Grayscale’s GBTC climbs 239% in 2023 as market eyes spot ETF approval

Grayscale’s GBTC climbs 239% in 2023 as market eyes spot ETF approval Quick Take

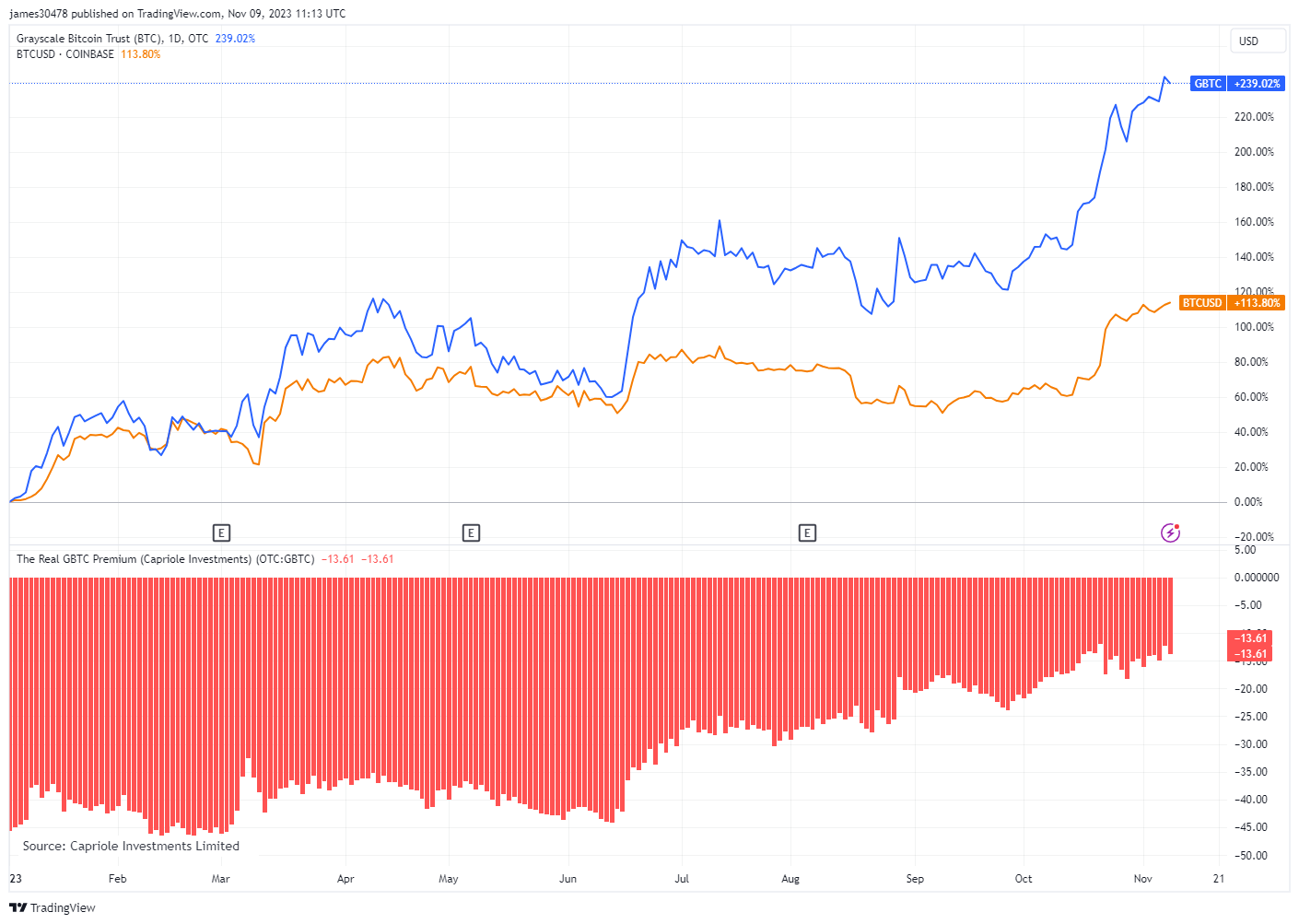

The Grayscale Bitcoin Trust (GBTC) is riding a surge of growth in 2023, with its value climbing by over 239% since January. Concurrently, the discount to its Net Asset Value (NAV) is contracting, currently standing at 13.6% – among the year’s lowest. These market dynamics suggest an anticipation of the approval of a spot Bitcoin ETF, which appears to be imminent in the coming weeks.

GBTC’s value has continued to rise even after market hours, with a 1% increase bringing its price to $28.15. Notably, Bloomberg analysts have pinpointed an eight-day window commencing today, Nov. 9, during which several spot ETFs could potentially be greenlit. This period is expected to serve as a critical observation phase for GBTC’s price action, providing valuable insights into the market’s expectations and responses to regulatory decisions.

As the crypto industry awaits an official announcement, it’s evident from the GBTC’s performance and the shrinking NAV discount that the market is starting to price in the possibility of the approval of a spot Bitcoin ETF, which could dramatically influence the future of the digital asset market.