Long-term Bitcoin holders display strategic patience amid 2024 price rallies

Long-term Bitcoin holders display strategic patience amid 2024 price rallies Onchain Highlights

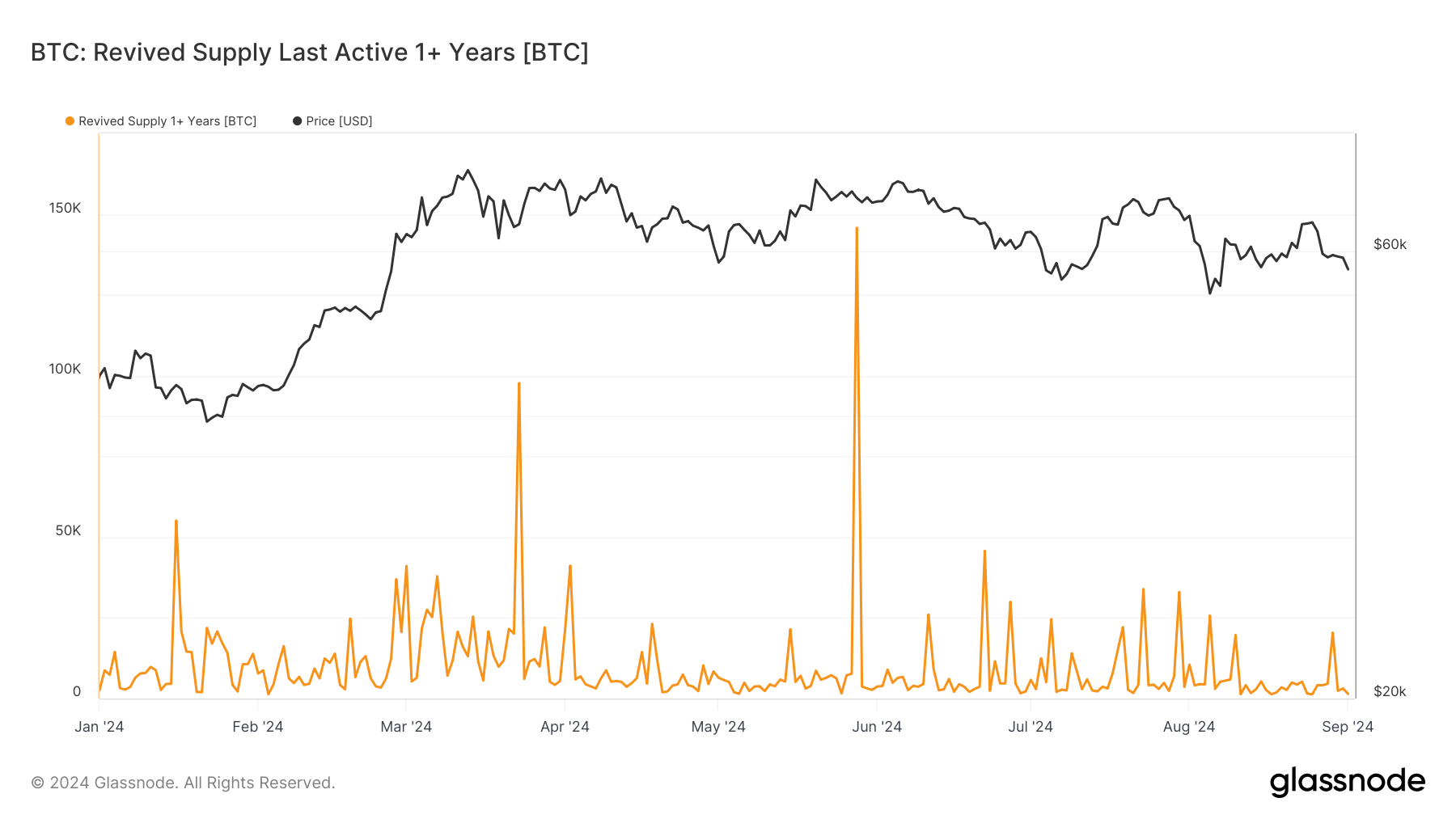

DEFINITION: The total amount of coins that return to circulation after being untouched for at least one year. In other words, it is the total transfer volume of coins previously dormant for 1+ years.

Bitcoin’s revived supply, which tracks the reactivation of coins dormant for over a year, has displayed notable fluctuations in 2024. There have been periodic spikes, particularly in April and June, coinciding with Bitcoin’s price nearing post-halving highs. These movements suggest that some long-term holders seized opportunities presented by market rallies, a behavior observed in past cycles.

Historically, significant increases in revived supply have often aligned with major price movements, such as the bull run in late 2017 and the surge in 2021. However, compared to earlier periods, the 2024 spikes are less pronounced, reflecting a broader trend of declining revived supply since Bitcoin’s 2021 peak.

This decrease suggests a shift in long-term holder behavior, potentially indicating increased conviction in holding or a more strategic approach to market participation as Bitcoin matures as an asset class. The ongoing trend contrasts with more volatile supply movements observed during earlier market cycles.

Farside Investors

Farside Investors