Bitcoin’s 25 Delta Skew experiences sharp fluctuations amid correction

Bitcoin’s 25 Delta Skew experiences sharp fluctuations amid correction Onchain Highlights

DEFINITION:Skew is the relative richness of put vs call options, expressed in terms of Implied Volatility (IV). For options with a specific expiry, 25 Delta Skew refers to puts with a delta of -25% and calls with a delta of 25% to demonstrate this difference in the market’s perception of implied volatility. 25 Delta Skew is calculated as the difference between a 25-delta put’s implied volatility and a 25-delta call’s implied volatility, normalized by the ATM Implied Volatility. This metrics focuses on option contracts expiring in 1 week.

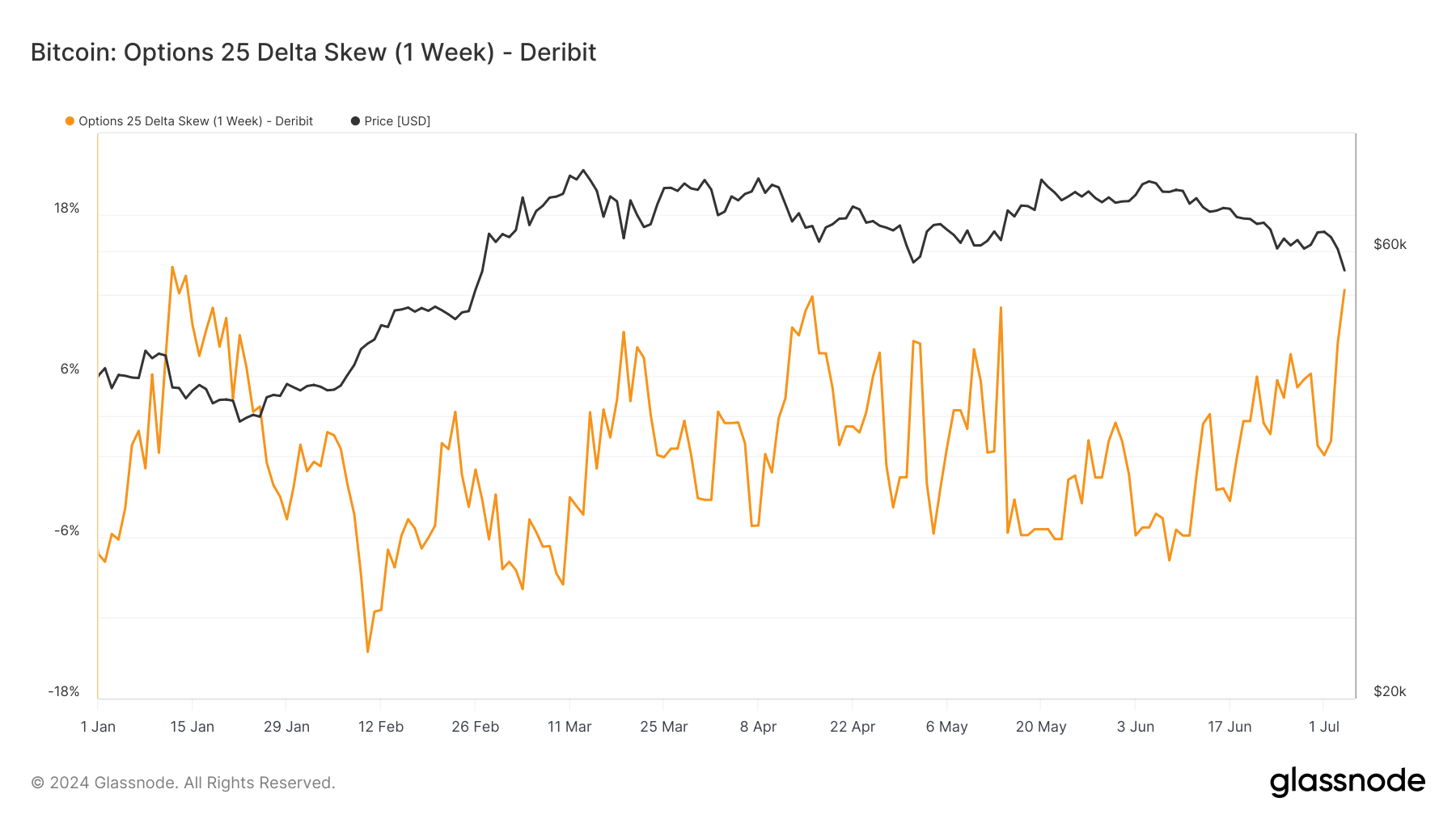

Bitcoin’s options market has seen significant volatility in the 25 Delta Skew over the past several months. The one-week 25 Delta Skew metric on Deribit, which tracks the difference in implied volatility between 25-delta puts and calls, has fluctuated widely. Since January, the skew has ranged from lows of around -15% to highs exceeding 15%, highlighting the shifting sentiment and market perceptions of risk among options traders.

