Bitcoin surges to new yearly high of $35.9k, causing over $100M in short liquidations

Bitcoin surges to new yearly high of $35.9k, causing over $100M in short liquidations Quick Take

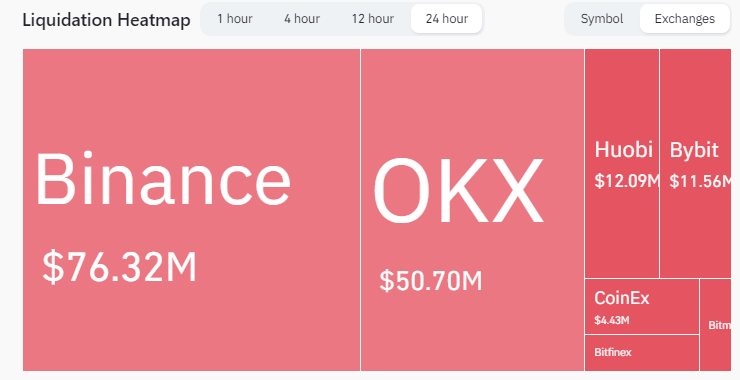

Bitcoin has achieved a new milestone, fortifying a support level at $35,000 and hitting fresh year-to-date highs last night on Nov. 1. In the past 24 hours, per data from Coinglass, a staggering 60,851 traders have faced liquidations, leading to a cumulative loss of approximately $160 million.

A deeper dive into the data reveals an interesting trend. Over $100 million of the liquidated amount was due to short liquidations, making up nearly 62% of the total liquidations. This indicates an overwhelming majority of traders betting against digital assets performance were caught off guard by this sudden uptick, resulting in considerable losses.

Furthermore, Binance, a leading cryptocurrency exchange, contributed a majority share to this phenomenon with $76 million worth of liquidations.

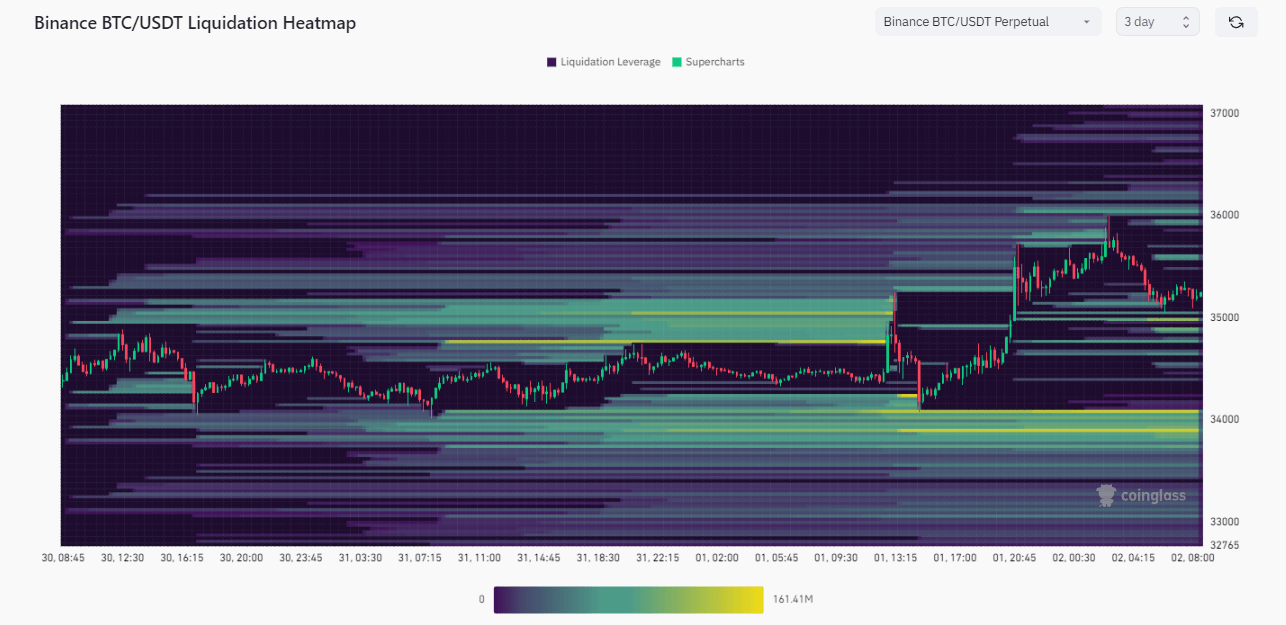

Upon examining the liquidation heatmap on Binance for the BTC/USDT pair, it becomes evident that there’s a significant liquidation threshold at $35,000. Should this support level be violated, it could potentially trigger a downward trend for Bitcoin. Notably, there are two substantial liquidation levels at around $34,000, each estimated to be approximately $140 million, further reinforcing the critical significance of these price points in the market dynamics.