Bitcoin’s active address volatility highlights user engagement beyond price cycles

Bitcoin’s active address volatility highlights user engagement beyond price cycles Onchain Highlights

DEFINITION: The number of unique addresses that were active in the network either as a sender or receiver. Only addresses that were active in successful transactions are counted.

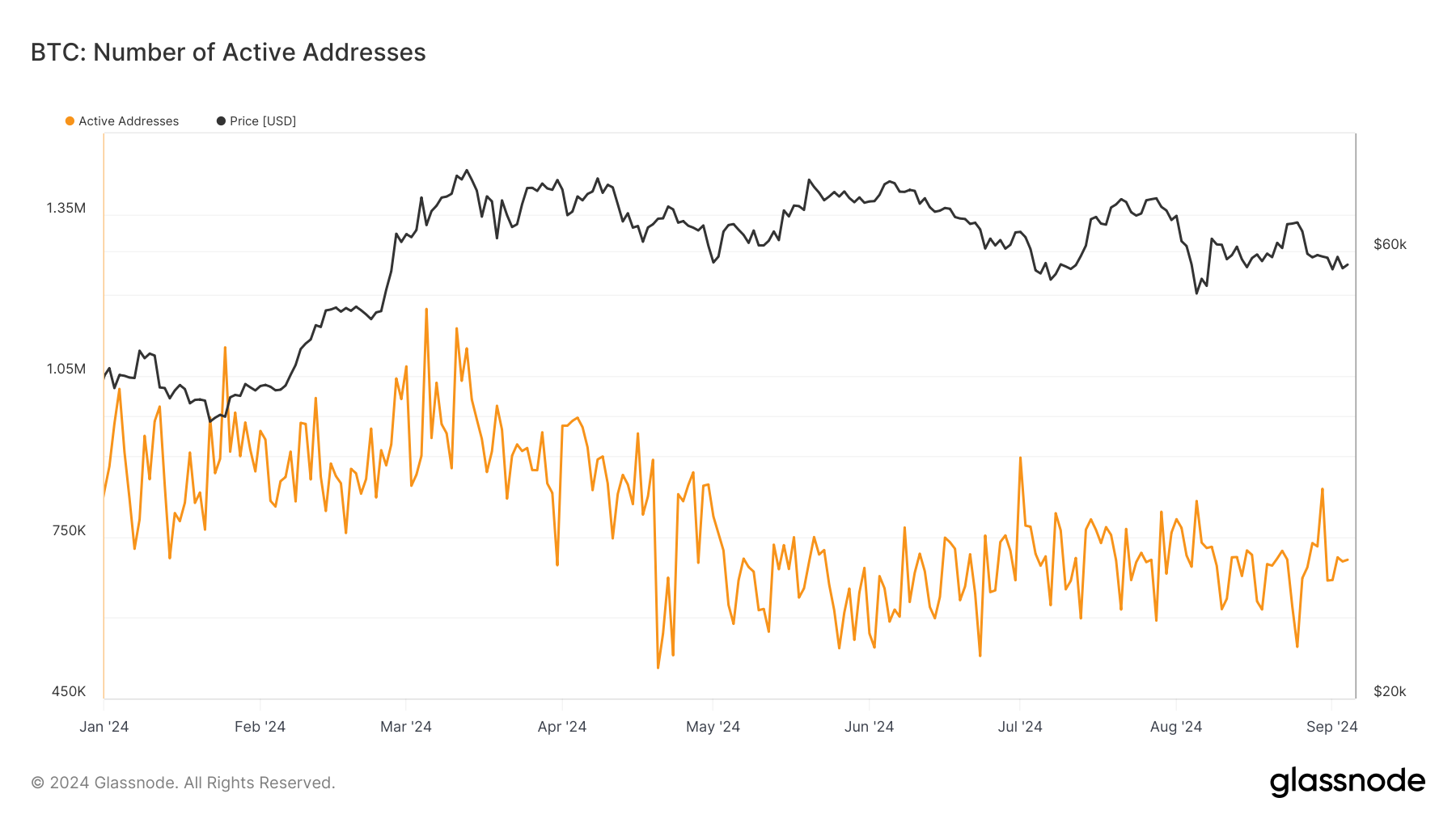

The number of active Bitcoin addresses in 2024 has shown significant volatility. After rising steadily following the lead-up to the halving event in April, activity peaked at over 1 million addresses before undergoing a notable decline.

