Grayscale Bitcoin trust sheds roughly 300,000 BTC since ETF launch

Grayscale Bitcoin trust sheds roughly 300,000 BTC since ETF launch Quick Take

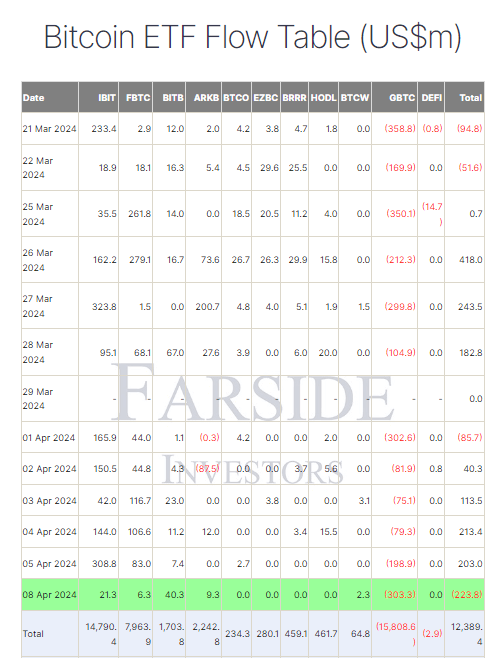

Farside data reports that the Bitcoin ETF market experienced a notable shift on Apr. 8, with the overall sector recording its first net outflow day since Apr. 1, totaling $223.8 million. The primary driver of this change was a significant $303.3 million outflow from the Grayscale Bitcoin Trust (GBTC), its largest outflow since March 25, which has now seen a total of $15.8billion in outflows.

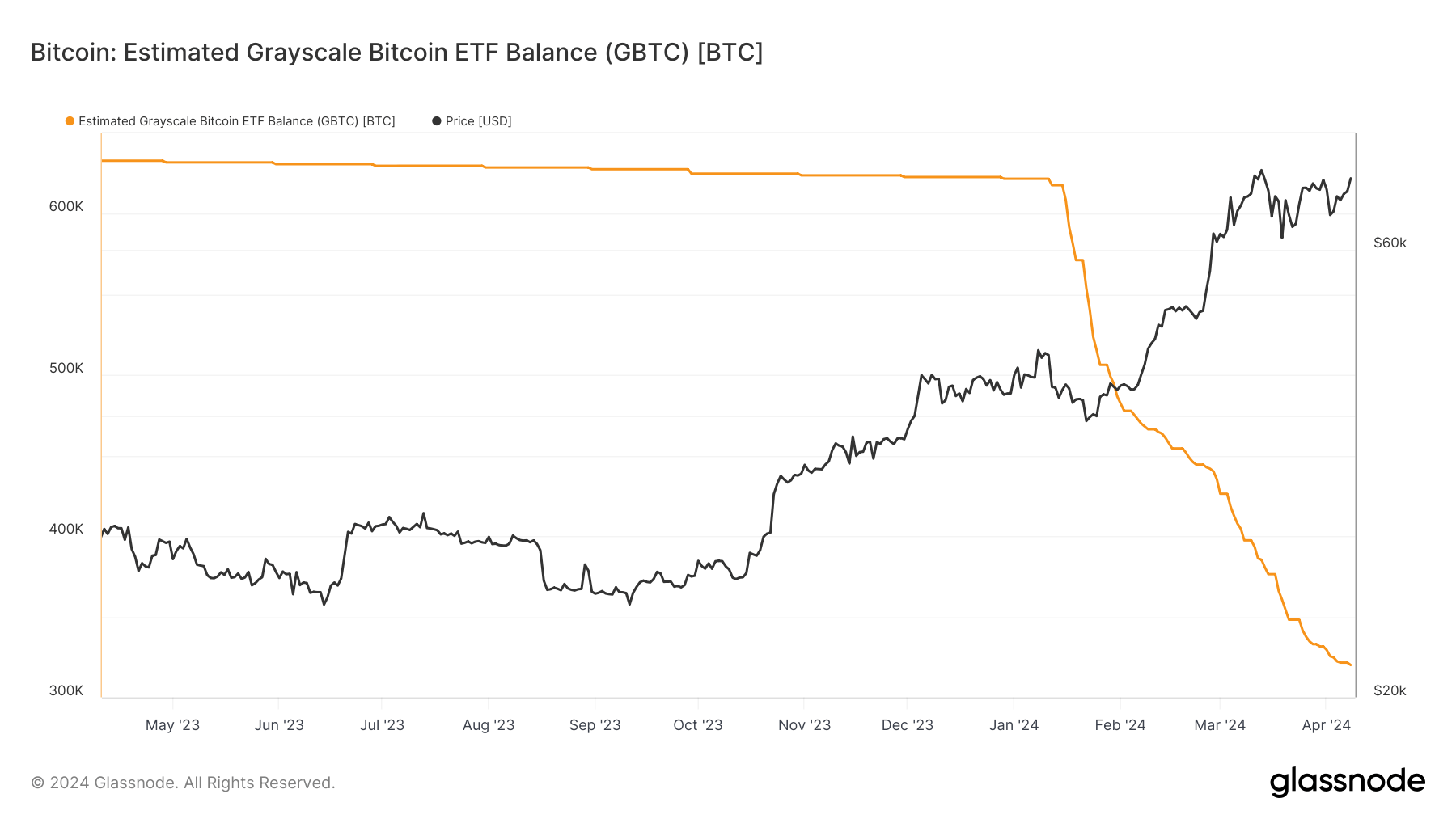

This outflow has resulted in GBTC’s Bitcoin holdings dropping from 621,000 to just 320,000 over the past three months, a decrease of 300,000 BTC, according to Glassnode.

In contrast, other spot Bitcoin ETFs saw relatively muted inflows, with Bitwise BITB leading the pack at $40.3 million, bringing their total inflow to $1.7 billion. BlackRock IBIT saw a $21.3 million inflow, bringing their total inflow to $14.7 billion, while Fidelity FBTC saw a $6.3 million inflow, bringing their total to $7.9 billion, according to Farside.

Farside data reveals that despite this minor decline, the total net inflow to the spot ETF market remains at a healthy $12.3 billion.