s initially surged near $48,000 before plummeting to $44,900, leading to the liquidation of short and long positions. The turbulence did not stop there.

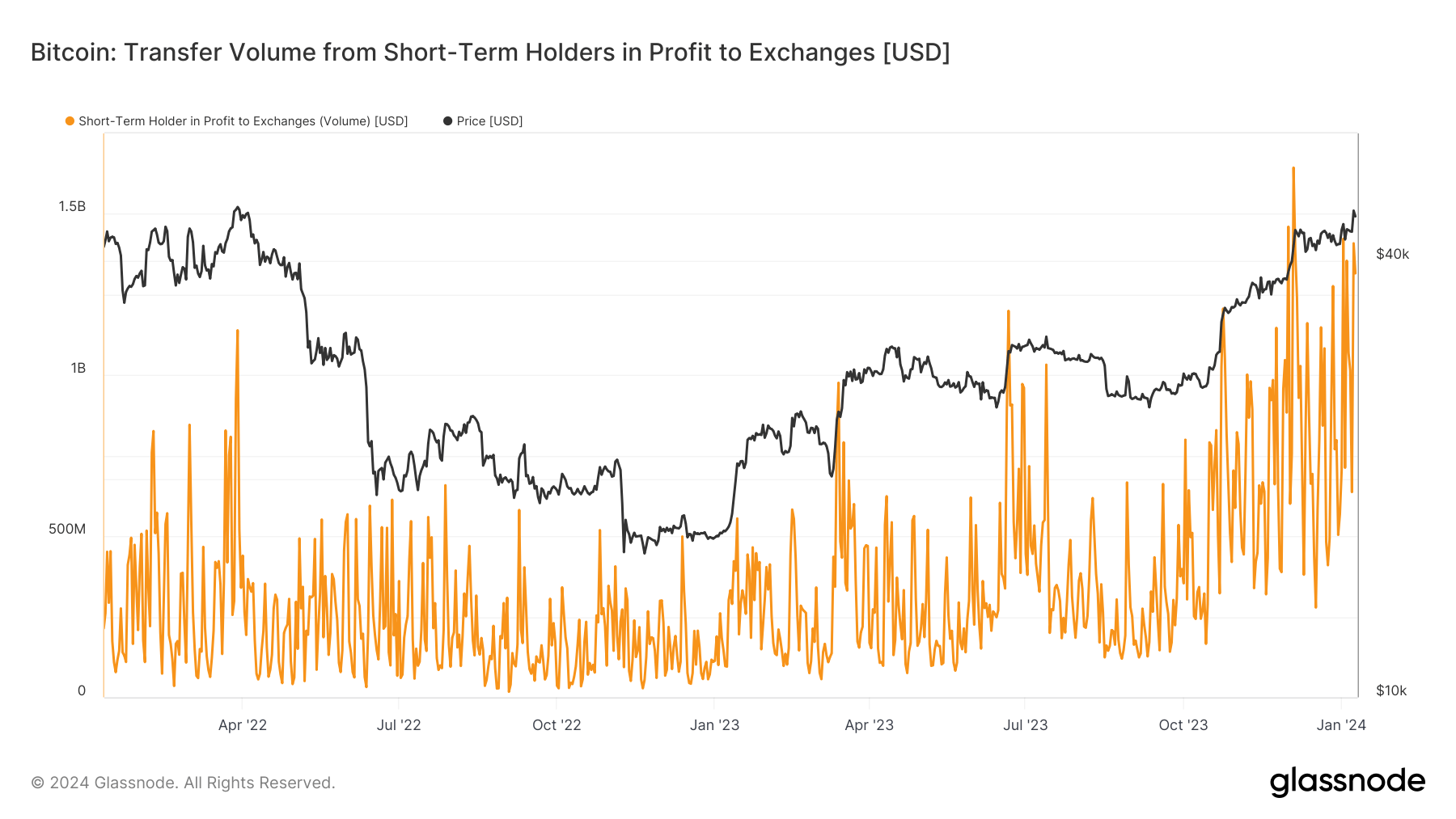

The market tumult also saw short-term holders, those who’ve held Bitcoin for less than 155 days, move a substantial amount of their profitable coins. These individuals transferred $1.3 billion in profit to exchanges, marking one of the highest profit transfer days in the past two years.

