Federal reserve drains a quarter of USD liquidity: economic consequences await

Federal reserve drains a quarter of USD liquidity: economic consequences await Quick Take

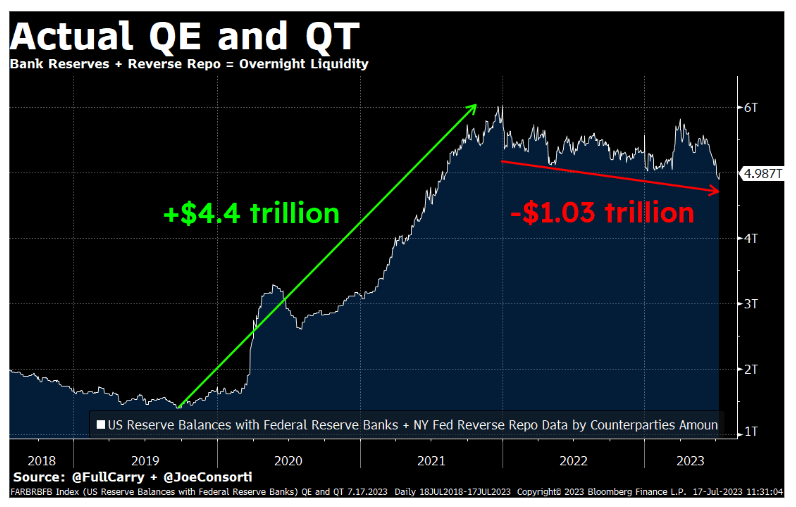

Recently, the Federal Reserve (Fed) has initiated a policy shift that sees a decrease in United States Dollar (USD) liquidity by 25%, according to analyst Joe Consorti. This strategy contrasts markedly with the earlier Quantitative Easing (QE) policies. The result is a significant reduction in the asset value that banks utilize for loan issuance, credit extension, and self-financing.

To understand this in simpler terms, envision banks being given less money to operate. Their ability to extend loans, provide credit, and maintain self-sustainability is seriously curtailed.

This policy shift impacts not only the overall liquidity but also the overnight liquidity in the financial system. Overnight liquidity, composed of bank reserves and funds obtained via reverse repurchase agreements (reverse repo), provides immediate financial resources that banks can use to meet short-term obligations or take advantage of investment opportunities. By reducing the overall liquidity, the Fed also limits the pool of funds available for these short-term transactions.

The critical question that Consorti presents is: how far can the Fed push this liquidity reduction before it leads to an economic downturn, or worse, a collapse? Liquidity, particularly overnight liquidity, plays a crucial role in maintaining economic stability and fostering growth.

We’re venturing into uncharted territory with these changes. The outcome of this policy shift will unfold over time, leaving domestic and international economic sectors speculating and bracing for potential impacts.