MicroStrategy to raise $2B with ATM offering as shareholders accrue more Bitcoin per share

MicroStrategy to raise $2B with ATM offering as shareholders accrue more Bitcoin per share MicroStrategy to raise $2B with ATM offering as shareholders accrue more Bitcoin per share

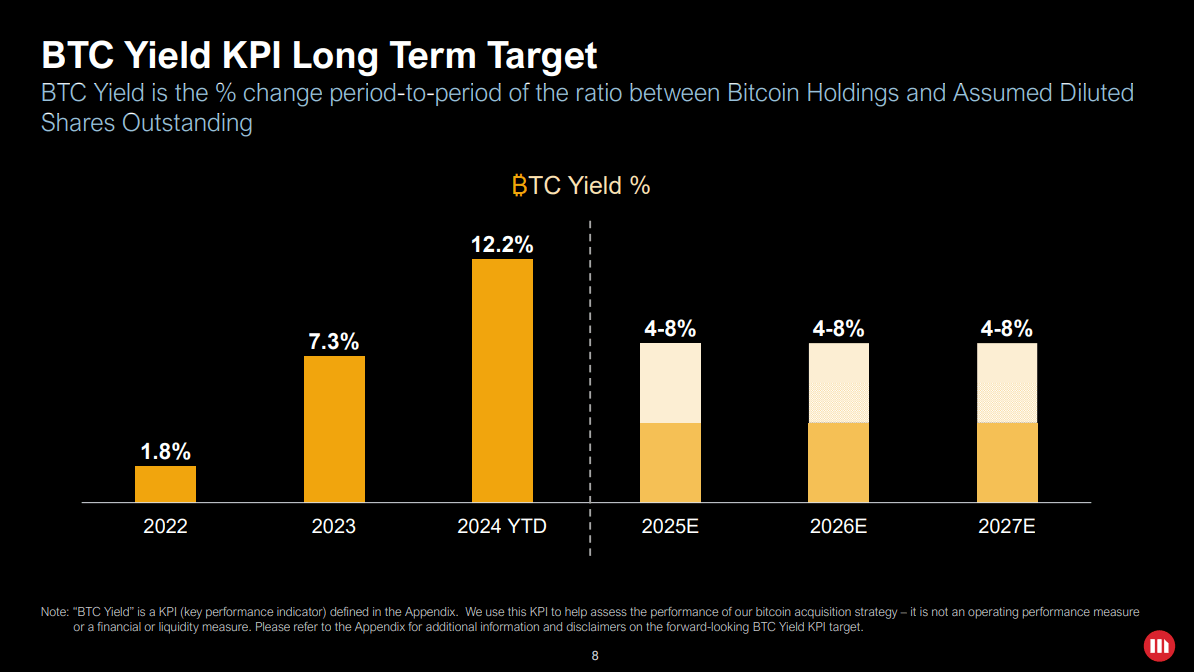

MicroStrategy reports a 12.2% year-to-date BTC yield, indicating successful leverage usage.