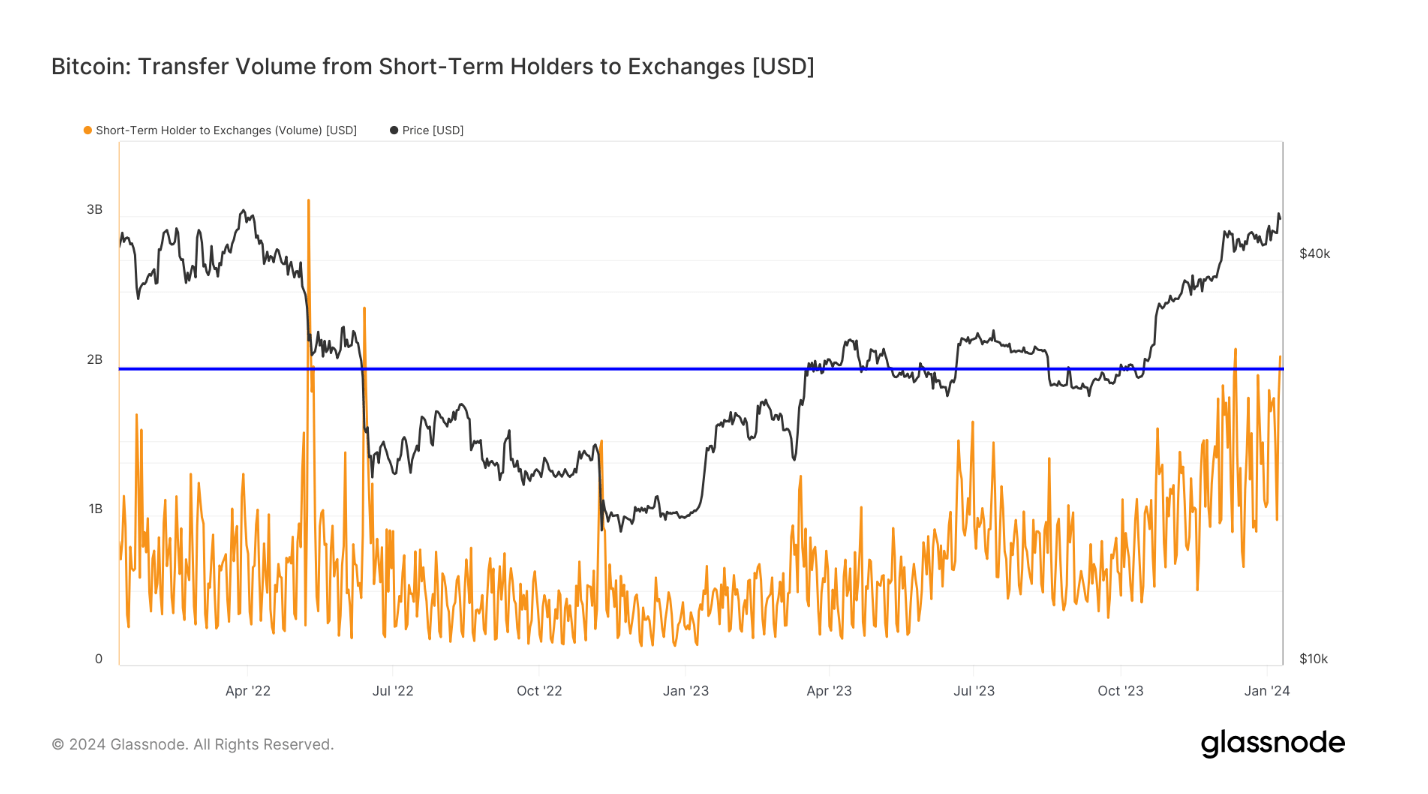

Moreover, in total, a staggering $2 billion worth of Bitcoin was sent to exchanges — a magnitude witnessed only three times prior. Unfortunately, this resulted in a significant amount of these transfers equating to losses, with $750 million sent at a loss, underscoring the severity of the market upheaval triggered by the false ETF approval news.