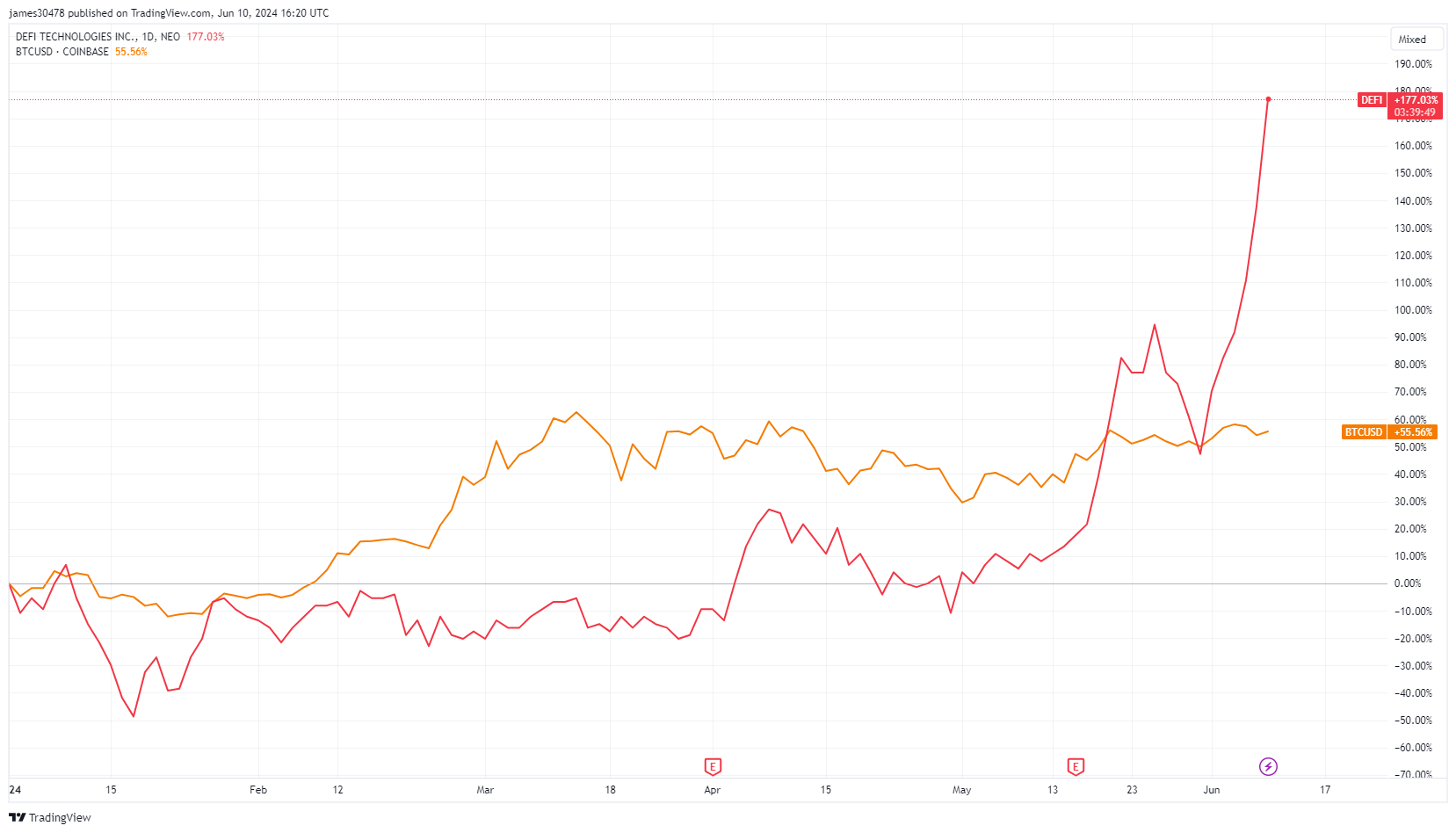

DeFi Technologies shares spike 15% in a day after it adopts Bitcoin treasury strategy

DeFi Technologies shares spike 15% in a day after it adopts Bitcoin treasury strategy DeFi Technologies shares spike 15% in a day after it adopts Bitcoin treasury strategy

CEO Olivier Roussy Newton voiced confidence in Bitcoin as an inflation hedge.

Quick Take

DeFi Technologies Inc., a public company traded on CBOE Canada (DEFI), has made a strategic decision to adopt Bitcoin as its primary treasury reserve asset, purchasing 110 Bitcoin, according to Newswire.ca,

This move highlights the company’s confidence in Bitcoin’s potential as a hedge against inflation and a safeguard against monetary debasement.

Olivier Roussy Newton, CEO of DeFi Technologies, stated,

“We have adopted Bitcoin as our primary treasury reserve asset, reflecting our confidence in its role as a hedge against inflation and a safe haven from monetary debasement.”

In addition to this significant adoption, Valour, a subsidiary of DeFi Technologies, reported an impressive AUM of C$837 million ($607 million) as of May 31, marking a year-on-year increase of 64.9%.

Valour has also successfully repaid an additional $5 million in outstanding loans secured by BTC and ETH collateral, following a prior repayment of $19.5 million.

Valour Inc. has launched several innovative exchange-traded products (ETPs), including the Valour Internet Computer (ICP) ETP, Valour Toncoin (TON) ETP, Valour Chainlink (LINK) ETP, and the world’s first yield-bearing Bitcoin (BTC) ETP.

These ETPs highlight the company’s continued innovation and financial acumen in the decentralized finance sector.

DeFi Technologies Inc.’s share price has increased by 15% following the announcement, bringing its year-to-date (YTD) growth to 176%.