Bitcoin’s correlation with Nasdaq drops to YTD low of -0.82

Bitcoin’s correlation with Nasdaq drops to YTD low of -0.82 Quick Take

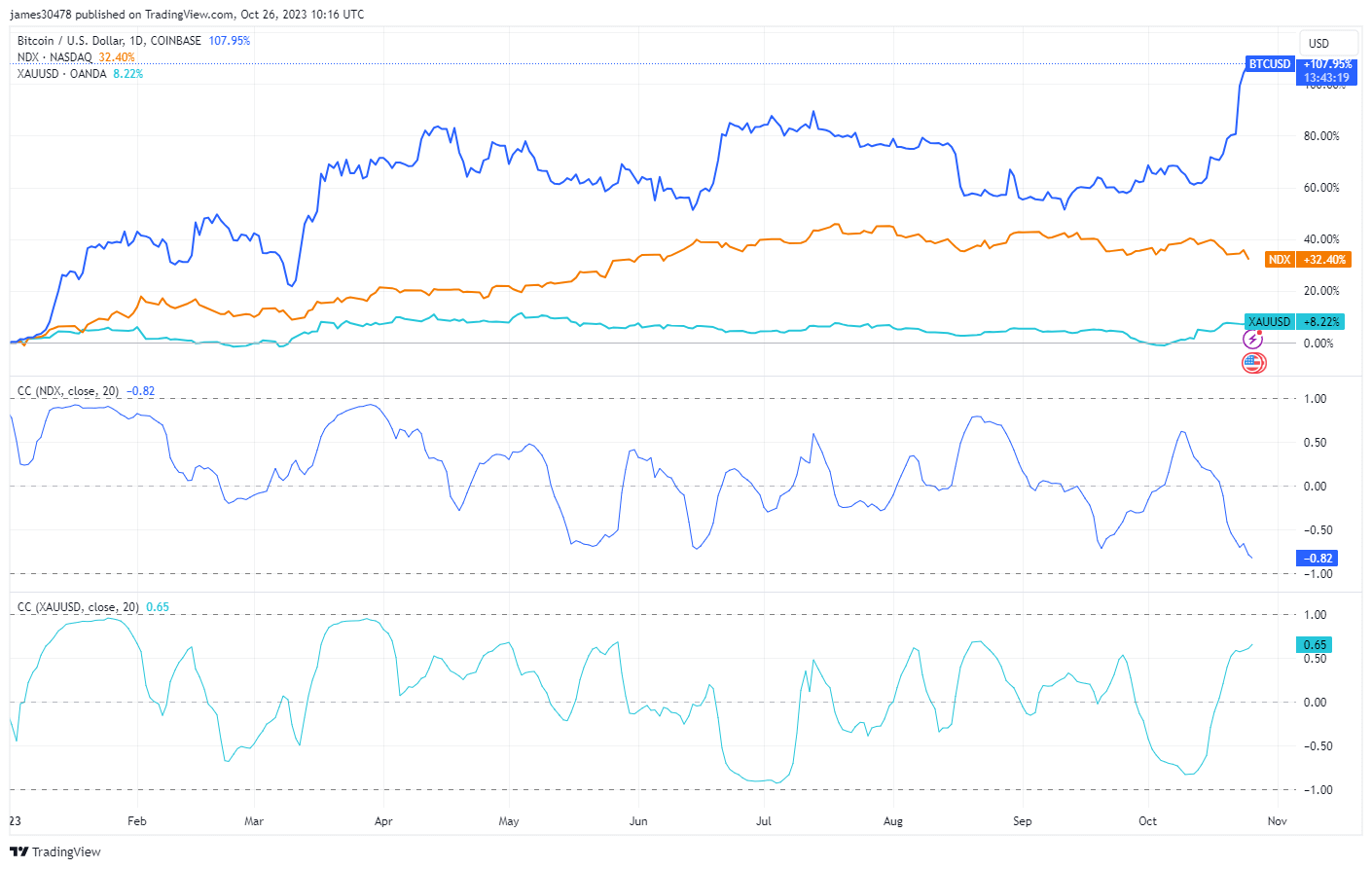

The performance of Bitcoin (BTC) within the current financial year has been remarkable, with an over 100% appreciation, well above the Nasdaq’s 32% and gold’s 8% increase.

Notably, BTC’s behavior in the market has undergone a significant shift compared to the previous year.

In 2022, Bitcoin was closely tethered to major indices, reflecting an almost 100% correlation.

However, recent weeks have witnessed a striking divergence between Bitcoin and the indices, especially the Nasdaq, with a year-to-date (YTD) low correlation of -0.82. This suggests that the price movements of Bitcoin and Nasdaq are currently moving in opposite directions, indicating a dislocation from major indices.

Moreover, an intriguing twist occurred around the onset of the heightened Gaza conflict on Oct. 7. Before this geopolitical event, Bitcoin and gold held one of their lowest correlations for the year.

However, as soon as the conflict increased, the correlation jumped to 0.65, indicating a pronounced shift in Bitcoin’s market behavior. This could imply that in times of global uncertainties, Bitcoin’s correlation is more similar to gold than tech stocks, reinforcing the narrative of Bitcoin as a ‘digital gold.’