Population of crypto millionaires surges 95%, driven by Bitcoin’s rise and ETFs

Population of crypto millionaires surges 95%, driven by Bitcoin’s rise and ETFs Quick Take

According to a report from New World Wealth and Henley & Partners published by CNBC, the population of crypto millionaires has surged by 95% over the past year. This rapid growth in wealth is particularly evident among Bitcoin holders, where the number of millionaires has more than doubled, reaching 85,400.

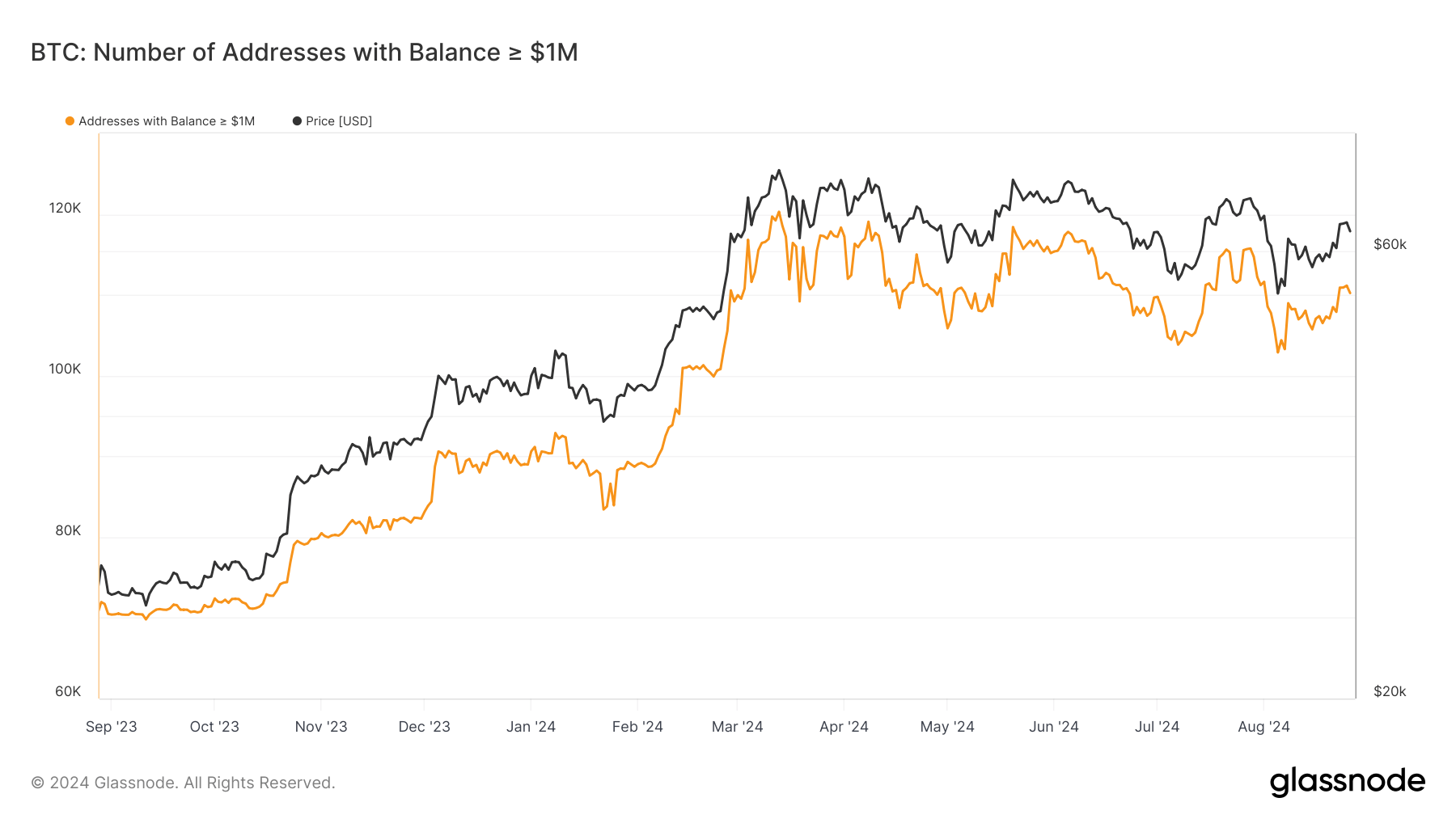

However, it’s important to note that tracking individual crypto millionaires is challenging, as only wallet addresses can be monitored. Since multiple addresses can belong to a single individual, precise tracking of individuals is not possible.

Data from Glassnode reveals that there are currently 110,000 Bitcoin addresses with balances exceeding $1 million.

The report also highlights the emergence of 325 crypto centi-millionaires (those with $100 million or more in crypto holdings) and 28 crypto billionaires. This increase in high-net-worth individuals in the crypto space has been significantly driven by the success of Bitcoin ETFs and a remarkable 140% year-over-year rise in Bitcoin’s value.

The report notes among the wealthiest in the crypto world, Changpeng Zhao, founder and former CEO of Binance, tops the list with an estimated worth of $33 billion. He is followed by Brian Armstrong, CEO of Coinbase; Giancarlo Devasini, CFO of Tether; and Michael Saylor, co-founder of MicroStrategy, all key figures contributing to the growing crypto wealth landscape.

An intriguing aspect of the report is the continued rise in the number of crypto millionaires and billionaires and the shifting trends of where these individuals choose to work and reside. The report highlights how tax-friendly and crypto-friendly jurisdictions, like Singapore, are becoming increasingly attractive.

Henley & Partners introduced a “Crypto Adoption Index,” where Singapore ranks first, followed by the United States in fourth place. According to the report, 15% of the United States population owns cryptocurrencies. The report notes:

“This is supported by strong infrastructure, with a high density of crypto ATMs, crypto-friendly banks, and an increasing number of businesses accepting cryptocurrency”.