Powell’s dovish remarks send Dow above 37k, Bitcoin over $43k as markets anticipate rate cuts

Powell’s dovish remarks send Dow above 37k, Bitcoin over $43k as markets anticipate rate cuts Quick Take

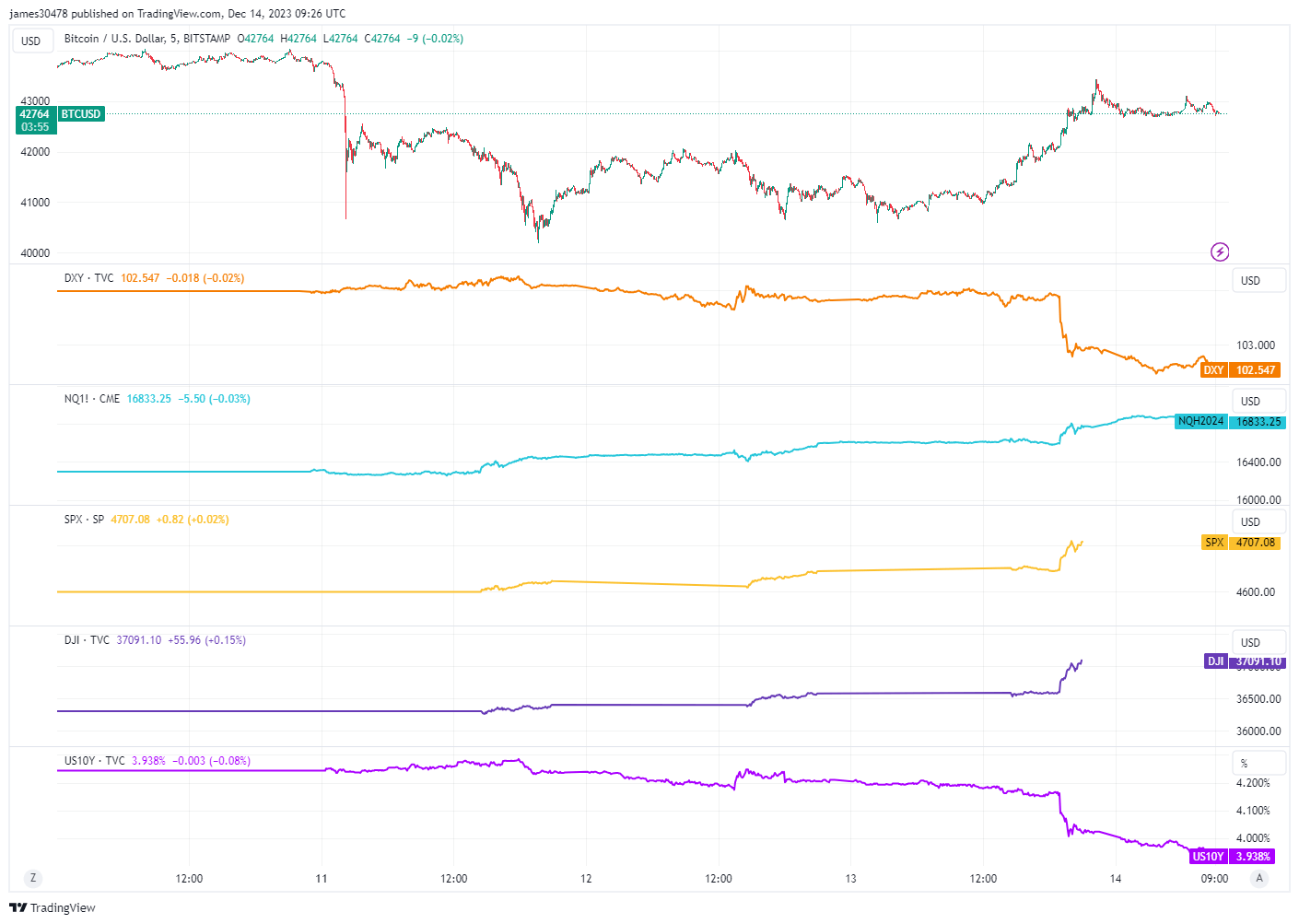

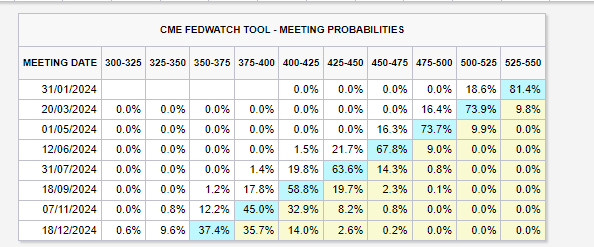

In response to Powell’s recent commentary, financial markets underwent significant shifts. The markets are bracing for a series of seven rate cuts in 2024, a move that would position Fed funds between 3.50 and 3.75. This anticipation set various indices in motion – the Dow Jones Industrial Average surpassed the 37,000 benchmark for the first time, while the S&P 500 nudged close to its record peak, up 1.4%, after crossing the 4,700 mark. Nasdaq futures also hit an all-time high. European equities such as the DAX and CAC 40 have also hit all-time highs.

Bitcoin’s value briefly passed the $43,000 threshold before falling back and is now retesting the level again as of press time. Meanwhile, the U.S. Dollar Index (DXY) slipped to 102.5, registering a 1% drop over five days. Perhaps most notably, U.S. yields experienced a sharp decline, with the 10-year yield dipping below 4%. These pivotal shifts underscore the reactive nature of financial markets to monetary policy cues and affirm their sensitivity to potential changes in the economic landscape.