Bitcoin addresses in profit hit 100% pre-halving but fell to 80% by August

Bitcoin addresses in profit hit 100% pre-halving but fell to 80% by August Onchain Highlights

DEFINITION:The percentage of unique addresses whose funds have an average buy price that is lower than the current price. “Buy price” is here defined as the price at the time coins were transferred into an address.

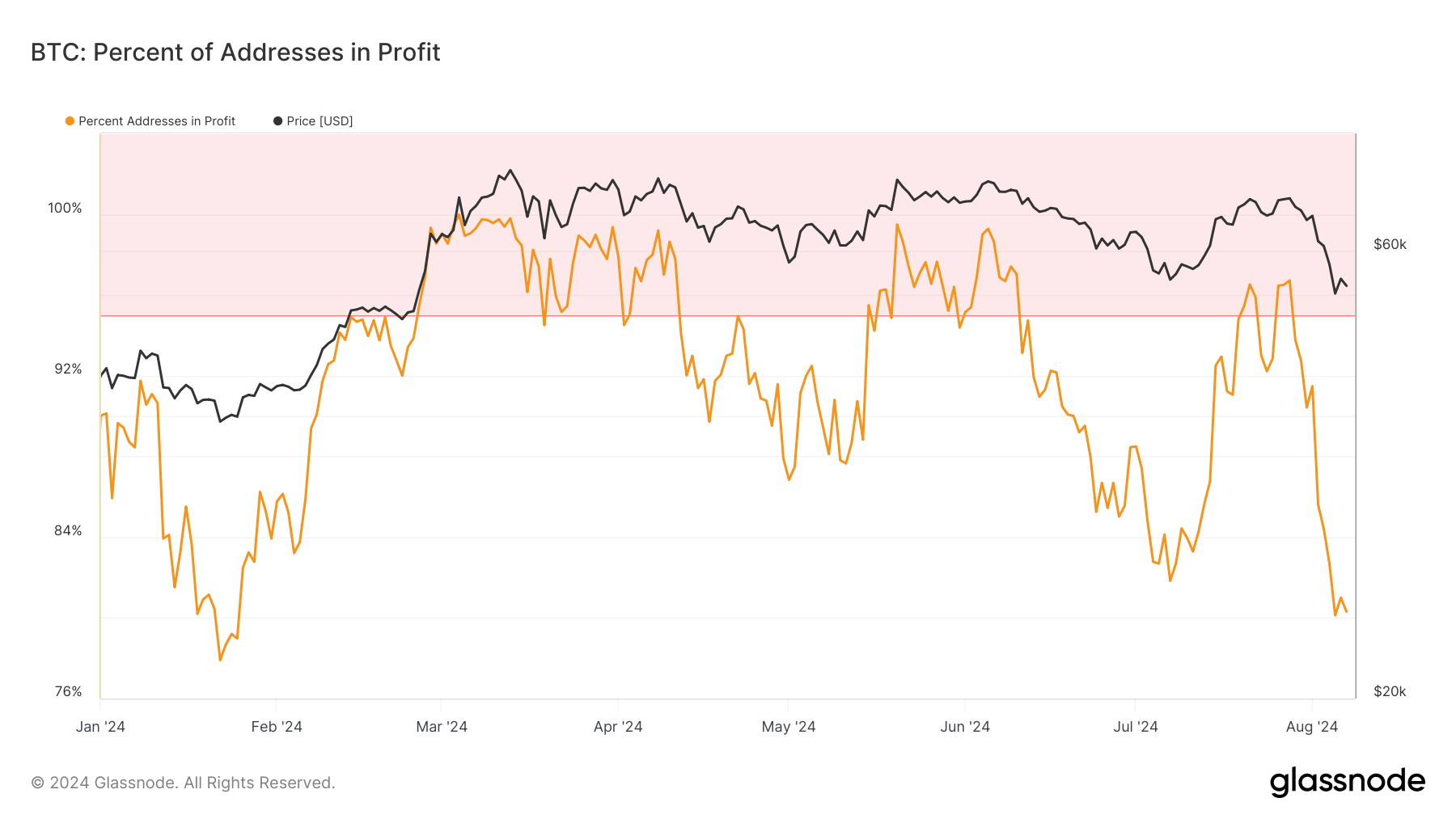

Bitcoin’s percent of addresses in profit experienced notable fluctuations throughout 2024. Early in the year, the metric hovered around 92%, coinciding with Bitcoin’s price near $50,000.

