Coinbase Bitcoin reserves hit lowest level since 2015 as 30,000 BTC departs

Coinbase Bitcoin reserves hit lowest level since 2015 as 30,000 BTC departs Quick Take

In the world of digital asset exchanges, Coinbase holds a unique position as a preferred choice for U.S. institutions, partly due to its status as a publicly traded company. It also serves as the principal custodian for the spot Bitcoin ETFs, currently under consideration by the SEC.

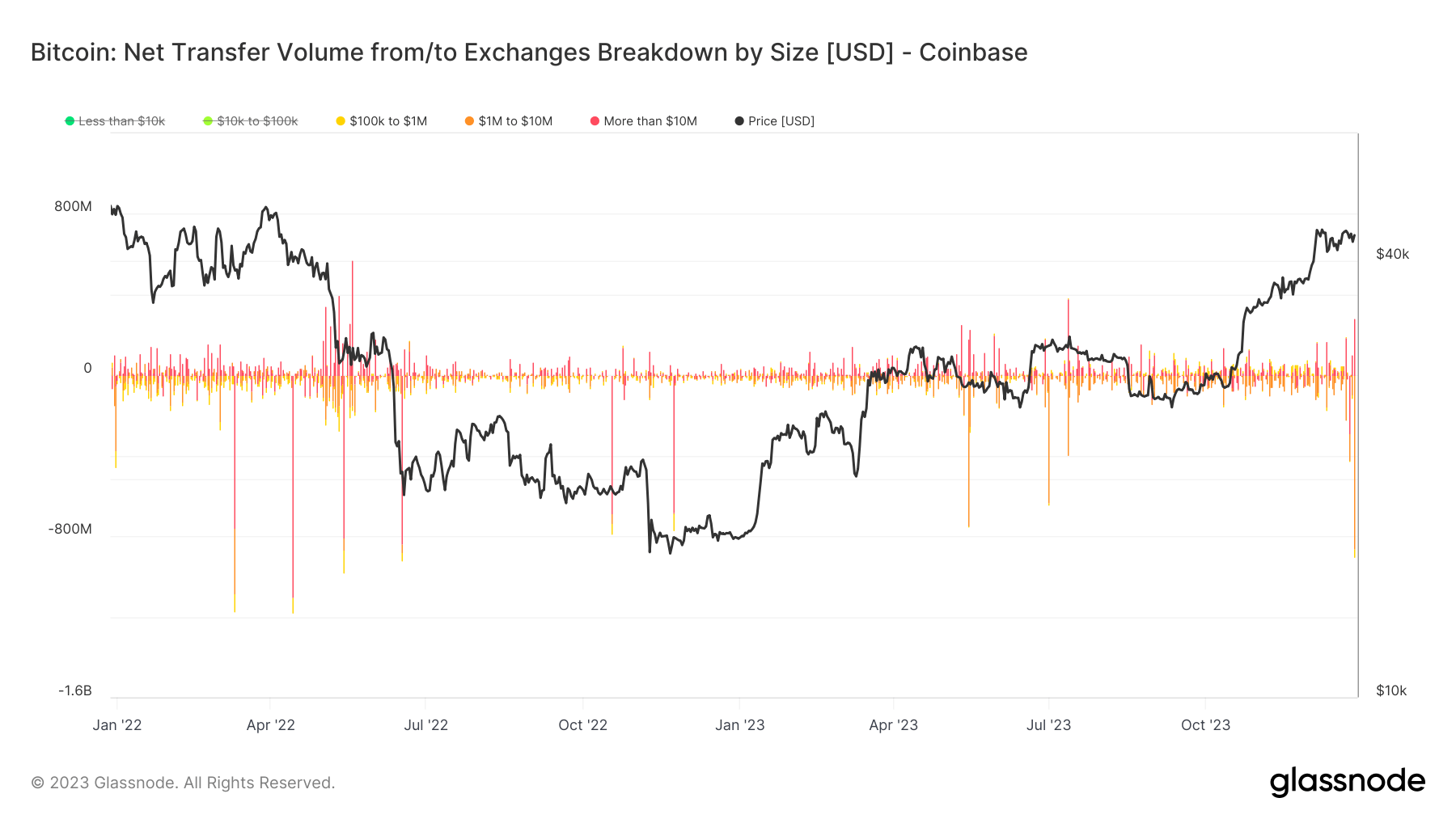

However, as 2023 draws to a close, a trend has emerged. According to data from Glassnode, CryptoQuant, and Coinglass, Coinbase’s Bitcoin balance has significantly dropped, with around 30,000 Bitcoin leaving the platform in a few days. The biggest withdrawal of Bitcoin since May

This reduction brings the platform’s Bitcoin holdings to an estimated 411,000, the lowest level since 2015. This notable outflow, together with increased activity on Coinbase, indicates a significant shift in investor strategies. The impacts of this shift, potentially affecting Bitcoin’s liquidity and overall market dynamics, warrant careful monitoring.