Resurgence of Bitcoin ‘whales’ signals confident market movement

Resurgence of Bitcoin ‘whales’ signals confident market movement Quick Take

Bitcoin has been witnessing an exceptional accumulation across all cohorts in Oct. 2023, a trend that has not been seen this year.

CryptoSlate’s analysis on Oct. 19 unearthed that this accumulation reached its zenith in July, right before Bitcoin began its upward trajectory from $30,000. This data underscores the strong confidence and active participation among Bitcoin holders irrespective of the size of their holdings, from less than one Bitcoin to over 10,000 BTC.

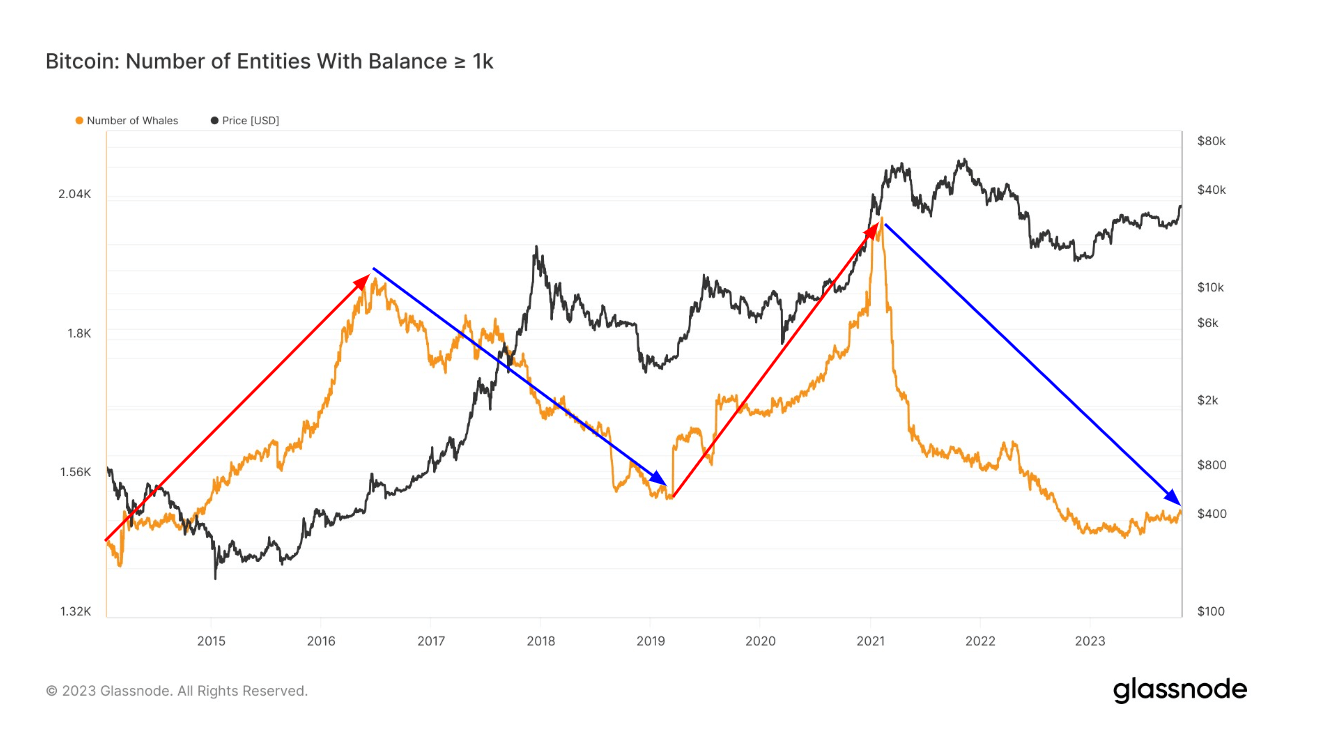

Additionally, the Bitcoin ecosystem has observed a significant resurgence of ‘whales’ – unique entities holding at least 1,000 BTC. This group’s behavior almost mirrors the price movements of Bitcoin.

Data from 2022 reveals a drop in the number of whales from 1,600 BTC to 1,450 BTC, concurrent with Bitcoin’s price plunge from $60,000 to $15,000, indicating whales were possibly selling off due to profit-taking or rising fear.

However, 2023 paints a different picture, with a steady climb in the number of whales from 1,400 BTC to 1,500 BTC, suggesting increased confidence and likely anticipation of a positive market movement.

Upon taking a broader perspective, it becomes evident that these ‘whales’ represent astute investors. They strategically accumulate and increase their holdings during bear markets and proficiently offload Bitcoin during bull markets.

BTC

BTC