National debt up by $6.7 trillion in three years, nearing $34 trillion

National debt up by $6.7 trillion in three years, nearing $34 trillion Quick Take

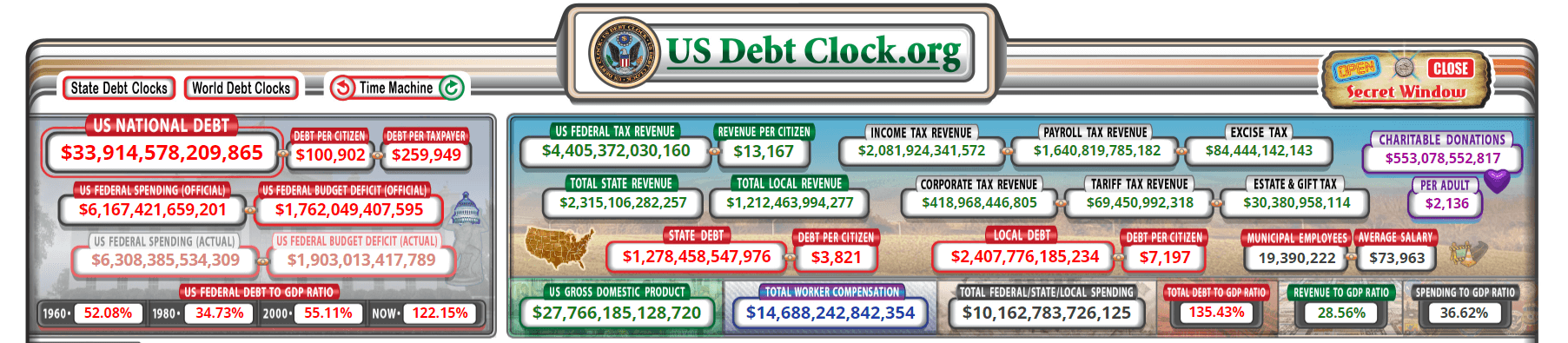

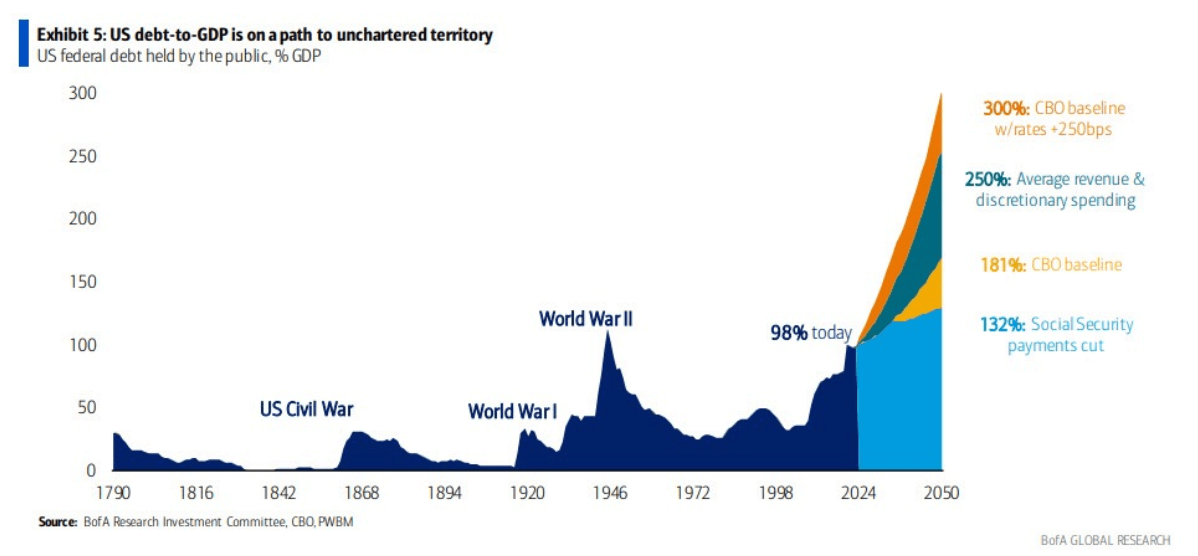

The US national debt has seen a startling increase of $6.7 trillion in just three years, closing in on a staggering $34 trillion, up from $27.3 trillion in Dec. 2020. This surge raises critical concerns about the nation’s fiscal health and economic sustainability. According to Bank of America (BofA) research, the debt to GDP ratio is approximately 100%, which parallels the unprecedented levels seen during World War 2.

More alarmingly, projections from the Congressional Budget Office (CBO) anticipate this ratio to catapult to 300% by 2050 if the interest rates remain at a steady 250 basis points. This drastic increase implies that interest payments would begin to command a larger share of the national expenditure, potentially leading to reductions in crucial sectors such as education and healthcare to accommodate the mounting debt obligations.

However, these projections are based on the assumption of a steady economic trajectory, not accounting for unforeseen “black swan” events like the COVID-19 pandemic, which could exacerbate the debt situation markedly.

To match the US debt of $34 trillion using Bitcoin valued at $43,000 per BTC, an estimated 790,697,674 Bitcoins would be required. There are only 21 million Bitcoin.