In the lead-up to the April 2024 halving, both the price and profit percentages saw increased volatility. The metric peaked at 100% in March when Bitcoin prices surged past $70,000, marking a significant high point for the year.

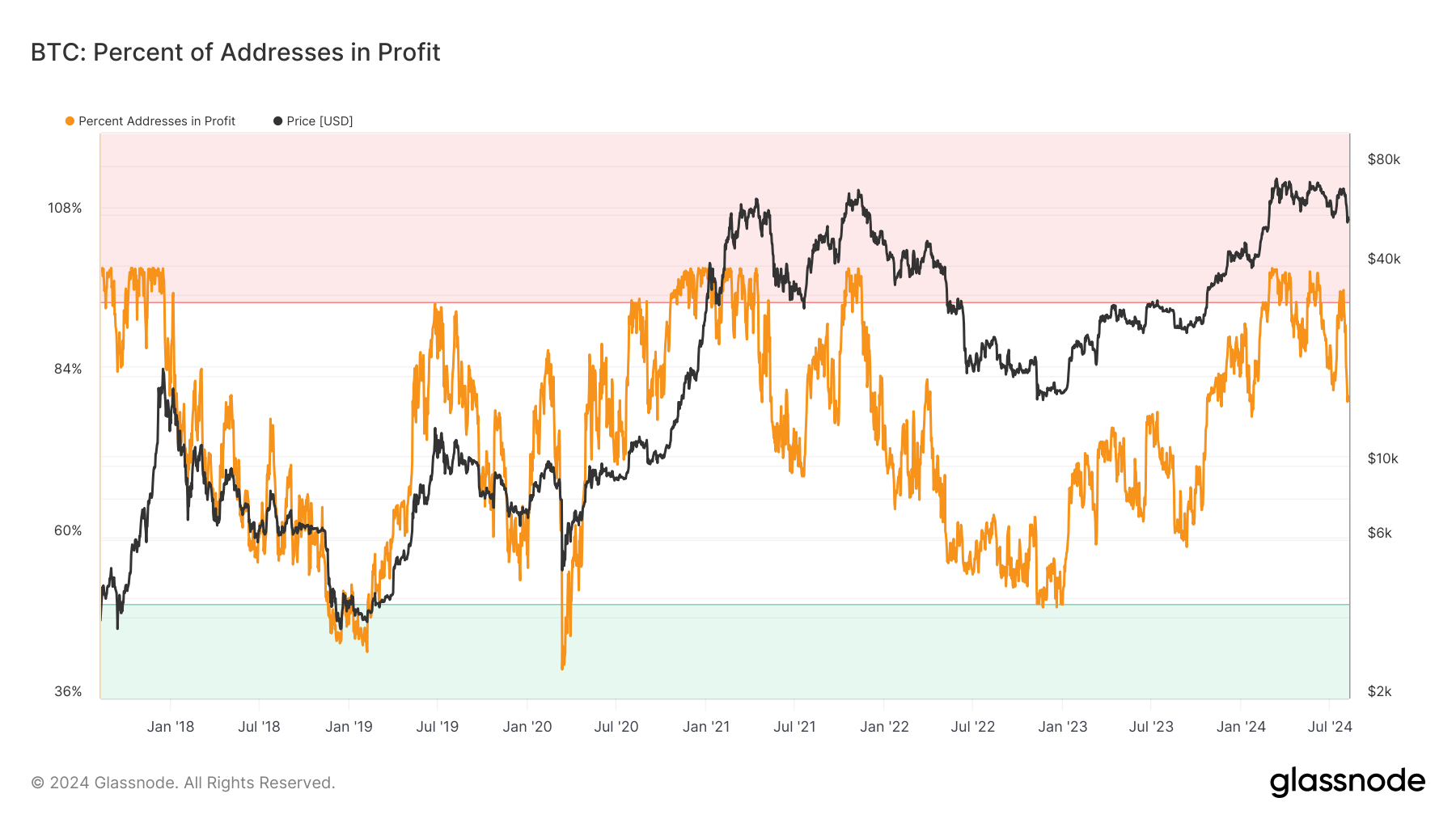

However, the subsequent months introduced downward pressure, with the percentage of addresses in profit dropping to around 80% by August as Bitcoin’s price retraced below the $55,000 level. This trend mirrors previous cycles, such as the significant fluctuations observed between 2018 and 2023, when similar patterns of sharp climbs followed by steep declines were evident.

These shifts highlight the cyclical nature of Bitcoin’s market behavior, influenced by major events like halvings and market sentiment shifts, leading to considerable impacts on the profitability of Bitcoin holders over time.