Derivatives data tracking Bitcoin’s response to global crises shows market cycle far from over

Derivatives data tracking Bitcoin’s response to global crises shows market cycle far from over Quick Take

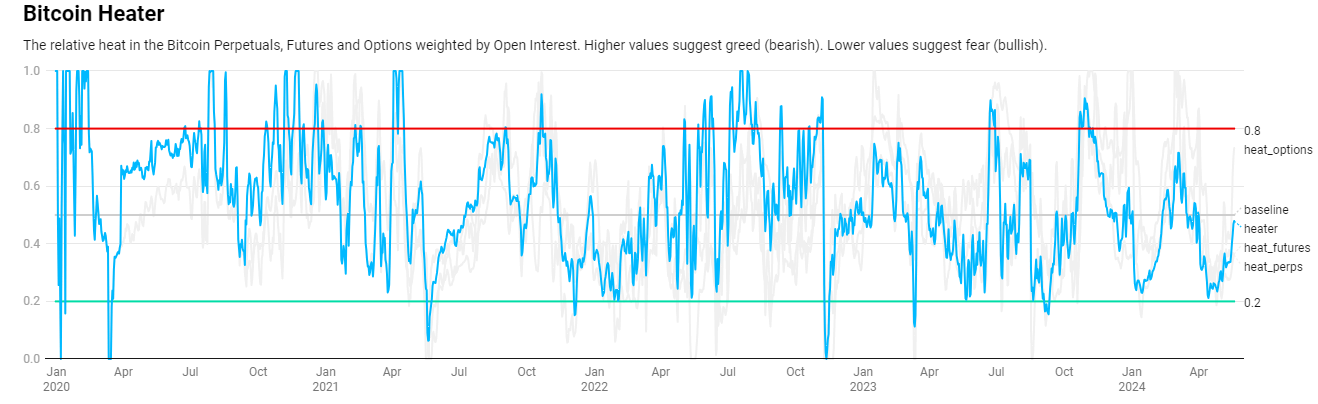

Capriole Investments’ derivatives data offers a unique lens into Bitcoin’s market health. By analyzing Bitcoin perpetual, futures, and options weighted by open interest, Capriole defines a metric that provides valuable insights.

Higher values on this metric indicate bearishness, signaling excessive leverage and speculation in the market. Conversely, lower values suggest bullishness, reflecting fear among market participants.

Capriole data shows that values above 0.8 have coincided with Bitcoin price tops, driven by greed and euphoria. Similarly, bottoming out near 0.2 or going below has been observed during periods of extreme fear, such as the COVID-19 crash in March 2020, the China mining ban in May 2021, and the FTX collapse in November 2022.

Capriole data shows that the metric hovers around the middle range, suggesting a healthy balance in the market. This follows a recent bounce off the 0.2 low in April, potentially indicating some speculation reentering the market during Bitcoin’s rally to $67,000. However, there are no immediate concerns, as the current levels do not signal excessive greed or fear.