Bitcoin short-term holders reap $1.8 billion in profits over 48 hours

Bitcoin short-term holders reap $1.8 billion in profits over 48 hours Quick Take

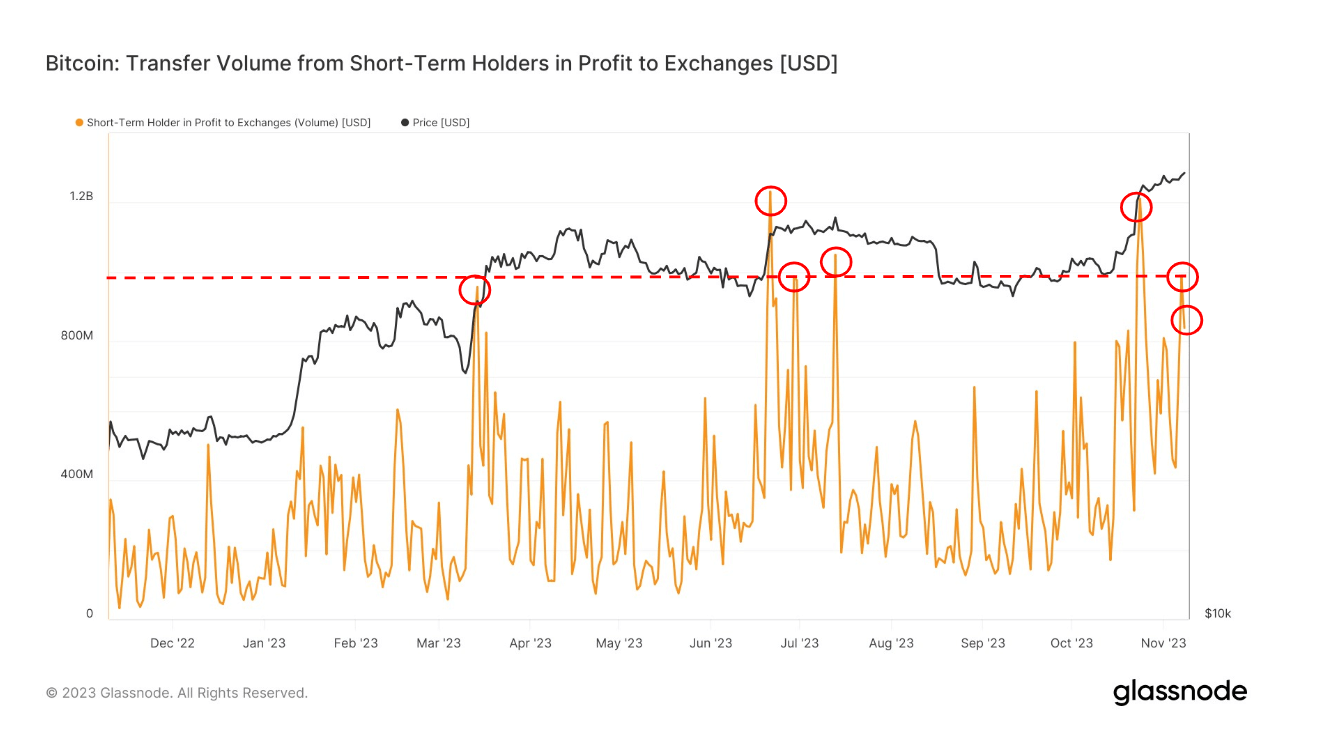

Over the 48-hour period of Nov. 7 and 8, short-term holders, specifically those who have maintained their Bitcoin investments for less than 155 days, have extracted a staggering $1.8B in profits. This massive profit-taking marks one of the highest volumes observed this year, rivaled only by instances such as the aftermath of the SVB collapse, the ascent to $30k in June, and a recent surge when Bitcoin began its climb from a low of $25,000.

