Bitcoin would reach $1.8 million per coin if it matched 2017 bull market run

Bitcoin would reach $1.8 million per coin if it matched 2017 bull market run While the title of this insight may seem overly bullish, it’s simply a fact based on the data. However, historical patterns don’t really line up with such a bullish scenario. Across each Bitcoin cycle, the price increase has been around 27% of the last period. Should Bitcoin continue this trend, we may still have cause for optimism, albeit not with satoshi/dollar parity quite yet.

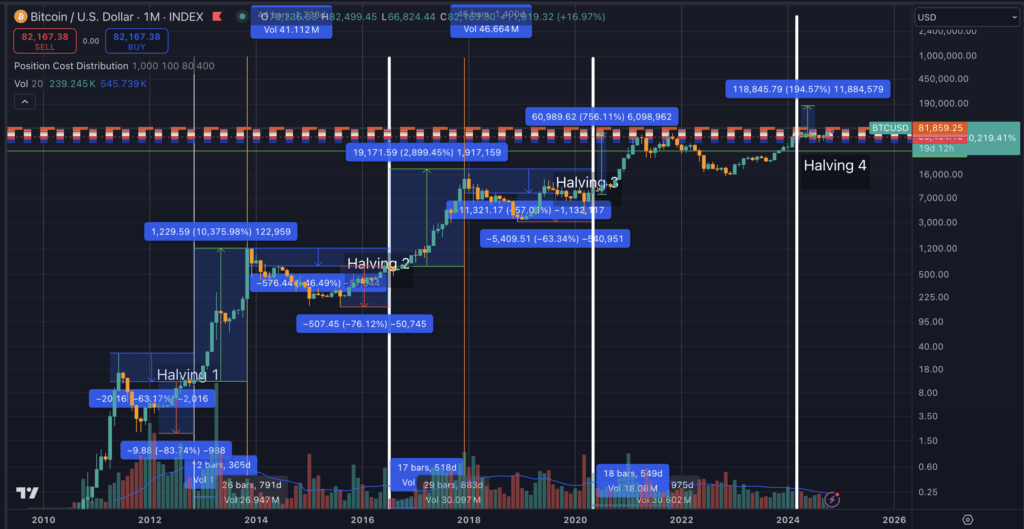

The price increase for each halving cycle appears to diminish significantly over time.

- First Halving (to Second Halving): 10,300% increase

- Second Halving (to Third Halving): 2,800% increase

- Third Halving (to Fourth Halving): 738% increase

Each cycle shows a substantial reduction in the percentage increase. To forecast a trend, let’s analyze the approximate rate of decrease:

- From Halving 1 to Halving 2:

(2800 / 10300) ≈ 27.18%of the previous increase. - From Halving 2 to Halving 3:

(738 / 2800) ≈ 26.36%of the previous increase.

If we continue this diminishing rate, Halving 4 might see an increase of around 26-27% of the previous Halving’s percentage increase:

738 * 0.265 ≈ 195.57%

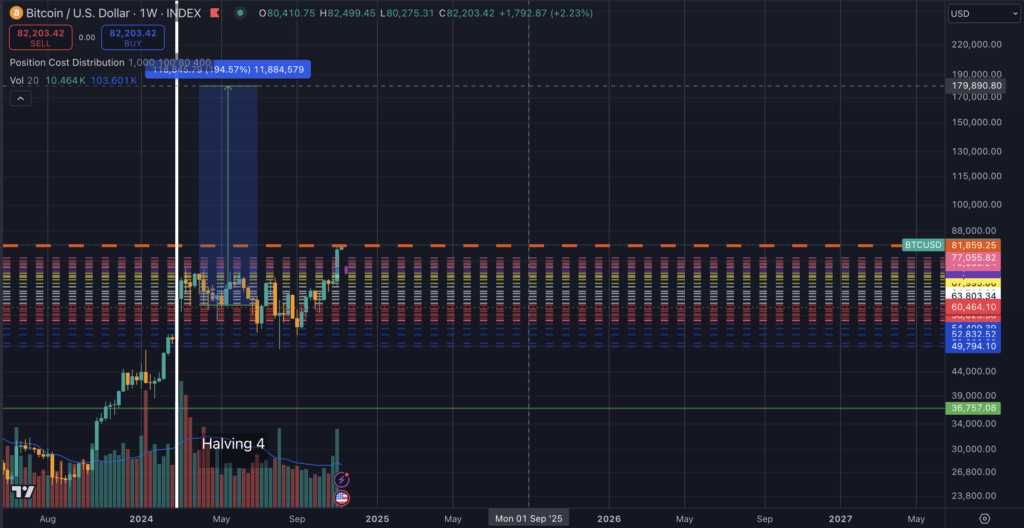

Estimate for Halving 4: We could estimate an increase of approximately 195% over the halving price. This follows the trend of diminishing returns per cycle.

Such a price increase would take Bitcoin to a peak of around $180,000 this cycle.

For fun, if Bitcoin were to break the diminishing returns pattern and increase by 50% or 100% of the last cycle’s increase, we would see prices of $304,000 and $520,000, respectively.

Should Bitcoin somehow find the vigor of the 2017 bull run, it would rise as high as $1.8 million per coin.

Remember, past performance is not a guarantee of future returns. Bitcoin is still in its infancy as an asset, and anything could happen next.

Except, in my view, going to zero.