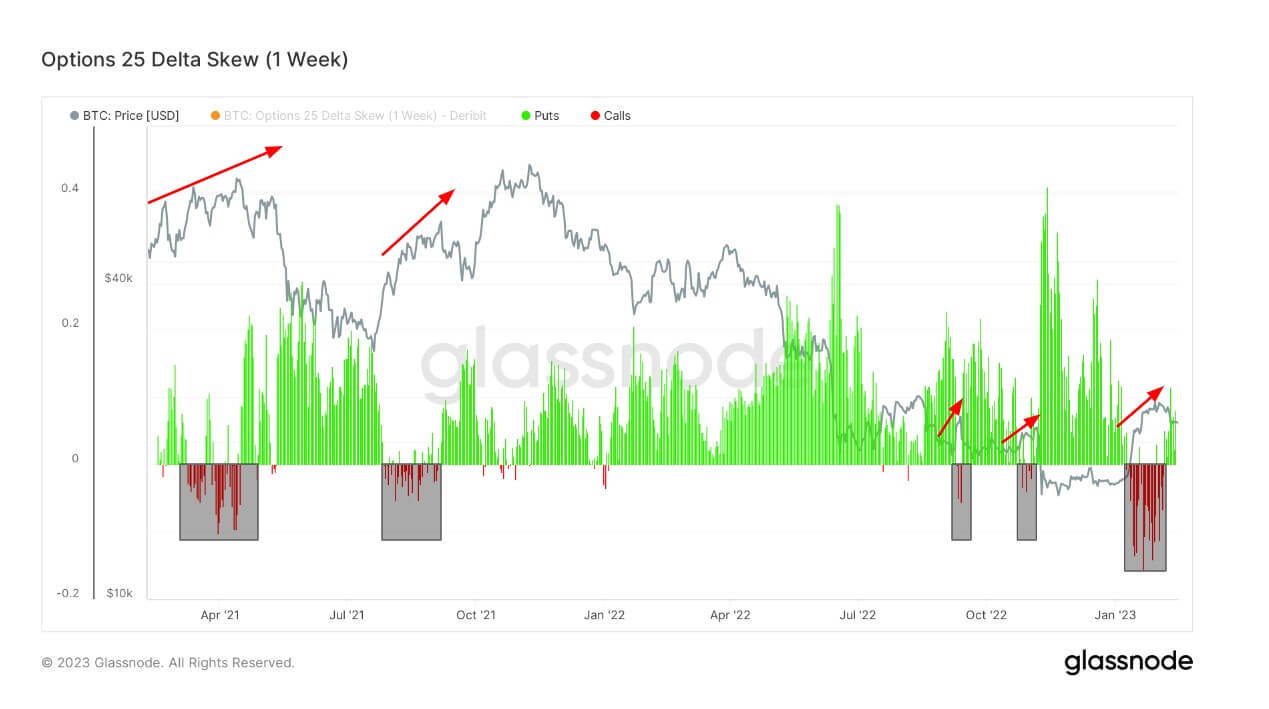

Options 25 Delta Skew suggests bearish sentiment ahead of CPI

Options 25 Delta Skew suggests bearish sentiment ahead of CPI Definition

Skew is the relative richness of put vs. call options, expressed in Implied Volatility (IV). For options with a specific expiry, 25 Delta Skew refers to puts with a delta of -25% and calls with a delta of 25% to demonstrate this difference in the market’s perception of implied volatility.

25 Delta Skew is calculated as the difference between a 25-delta put’s implied volatility and a 25-delta call’s implied volatility — normalized by the ATM Implied Volatility.