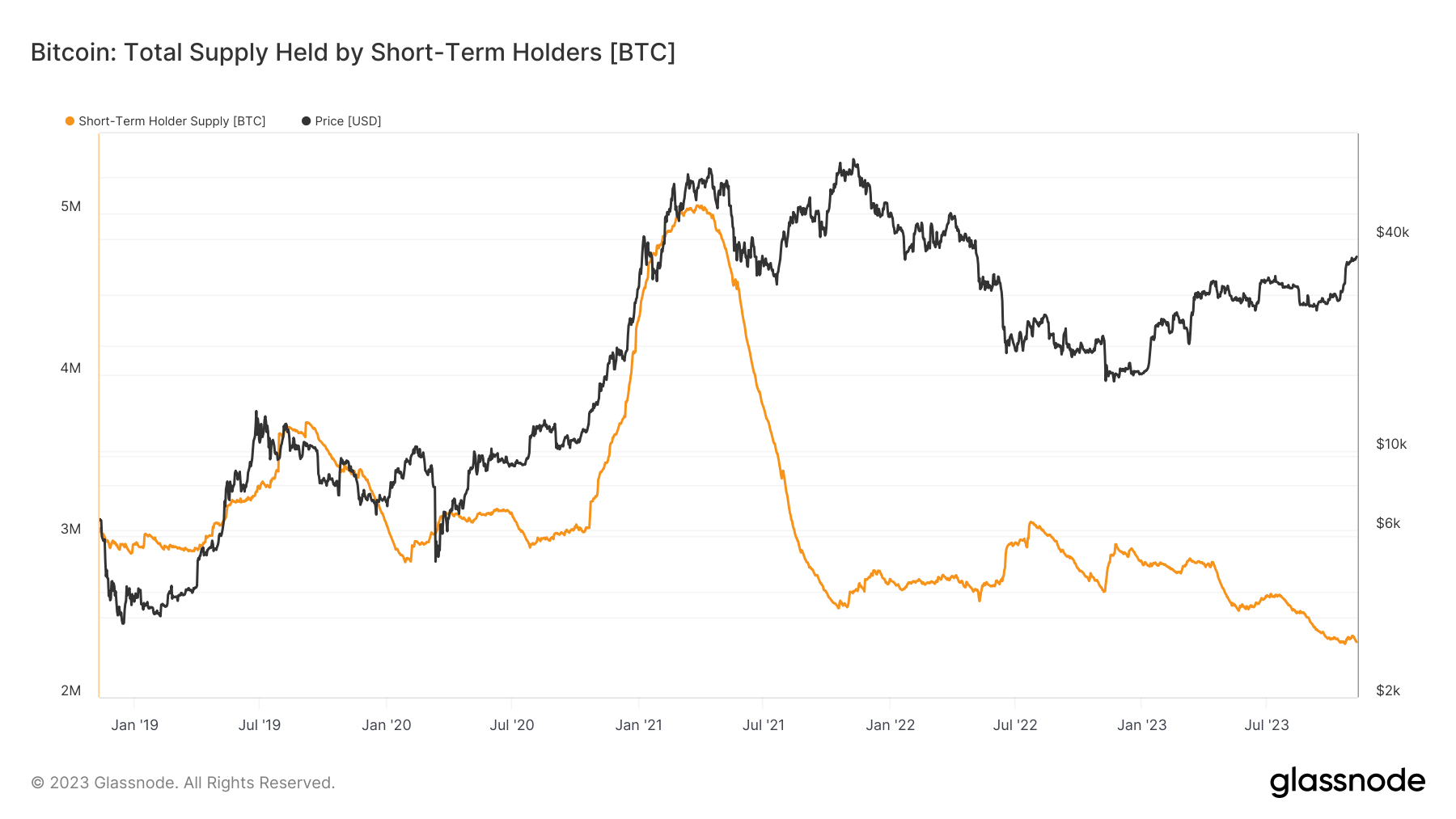

The supply of Bitcoin among these short-term holders currently sits at about 2.3M BTC, showcasing a continual decline.

