Market anticipates 25-basis point rate hike in June

Market anticipates 25-basis point rate hike in June Quick Take

- Troubling new numbers from the Fed’s preferred inflation metric, the Personal Consumption Expenditure (PCE) Price Index, are set to be released today.

- The PCE Index measures the changes in the cost of consumer goods and services month over month; today’s numbers are expected to surpass the anticipated 3.9% to reach 4.4%.

- The Kobessi Letter summarized the PCE inflation report in a tweet pointing out that PCE inflation for both April and May were higher than expected.

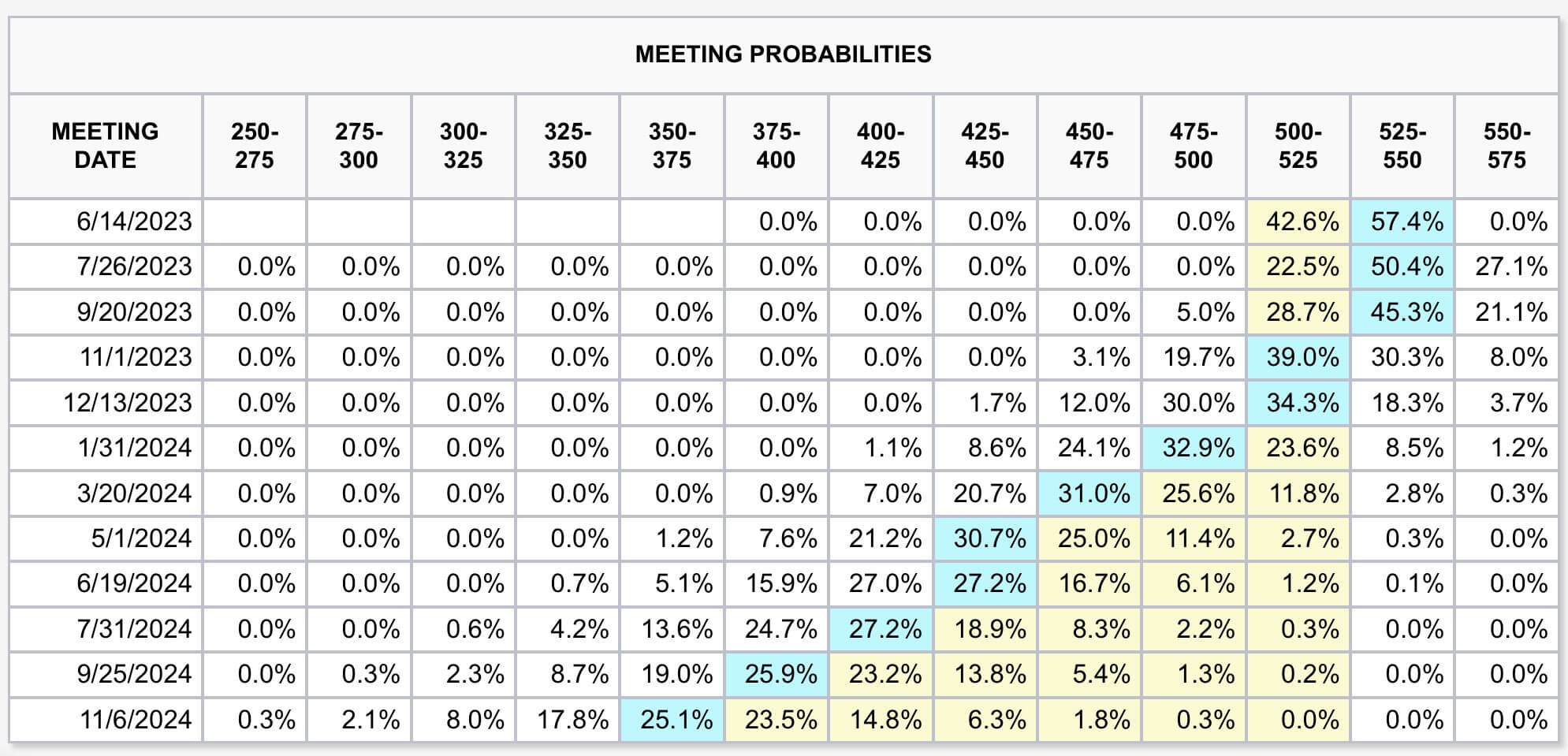

- Markets are now forecasting a further 25-basis point rate hike, raising the federal funds rate to 5.25-5.50%.