Quick Take

Q2 2024 Highlights

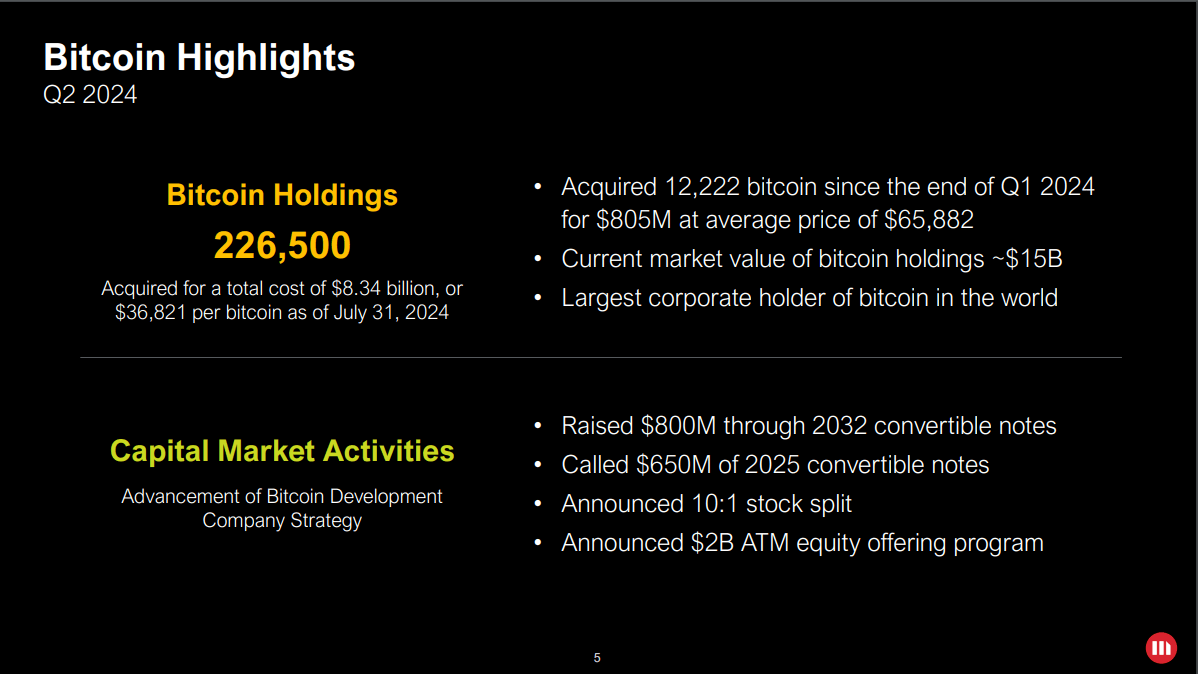

On Aug. 1, MicroStrategy announced its Q2 results, highlighting a significant milestone as its total Bitcoin holdings reached 226,500 BTC. The company reported several key financial moves in Q2 2024, according to their quarterly presentation, including raising $800 million through 2032 convertible notes, calling $650 million of 2025 convertible notes, and announcing a 10:1 stock split effective Aug. 7 alongside a $2 billion ATM equity offering program.