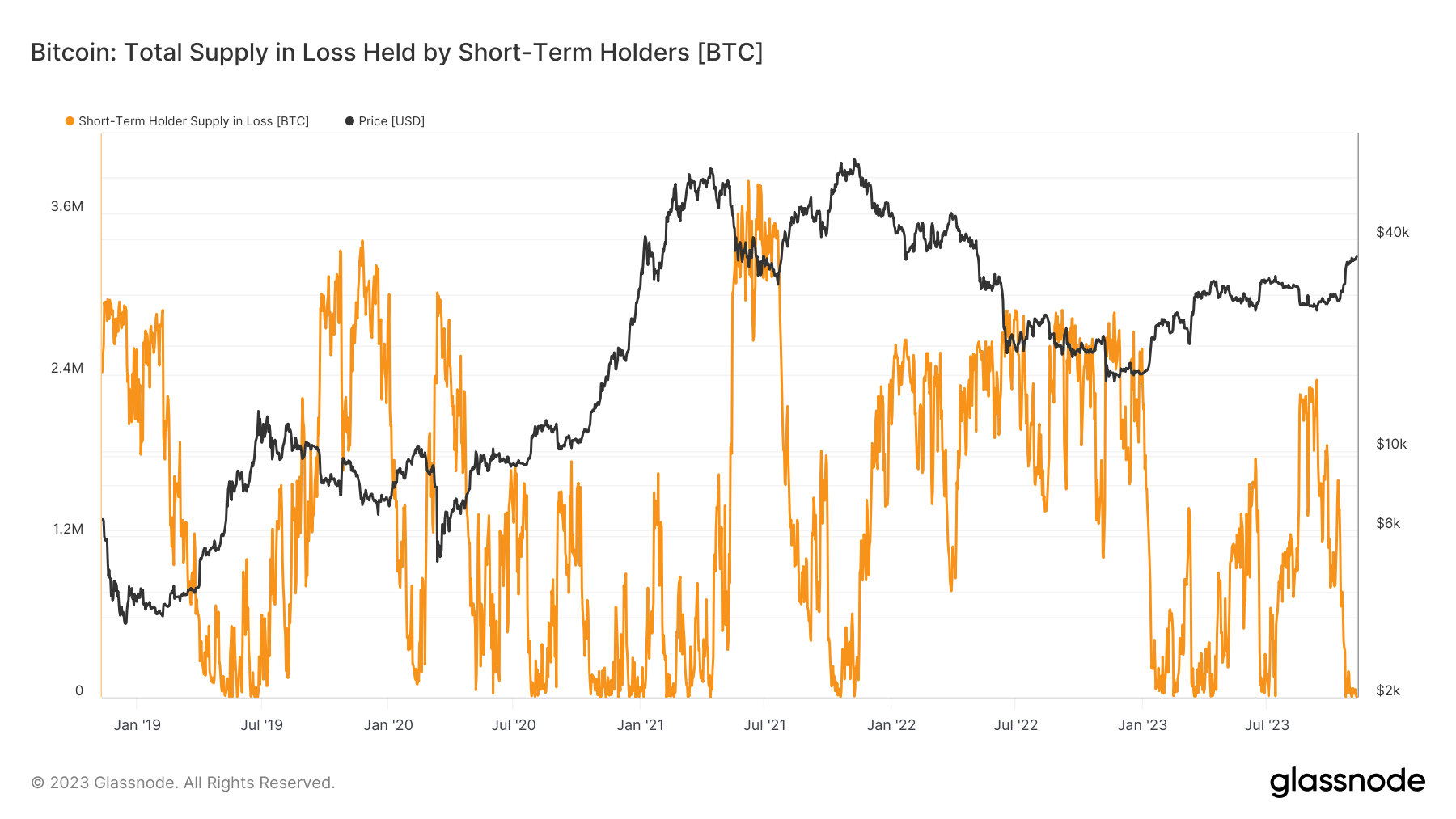

At the same time, records show a minimal short-term holder supply in loss, reaching a low of 400 BTC. This relatively insignificant figure underscores that virtually all investors within this short-term cohort are holding onto profits. Such a trend of massive profit-taking may reflect a careful approach from these investors, possibly an attempt to safeguard their returns amidst market volatility or as a strategy to leverage high market values.