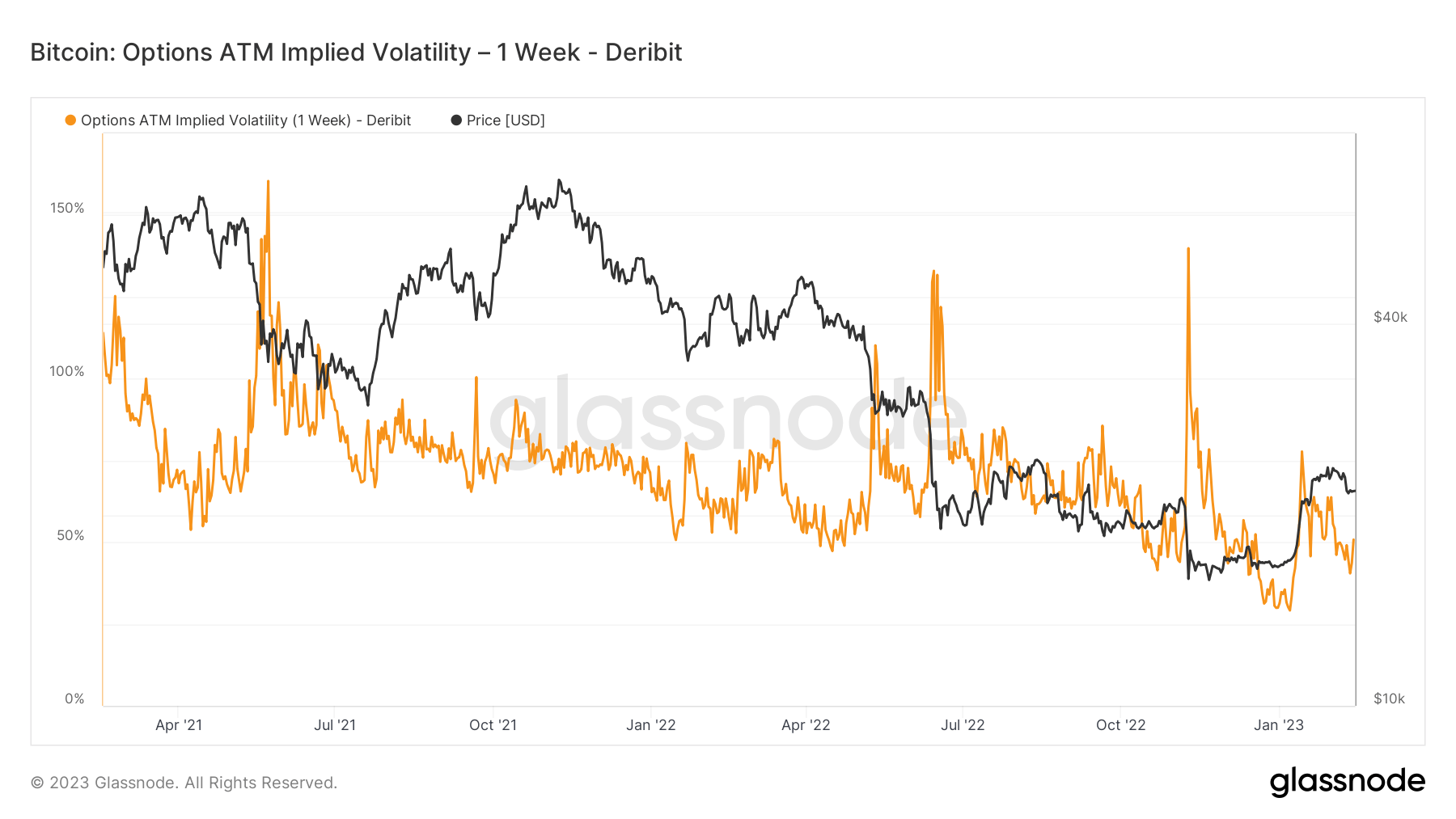

While Implied Volatility is the market’s expectation of volatility.

Quick Take

- Options 25 Delta Skew suggests puts are more expensive than calls — indicating bearish sentiment ahead of the CPI announcement today.

- For the past two years, calls have become more expensive each time than puts highlighted in the black box. Bitcoin has rallied in price — potentially indicating a bear market rally.

- Implied volatility has come down meaningfully since the FTX collapse, currently at 50% — as opposed to 140%.

- 25 Delta Skew and implied volatility focus on options contracts expiring in one week from today.