Bitcoin momentarily surpasses $38k to hit year-to-date high in EU trading session

Bitcoin momentarily surpasses $38k to hit year-to-date high in EU trading session Quick Take

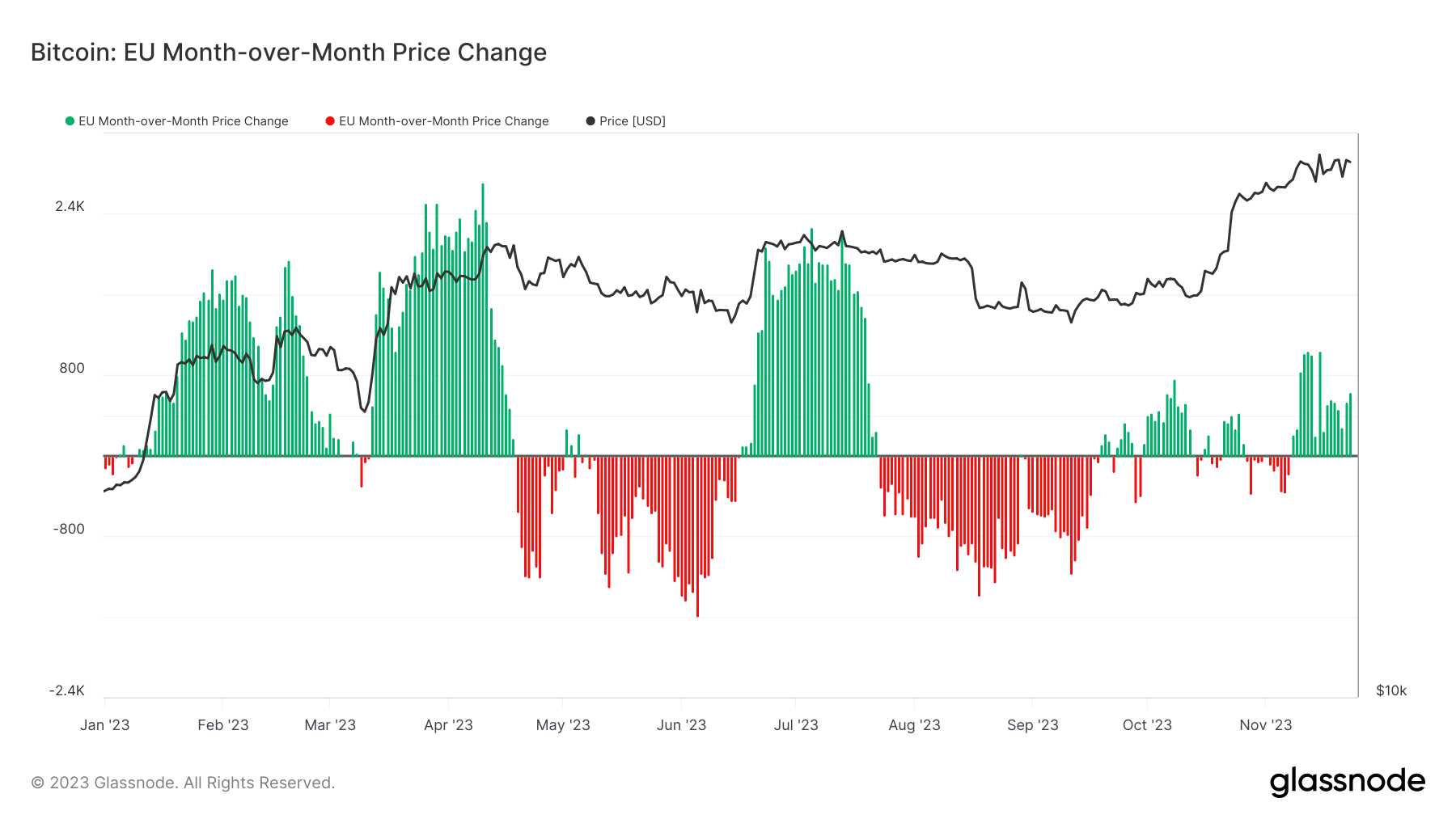

In the recent EU trading session, Bitcoin’s value showed an upward trend, eventually breaking past the significant threshold of $38,000, setting a new year-to-date high at $38,100, up roughly 2% on the day.

A noticeable trend is evident during the month of November, wherein EU traders have exhibited a more bullish disposition during their trading hours. This has potentially contributed to the positive price movements in this region.

Furthermore, Bitcoin’s recent upsurge has triggered substantial liquidations in the crypto markets over the past four hours. According to Coinglass, these liquidations amounted to $24 million, primarily in short liquidations amounting to $18 million. Binance, a major player, has experienced nearly half of these liquidations, with an estimated total of $10 million.

Attention now shifts to the U.S market, with several pre-market trading activities indicating an uptick. Notably, crypto equities such as Coinbase has witnessed a 1.3% increase, while Iris Energy has seen a 2.85% rise, marking potential positive momentum in the sector.