As of September, active addresses hover near 650,000. This trend aligns with the broader market movements, where Bitcoin’s price saw a substantial rally before stabilizing just below $60,000.

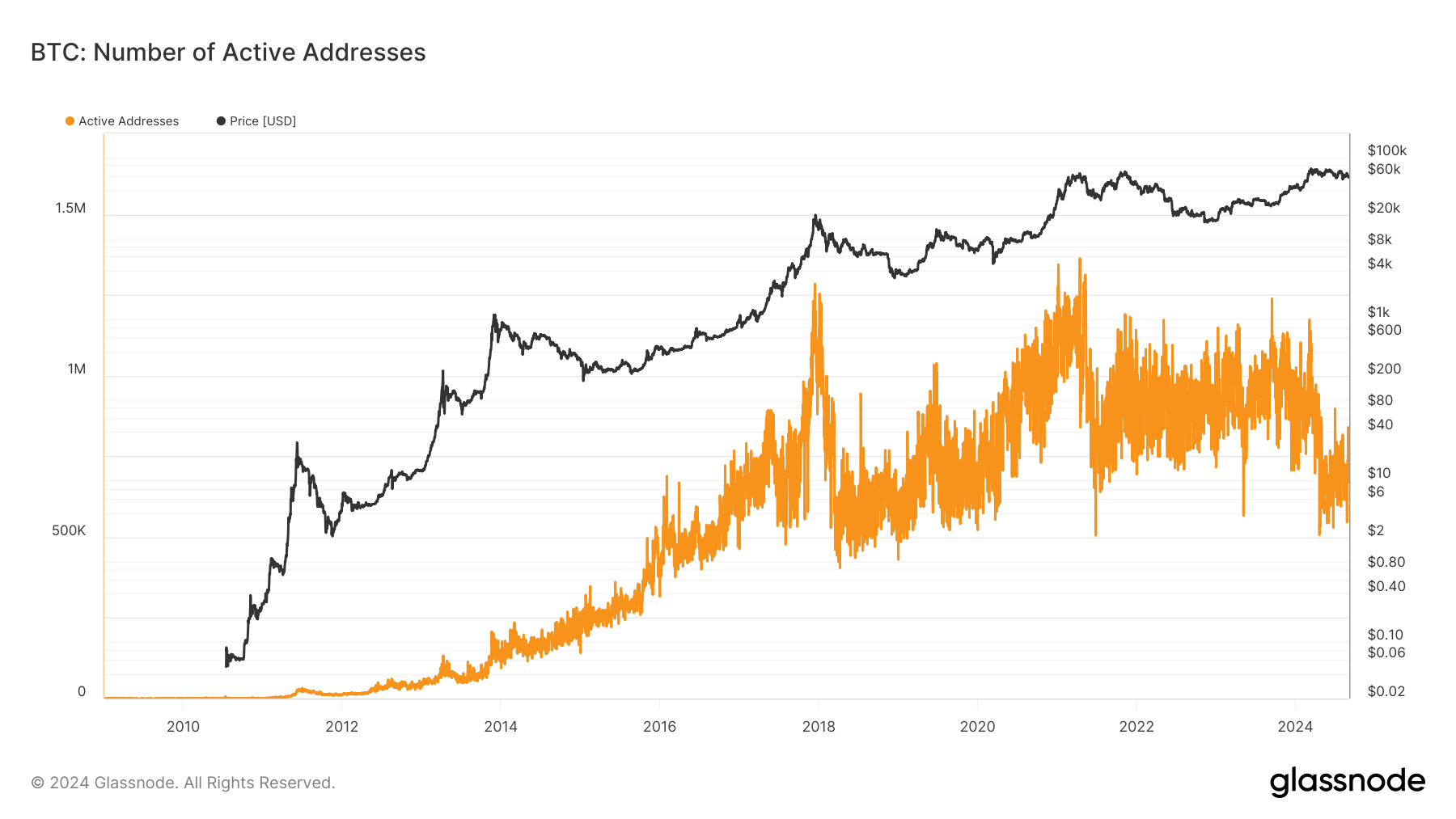

Historically, active addresses have played a crucial role in signaling market engagement. Comparing previous cycles shows that while the number of addresses remains lower than the peak periods of 2021, current activity levels are higher than in the early phases of past bull markets, such as 2016 and 2017. This suggests continued user engagement despite price corrections, which could indicate long-term network strength.