Major UK banks troubled as stocks record double digit falls

Major UK banks troubled as stocks record double digit falls Quick Take

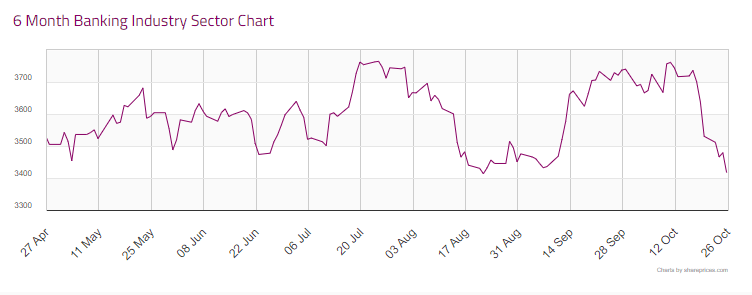

Recent financial reports have highlighted an unsettling trend in the UK’s banking sector, which has reached a six-month low, according to shareprices.com

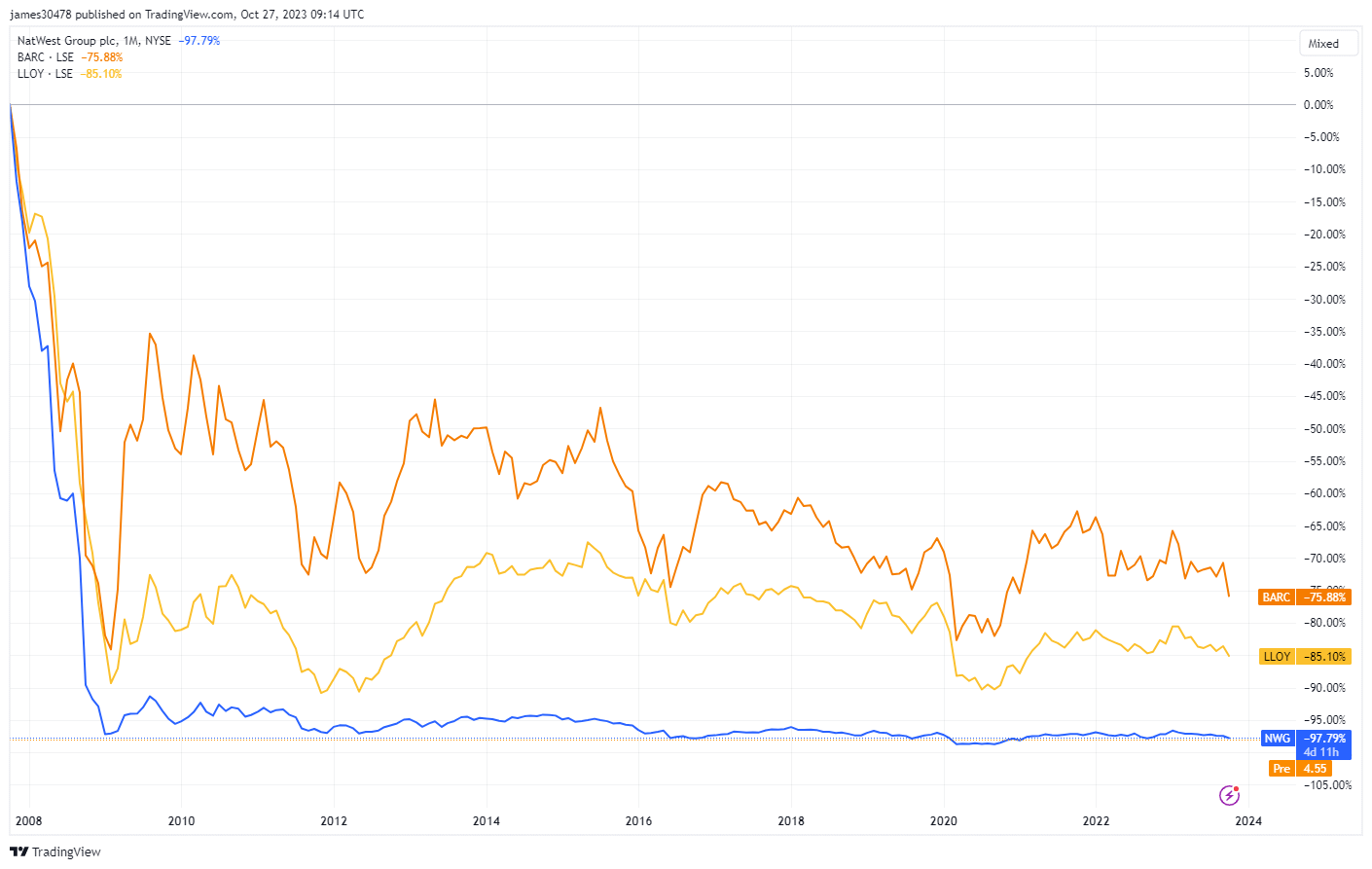

Despite reporting better-than-expected Q3 results, according to the Financial Times, Lloyds Bank has seen its share price fall by 8% in the past month, a development attributed to the onset of higher interest rates.