The latest data shows a sharp increase in the skew due to Bitcoin current correction. Such swings often reflect traders’ shifts between bearish and bullish outlooks.

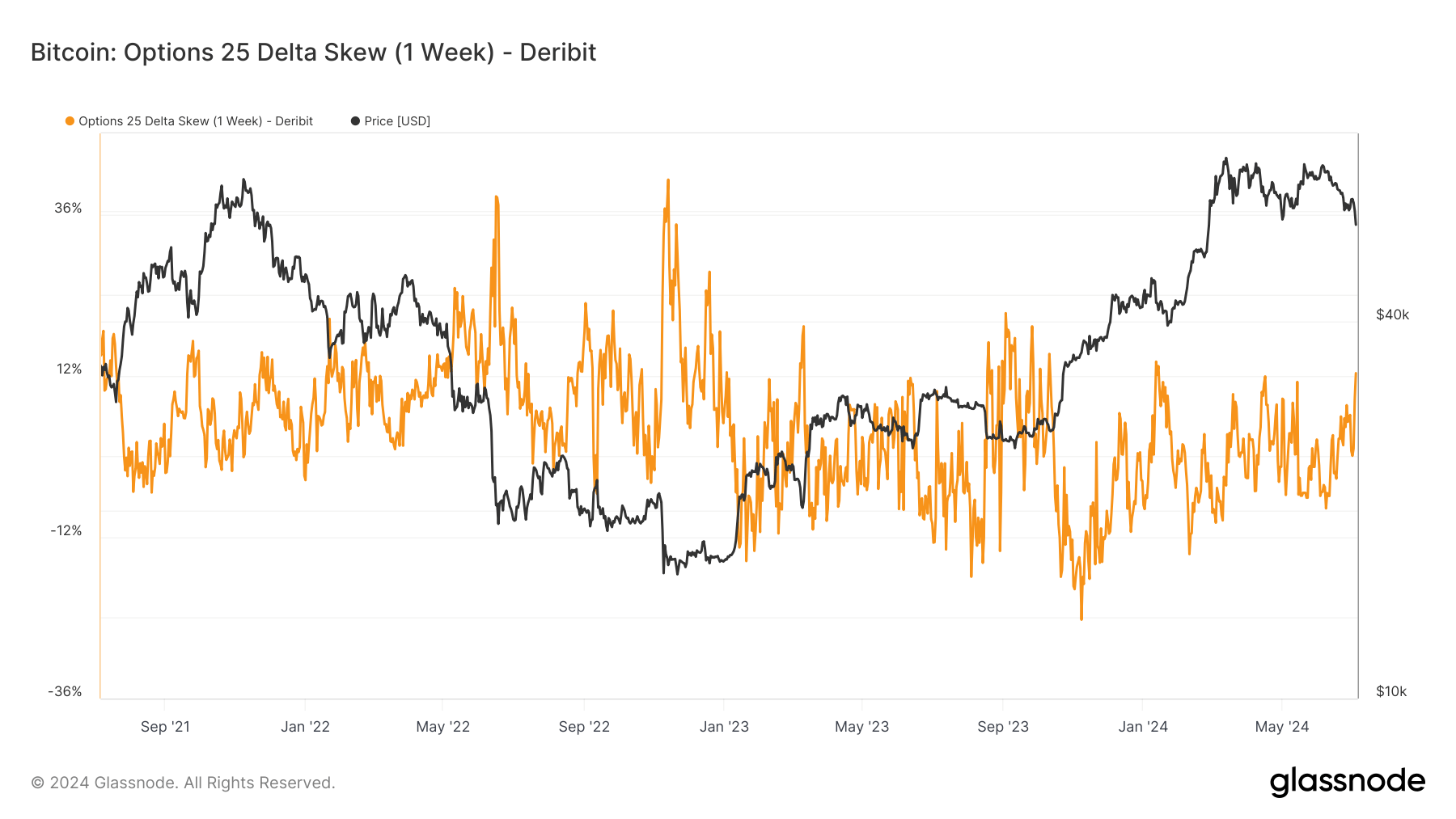

For much of 2021 – 2023, the skew’s movements were less pronounced, with fluctuations primarily between -12% and 12%.

This year’s heightened volatility could indicate increased uncertainty or differing hedging strategies post the April 2024 Bitcoin halving. The halving, which reduces miners’ rewards, typically influences long-term market conditions by constraining supply.

Understanding these dynamics is crucial for anticipating potential price movements, as options skew can serve as a leading indicator of broader market sentiment.