Bitcoin Per Share

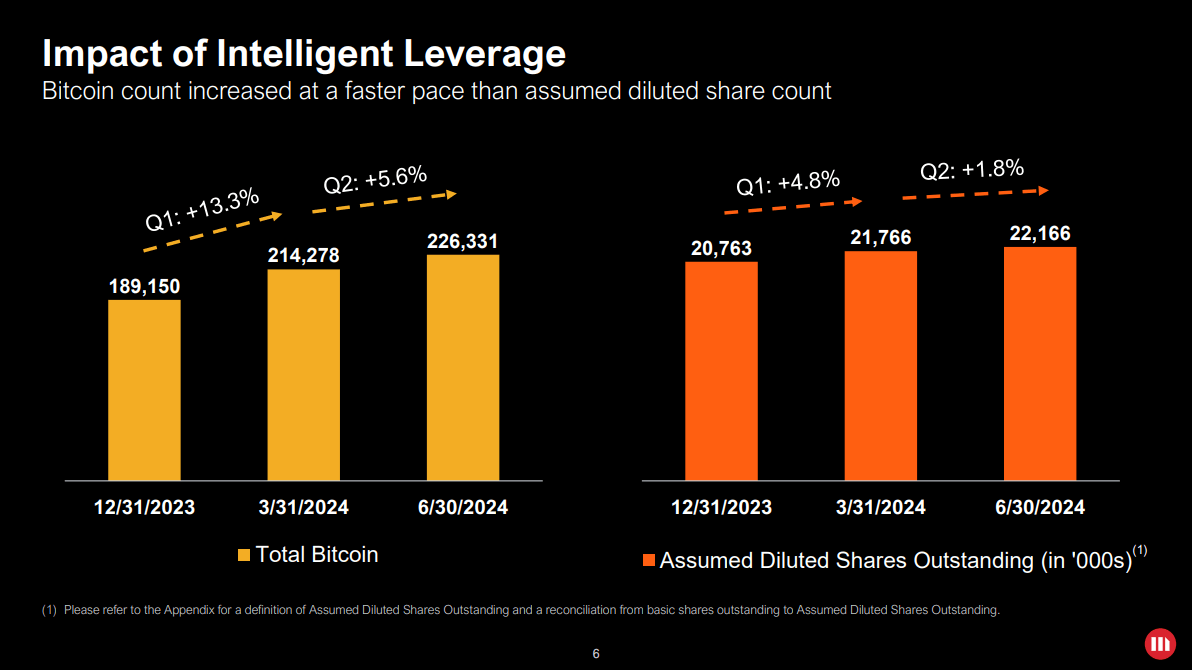

As previously discussed by CryptoSlate, an essential metric for evaluating Bitcoin accretion to shareholders is the Bitcoin per share ratio, calculated as BTC holdings divided by shares outstanding. Currently, this ratio stands at approximately 0.012, indicating that shareholders continue to accrue more Bitcoin per share over time.

The Q2 presentation highlighted that since Dec. 31, 2023, MicroStrategy’s Bitcoin holdings have increased by roughly 20%, rising from 189,150 BTC to 226,500 BTC. Concurrently, the assumed diluted shares outstanding have grown by approximately 7%.

The company’s use of intelligent leverage has resulted in a “BTC Yield” of 12.2% year-to-date, a measure of the period-to-period percentage change in the ratio between Bitcoin holdings and assumed diluted shares outstanding. MicroStrategy maintains a longer-term focus on BTC yield through 2027, targeting a 4-8% range.

Debt Maturities

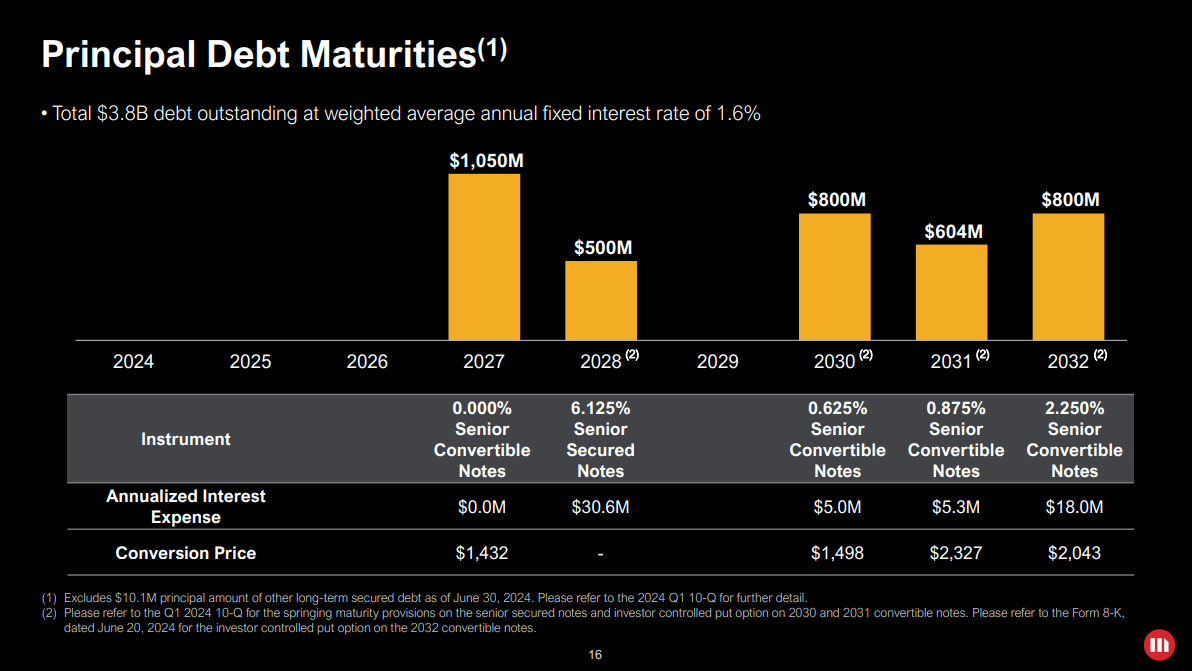

MicroStrategy’s financial strategy includes a total debt of $3.8 billion outstanding, with a weighted average annual fixed interest rate of 1.6%. Notably, $2.2 billion of this debt is due in 2030 or later.

These strategic financial maneuvers and the increasing Bitcoin holdings spotlight MicroStrategy’s commitment to enhancing shareholder value through substantial BTC accrual and intelligent debt management.