Comparable challenges are faced by Natwest Group, whose share prices plunged by 14% within the month following a cut in margin guidance, according to Bloomberg. Both Natwest and Lloyds bailed out in 2008 and have struggled to recover their share price since.

Barclays Bank’s share price has similarly taken a hit, dropping 17.5% in the past month after a downgrade by BofA due to restructuring uncertainties, according to Reuters.

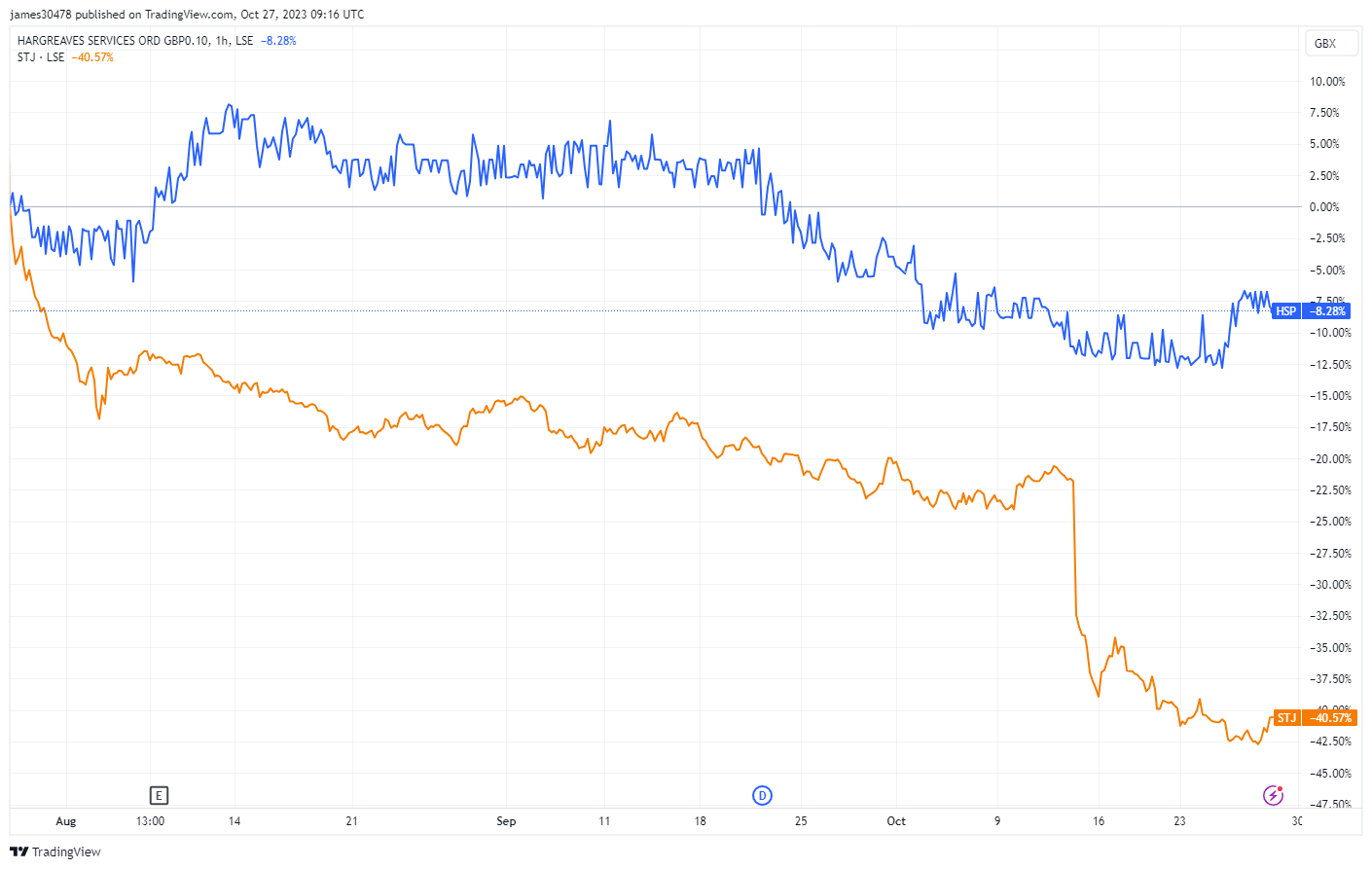

St. James Place, one of the UK’s largest financial services, is down by 26% this past month and a significant 44% YTD. The firm recently suspended trading in its property fund, adding to its woes, according to City AM. Finally, Hargreaves Lansdown, another financial services company, has experienced a decline of 19% YTD and 14% in the past month.

This broad downturn underscores the current strain on financial service companies in the UK, highlighting the need for stakeholders to remain vigilant in uncertain market conditions.